Cryptos and gold see losses in volatile day of trading as investors await Friday’s PCE data

.png)

It was a volatile day of trading across financial markets on Wednesday as asset prices trended higher during the morning session but came under pressure in the afternoon as investors focused their attention on Friday’s key Personal Consumption Expenditures (PCE) release.

The downward pressure across diverse assets from cryptos to stocks and gold comes as this week has been peppered with comments from Federal Reserve speakers who stressed their caution in deciding to make interest-rate cuts dependent on the data.

“Wall Street's focus [is in the process of shifting] to new inflation data with the release of May’s personal consumption expenditures price index on Friday,” said analysts at Secure Digital Markets. “The Federal Reserve closely monitors this preferred inflation gauge, and investors are hopeful that a continued moderation in price increases might prompt the central bank to lower interest rates later this year.”

It remains to be seen whether the PCE will show improvement on the inflation front or if it will come in hotter-than-expected, and judging by Wednesday’s price action in the markets, investors are uncertain as to how it will all play out.

At the close of markets, the S&P and Nasdaq squeezed out positive gains of 0.16% and 0.49%, while the Dow finished flat.

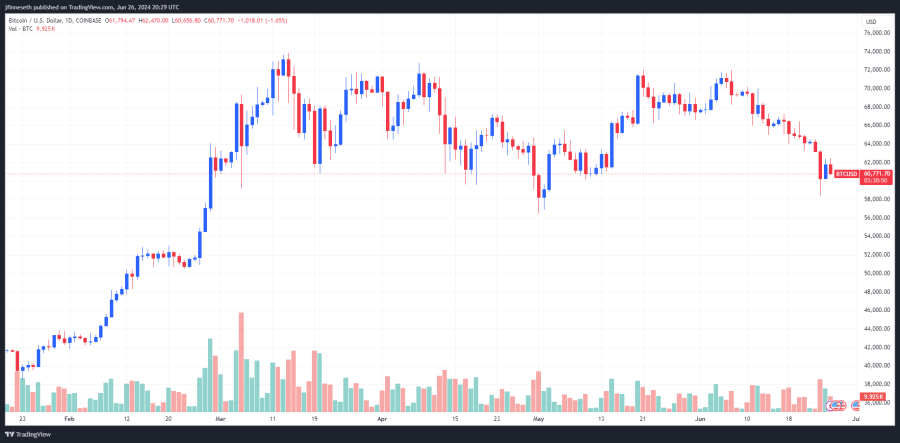

Data provided by Trading View shows that Bitcoin (BTC) rallied to a high of $62,487 during the morning trading session, but fell back below $61,000 in the afternoon.

.jpeg)

At the time of writing, Bitcoin trades at $60,730, a decrease of 2.05% on the 24-hour chart.

Waiting for inflows into spot BTC ETFs

While crypto analysts debate the near-term future for Bitcoin’s price, most agree that the decline in flows into spot BTC exchange-traded funds (ETFs) corresponds with the weakness and sideways price action seen over the past several months.

“Currently, the market is under pressure,” said Nick Cowan, Group CEO of Valereum PLC, in a note to Kitco Crypto. “The first high of 64,899 was in April 2021, after which we saw a halving in the BTC price down to 30,000 in the next month.”

“The price pushed back up to its previous highs, breaking it in October 2021, and then reaching a new high in November 2021 at 69,000,” he added. “But the buyers could not sustain the advance and the price rolled over, falling to below 16,000 a year later (November 2022). The price of BTC then slowly gained momentum climbing to 31,000 before breaking out in October 2023. Since then, we have seen a huge bull market with the price rallying over 100%, accelerating in Q1 2024 with the approval of the BTC ETFs by the SEC.”

Cowan noted that Bitcoin’s “price has stalled once again. It managed to break its previous high of 69,000 in March 2024, rising to a high of almost 74,000, but the big jump in volume signaled distribution and possible climactic action, confirmed by the price action in the following weeks – i.e. a drop in volume and prices moving sideways to down (to a low of 56,500 at the end of April 2024).”

“BTC is now in a downward trend and looks vulnerable because buying has stalled and, at the time of writing, is trading below its April 2021 levels (its original high),” he said. “To move ahead from here, BTC must absorb the selling pressure, consolidate its position, and then demonstrate a solid breakout above 74,000 in order to reach new highs.”

“Until then, it’s likely that investors will proceed with caution — ironically, retail investors tend to buy when price action is bullish rather than during weaker periods,” Cowan noted. “If we see positive price action, we can expect subscriptions to go up, resulting in buying demand for BTC.”

“If you look at the periods Feb and March, you can see a huge explosion in volume coupled with explosive upwards price action,” Cowan added.

“This signals climactic action – often a sign that the big holders have distributed their holdings – and it is entirely expected that these types of moves result in: 1) Prices often moving higher but on much lighter volumes, as the retail investors and their FOMO puff prices a little higher — the challenge is always what power the retail guys have to sustain the price levels once the FOMO dies down; and 2) The price then tending to move sideways, entering a range which is essentially what has happened for the last 3 months ($60,000 to $70,000),” Cowan said.

“BTC is currently at the bottom of its range so support would be expected to halt further falls if the range is to be maintained,” he concluded.

Macro trader and economist Alex Krüger is confident that support will hold and sees Bitcoin and the broader crypto market rallying higher in the second half of 2024.

“My outlook for Bitcoin remains very bullish into year-end,” Krüger said in an interview with Arca chief investment officer Jeff Dorman. “And if that happens… it just makes sense that it carries everything with it. Like when Bitcoin is going up usually everything goes up. It is that simple.”

“[Over the] mid-term like into 2025 the market should keep on rallying,” Krüger added. “Market, in this case, is the S&P 500 index, the NASDAQ, risk assets, equities, and the exchange-traded funds (ETFs), they finally linked Bitcoin and Ethereum to the macro side on a permanent basis now. This correlation comes back and forth. It’s definitely there.”

Krüger said he sees the current environment as one “where risk assets perform very well,” and his “macro view towards year-end is that leaving aside the [US general] elections that are very momentous and should drive very significant volatility, which I think would give very good entry points for risk assets.”

Altcoins fall into the red amid Bitcoin's weakness

The majority of altcoins in the top 200 fell into the red as Bitcoin trended lower in the afternoon, with only a handful of tokens managing to post gains on the day.

WEMIX (WEMIX) was the top performer, increasing by 28.5%, followed by gains of 11.2% and 9.3% respectively for Fetch.ai (FET) and Blast (BLAST). Blur (BLUR) was the biggest loser, falling 15.4%, while Arweave (AR) lost 11.2%, and Curve DAO Token fell 9.7%.

The overall cryptocurrency market cap now stands at $2.25 trillion, and Bitcoin’s dominance rate is 53.2%.

David