Wall Street joins Main Street in the bear cave for next week as gold’s price momentum wanes

The gold market had plenty to digest this week, with manufacturing and services sector data, nonfarm payrolls, and the FOMC rate decision, and while precious metals prices did see a boost from the Fed that effectively ruled out a hike and left room for a cut in Q2, the overall trajectory was down as Asian demand cooled somewhat and Mideast tensions fell off the front pages altogether.

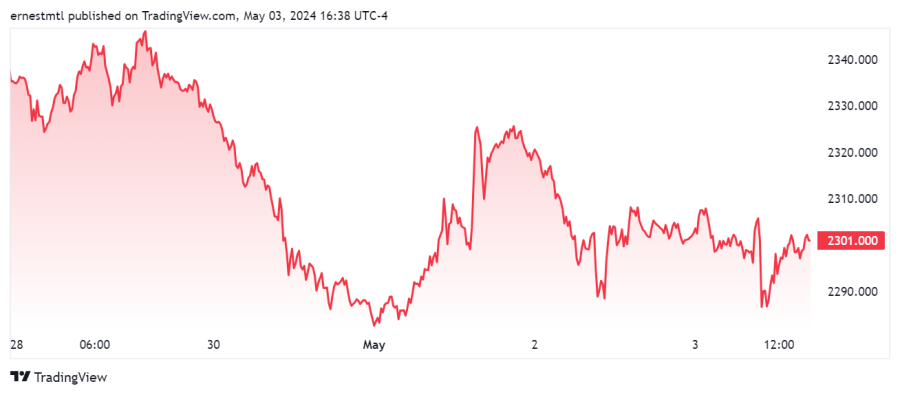

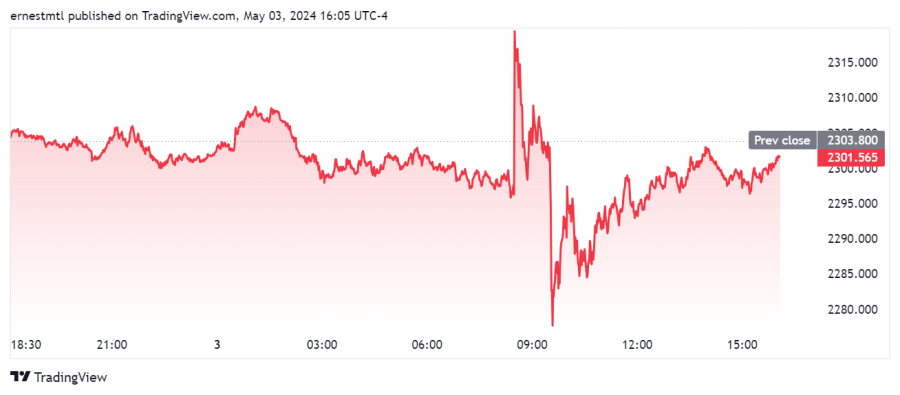

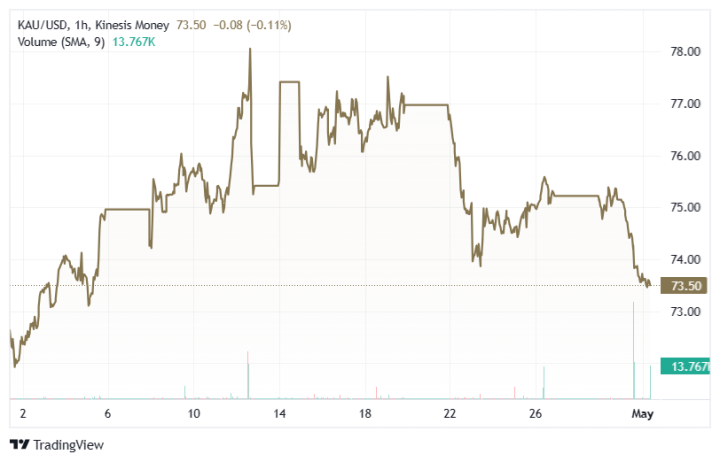

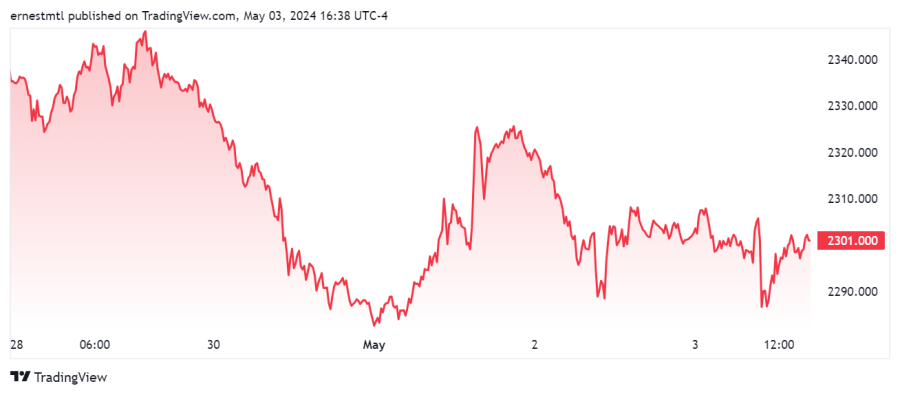

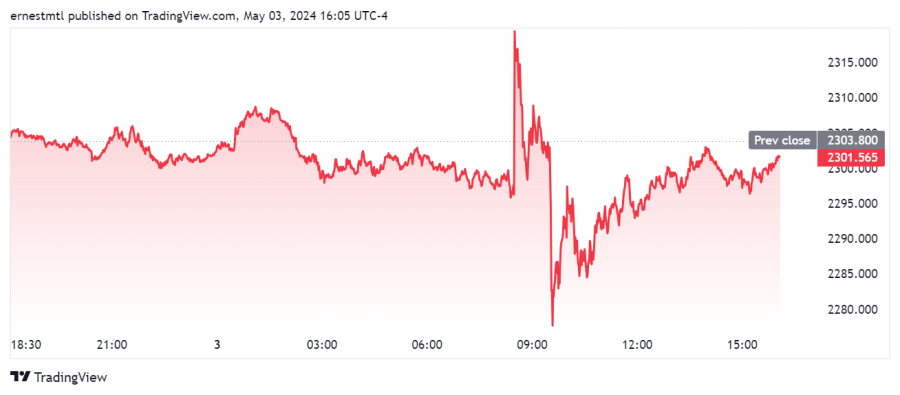

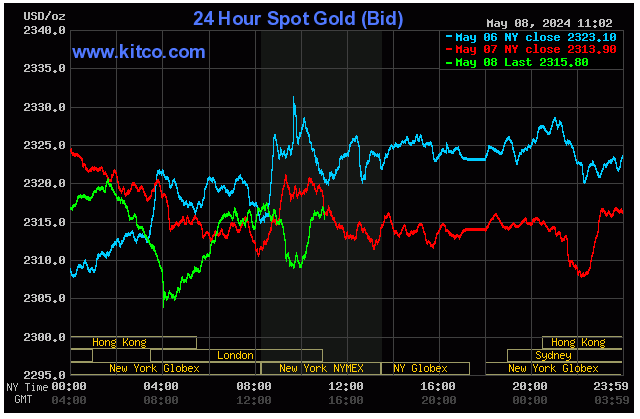

