Gold bears are hibernating this week as the market sees record closing price

A record weekly close for gold is fueling significant bullish sentiment in the marketplace; however, some analysts have said that this breakout still needs to be tested, and investors should be careful about chasing prices.

Results of the Kitco News Weekly Gold Survey show that both Wall Street analysts and retail investors are cautiously optimistic about gold next week.

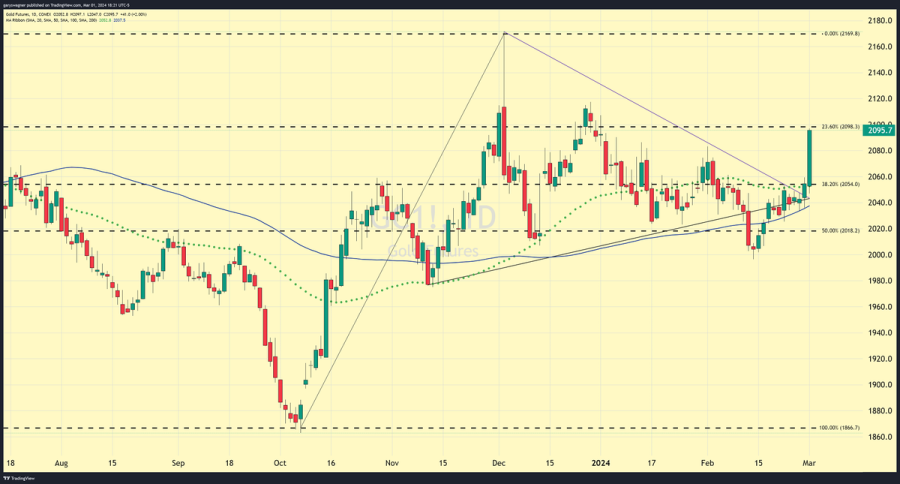

Gold prices managed to push above $2,050 an ounce Thursday after The Federal Reserve’s preferred inflation gauge showed a benign rise in consumer prices. After a slow start Friday, the precious metal started to attract some followthrough buying momentum following weaker-than-expected manufacturing and sentiment data.

April gold futures last traded at $2,095.20 an ounce, up 2% from last week. The precious metal’s best performance since late November has created a new record closing price.

While the rally has breathed new life into the precious metals market, some analysts have said that the price action remains sensitive as profit-taking and volatility could push prices back to within their well-defined channel.

Adam Button, chief currency strategist at Forexlive.com, said that Friday’s rally shows how much potential gold has; however, he added that he doesn’t see the rally as being backed by strong fundamentals.

“I just don’t see how a miss in ISM manufacturing could drive prices this high. I would be more convinced this rally was sustainable if it came after really disappointing employment numbers,” he said. “I think investors do need to pay attention because this shows how many investors are waiting for the dollar to crack before jumping into the market.”

James Stanley, senior market strategist at Forex.com, said that he is also not chasing the market, even as he anticipates higher prices in the near-term.

“I don’t think the pivot at the Fed is here yet. And while I have been very bullish on gold the past few weeks, even after the 2k test, spot [prices] trading over $2,075 is something I don’t want to chase here. That was the level that caught the high in 2020 and has remained a significant roadblock for bulls in the three and a half years since,” he said. “The NFP report is going to be a big deal for macro next week, but that’s not until Friday, so there could be some testing around $2100, but I’m not optimistic enough on drive beyond that level to chase the move while near that long-term resistance.”

This week, 14 analysts participated in the Kitco News Gold Survey and not one is bearish on gold in the near term. The survey showed 11 analysts, or 79%, were bullish on gold. At the same time, three analysts, or 21%, were neutral on the precious metal.

Meanwhile, Main Street investor sentiment continues to improve steadily. This week, 175 votes were cast in Kitco’s online survey. In a slight improvement from last week, 77 retail investors,representing 44%, looked for gold to rise next week. Another 43, or 25%, predicted it would be lower, while 55 respondents, or 31%, were neutral on the near-term prospects for the precious metal.

Marc Chandler, Managing Director at Bannockburn Global Forex, said $2,088 could represent a major resistance point for gold next week.

“Beyond that is the record high set on that spike in early December to $2135.60. I think we will see a need for the dollar’s resilience to buckle, and that may take greater confidence in a near-term Fed cut. Some Wall Street economists have begun giving up on a cut, and former Treasury Secretary Summers has cautioned that the next move may still be a hike,” he said.

Phillip Strieble, chief market strategist at Blue Line Futures, said that while gold’s rally is impressive, he would like to see gold hold higher support to confirm that this isn’t another bull trap.

Some analysts have said that while gold is seeing an impressive rally, it faces significant resistance at $2,100 an ounce.

Sean Lusk, co-director of commercial hedging at Walsh Trading, said that he sees potential for gold to go higher but remains hesitant to chase the market.

“We have been consolidating for a while now, so this could have some teeth to it,” he said.

Lusk added that investors could look at options to get some exposure to gold and take advantage of the market's momentum. He added that a medium-term play would be to buy $2,100 August gold calls and sell $2,275 February gold puts.

“A modest 5% rally takes the market to $2,175,” he said. “Should August 2100 call trade $70 in the money, we could collect $5K to $6K per spread upon exit, in my opinion.”

Kitco Media

Neils Christensen

David