Precious metals should shine in H2 2024 based on seasonal trends, summer price gains should be strong – MKS PAMP

.jpeg)

Based on historical trends and regular seasonal performance, precious metals may be significantly underpriced going into the second half of the year, according to precious metals strategists at MKS PAMP.

In the company’s Precious Metals Seasonal Report released on July 3, the strategists wrote that a nuanced understanding of seasonal trends is important for metals investors.

“Seasonal trends alone don’t form the foundation of any trade or view, but it’s usually a useful supplement to existing ideas and helps explain away price out/underperformances,” they wrote. “Given we’re entering 2H, and after the recent strong price performance across most metals in 1H’24, it's worthwhile to provide a review of 1) how 1H 2024 performances stacked up against historical seasonal trends, and 2) provide a quick overview of the outlook for metals performances and how they ‘should perform’ into 2H and in this late summer (July 4th-Labor Day) period.”

They said that on average, second-half performances are more bullish than first-half performances historically for Gold, Silver, Platinum, Palladium, and Copper. “[A]verage 2H metals performances are 6x larger than average 1H metals performances (data was largely boosted by historical Palladium outperformance in 2H since 2010).

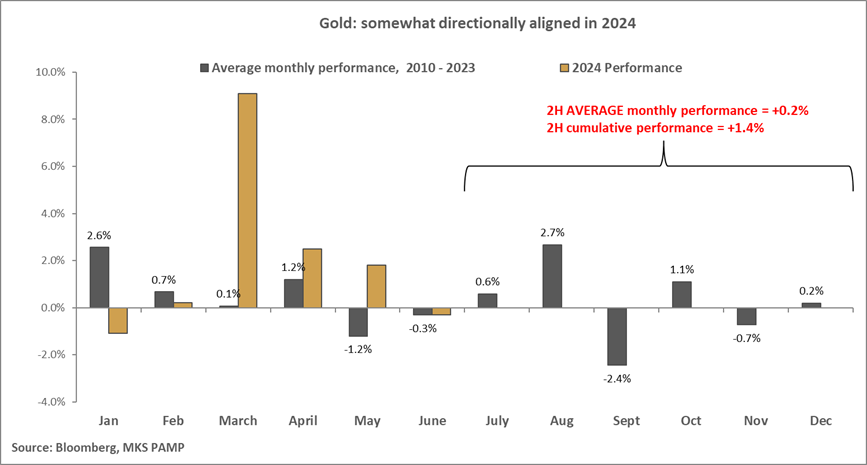

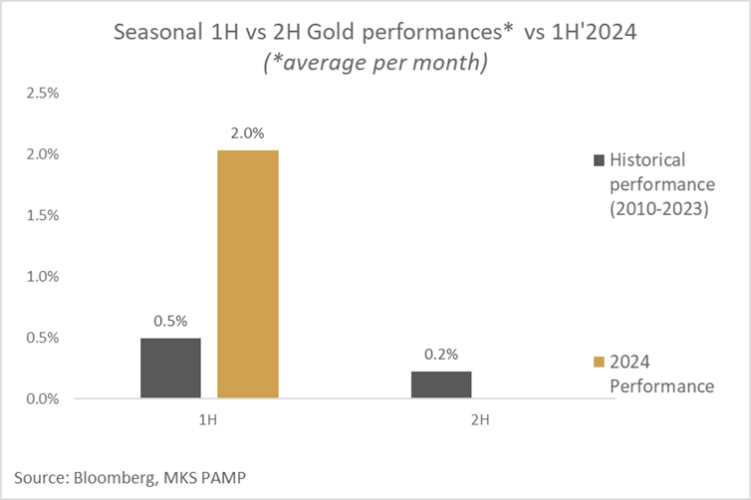

“Gold & Silver performances in 1H’24 directionally adhered to historical seasonal price performance norms; they rallied when they were meant to rally with Gold putting in average monthly gains 1H’24 of +2% and Silver of +3.6%/month,” they pointed out. “The notable seasonal out-performance was due to 1) Central Banks and Asia base building (Gold) and 2) fears of inflation/war/geopolitical/dedollarization risks trumping a HFL Fed hikes & a stronger US$ (Gold, Silver).”

teaser image

The platinum group metals (PGM) and copper, for their part, defied seasonal trends in the first half, with platinum and copper rallying when they would be expected to fall, while palladium posted large monthly losses when it should have seen mild gains. “The seasonal dislocation was due to 1) Platinum piggybacking Golds gains, 2) Copper capitalizing on strong fundamentals and macro participation, 3) Palladium losing out to paper shorts/positioning,” they wrote.

Statistically, gold prices posted average monthly gains of 2% in the first half of 2024 against a historical expectation of a 0.5% gain per month. “Silver rallied ~3.6% on ave per month in 1H (vs historical past ave gains of +0.2%); Platinum rallied +0.3%/month in 1H’24 (vs -0.1% losses),” they noted. “Palladium fell a chunky 2.4% / month in 1H’24 where it should put in 0.3% gains.”

Based on historical seasonal trends, MKS PAMP sees gold and silver prices posting decent gains. “[S]ince 2010, their past cumulative 2H gains are +1.4% and +2.2% respectively,” they wrote, “and Palladium should fly (cumulative gains of +10.4% in 2014). Platinum is meant to post minor losses (cumulative monthly losses of -0.7% in 2H).”

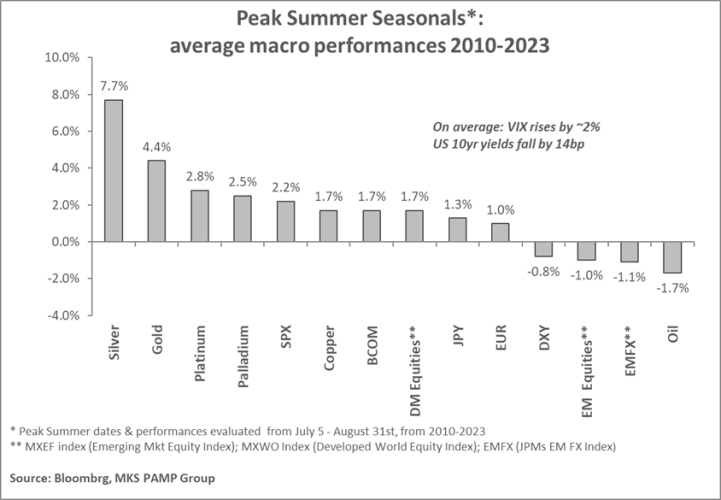

As for the short-term summer outlook, the strategists expect all the metals covered in the report to see strong performances.

“Precious metals are typically solid outperformers in late summer from July 4th into Labor Day, with Silver (+7.7%) & Gold (+4.4%) as macro investors take a step back from mainstay assets (DM equities are up marginally while US bonds typically fall and the USD$ traditionally falls -0.8%),” they said. “Some of this seasonal strength in Gold/Silver can be explained away by past dovish expectations around Jackson Hole, the 2011 European crisis & COVID monetary response (which skewed data around July/August), and preemptive buying ahead of the seasonal physical demand pickup in September. EM assets (from EMFX to equities) traditionally face headwinds over this peak summer lull.”

MKS PAMP summarized their position as follows: “if 1) markets start pricing in a Fed rate cutting cycle (HFL gives way), 2) macroeconomic data risk falls to US political risk in 2H’24, 3) broader acceptance of low likelihood of a large Global recession and/or large credit event, 4) paper positioning in Precious is lower than seasonal averages/trends —> then precious metals (especially Palladium) are rather underpriced heading into 2H.”

Kitco Media

Ernest Hoffman

David