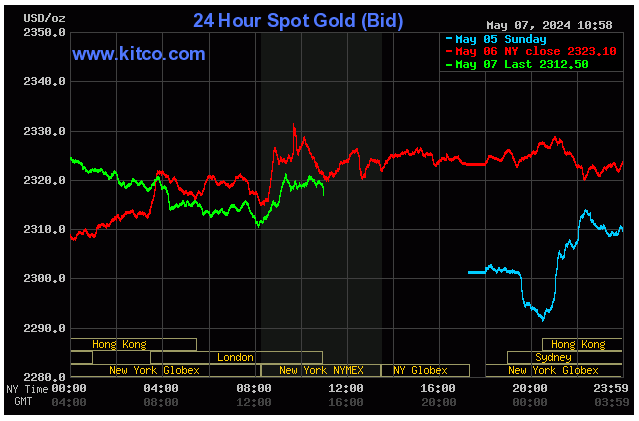

After opening the week above $2,335 per ounce, spot gold twice failed to hold above $2,340 on Monday, and by the afternoon, it had begun its steady slog downward, hitting a weekly low below $2,283 at exactly noon Wednesday.

Then positive momentum returned to the market, and the release of the Federal Reserve’s interest rate announcement and Fed Chair Powell’s press conference in the afternoon launched gold back above $2,325 per ounce.

But after a second attempt to breach that level, bullish momentum dissipated once again, and markets saw gold slide back down to support around $2,300 per ounce, where apart from the occasional test of $2,290, it languished for the rest of the week.

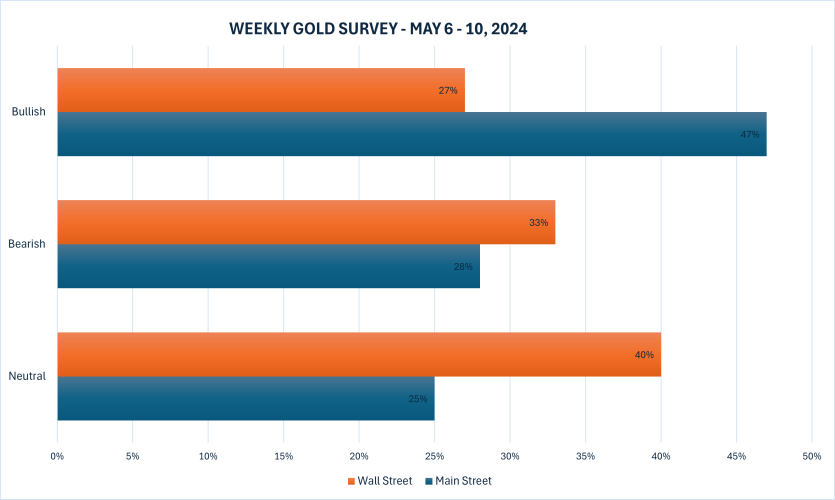

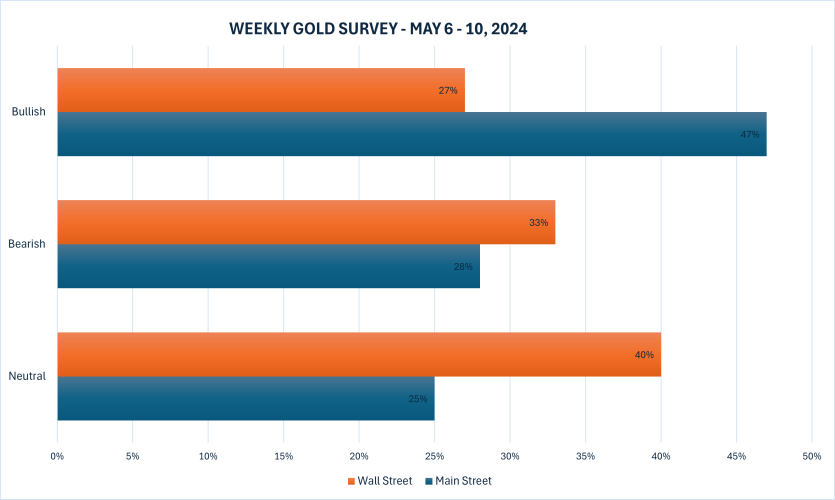

The latest Kitco News Weekly Gold Survey has experts as pessimistic as they’ve been in some time about gold’s near-term prospects, while most retail traders still see gold prices falling or chopping sideways.

FXTM Senior Research Analyst Lukman Otunuga said the signals are bearish for bullion in the coming days. “Gold prices are flashing red, surrendering initial gains from the downbeat US jobs report,” he noted.

Adrian Day, President of Adrian Day Asset Management, was among those who still believe in gold for the coming week.

“Gold’s resilience in the face of delays in cutting rates, by the Federal Reserve primarily as well as some other central banks, is powerful and telling,” Day said. “Whoever is buying gold – and we know that it is primarily global central banks and Chinese savers – is buying for reasons other than the traditional macro-economic factors that would lead to a higher gold price. This buying is largely price agnostic, and likely to continue.”

Marc Chandler, Managing Director at Bannockburn Global Forex, sees the balance of near-term trading tilted to the downside next week, as he expects to see Asian demand dialing back.

“Gold consolidated in recent days and the key issue is whether it is a consolidation pattern or a bottoming formation,” he said. “I suspect the yellow metal can have another leg lower toward $2250-60.”

Chandler said improved support for the yuan may further soften Chinese retail demand for gold. “Also note that HK stocks and mainland stocks that trade in HK have exploded for the past week and a half and this may reduce the urgency of seeking the safety of gold for some investors,” he added. “The recovery of the yen may also slow the local demand.”

For his part, Adam Button, Head of Currency Strategy at Forexlive.com, expects Chinese demand to pick up after domestic traders return in force.

“China is back from holiday next week and will likely resume buying,” he said.

This week, 15 Wall Street analysts participated in the Kitco News Gold Survey, and after two weeks of downward consolidation, most see gold sliding further in the near term. Only four experts, or 27%, expected to see gold prices climb higher next week, while five analysts, representing 33%, predicted a price drop. Six experts, or 40% of respondents, see gold continuing to trade sideways.

Meanwhile, 217 votes were cast in Kitco’s online poll, with only a minority of Main Street investors expecting prices to move higher in the near term. 102 retail traders, representing 47%, looked for gold to rise next week. Another 61, or 28%, predicted it would be lower, while 54 respondents, or 25%, expect the precious metal to trend sideways in the week ahead.

Next week will be among the lightest of the year for economic data releases. The main highlights, such as they are, will be Wednesday’s 10-year bond auction, the Bank of England’s monetary policy decision and the Treasury’s 30-year bond auction on Thursday, and the Friday release of Preliminary University of Michigan consumer sentiment.

Chandler noted the absence of major indicators on the docket for next week, and said he’ll be watching the sovereign bond market for clues on the market’s potential direction. “After the FOMC and jobs data, next week looks quiet, but large Tsy supply with bills and quarterly refunding,” he said.

Darin Newsom, Senior Market Analyst at Barchart.com, was reflecting on this week’s bumper crop of economic indicators.

“I don't think we learned anything we didn't already know about the U.S. economy,” Newsom said. “The key takeaway for me this week is that the monthly employment data is strictly for entertainment purposes, and not information. It's just hilarious to watch it come out every month and be hundreds of thousands off from the quote-unquote experts’ opinions on what it should be.”

“It’s a very high-profile game of pin the tail on the donkey, and nobody plays it very well.”

Newsom said that other things are revealing the true state of the economy. “There are some cracks showing up in the U. S. economy, finally, that haven't been in place for quite some time,” he said. “We saw Starbucks earnings come in, and what was interesting about Starbucks is it wasn't just sales were down because of the higher price of the commodity itself, given the recent rally in coffee. It was actual sales, people in the door that were down. U.S. consumers might actually have started to change some of their habits and cutting that six- to eight-dollar cup of coffee out every morning.”

Another sign that the U.S. consumer may be weakening was the steep decline in demand for boxed beef last month. “We saw a sharp drop-off there at a time when these markets usually are going up as retailers are buying ahead of the summer grilling season, the biggest demand time of the year,” Newsom said. “Are U.S. consumers finally starting to tighten the belt after years of everyone telling them how terrible the situation was? Have they finally started tightening the belt to where they're cutting out that cup of coffee every day, where they're not buying the expensive cuts of meat?”

“These to me were the two key things that we saw this week,” he said. “Everything else just fit with what we already knew: there's still inflation, both sides of the aisle are going to argue, it's bullish, it's bearish, whatever. But our reads on what some of these key consumer markets are doing, I think it's more important.”

As for what all this means for the gold market, Newsom sees some exhaustion on the side of the bulls, which he thinks is understandable given gold’s recent run-up.

“June gold is close to finishing off its short-term downtrend midday Friday,” he said. “This means a bullish technical reversal is possible either today or Monday. The market is technically oversold short-term as well.”

“The short-term downside target is still $2,268 with June sitting near $2,300 Friday.”

Newsom compared gold’s current position to another popular commodity. “I certainly can't make a nice hot cup of it, but to me, it reminds me of cocoa,” he said. “Cocoa ran up so high on fundamental factors that it ran out of buyers and has collapsed.”

“Gold went to new all-time highs,” Newsom noted. “And while there's always going to be Middle East tension, there's always going to be some sort of currency questions around the world, and inflation hasn't gone away, it simply ran out of buyers. There was a vacuum underneath the market, which is why when it finally gave some short-term technical signals that were bearish, it certainly seems to be what's played out [earlier this week].”

He underlined, however, that there are still plenty of medium and longer-term factors supporting gold demand.

“We still have inflation,” he said. “It still looks like interest rates are going to be cut at least once this year, that should weaken the U.S. dollar and should create more of an inflationary environment. And the Middle East isn't going away. As I've said for quite some time, the closer the U.S. gets to its next election, the more chaos around the world we're going to continue to see in hopes of swaying the election one way or the other. So gold's still going to be the play. I think it's going to find some buyers down here, I think the algorithms are going to kick back in.”

Taking all of this into account, Newsom said that the long-term outlook for gold hasn't changed. “It's still probably the best hedge against everything that's going on,” he said. “It just needed to take a breather and hit a vacuum where there wasn't as much buying interest.”

And Kitco Senior Analyst Jim Wyckoff said the technical picture still supports high gold prices next week. “Steady-higher as charts remain overall bullish,” he said.

Spot gold last traded at $2,301.56 per ounce at the time of writing, down 0.10% on the day and down 1.56% on the week.

Kitco Media

Ernest Hoffman

Time to Buy Gold and Silver

David

.png)