These defense pacts could trigger WW3 and drag the U.S. into conflict – it's not being covered by mainstream

Kitco News

The Leading News Source in Precious Metals

Kitco NEWS has a diverse team of journalists reporting on the economy, stock markets, commodities, cryptocurrencies, mining and metals with accuracy and objectivity. Our goal is to help people make informed market decisions through in-depth reporting, daily market roundups, interviews with prominent industry figures, comprehensive coverage (often exclusive) of important industry events and analyses of market-affecting developments.

These defense pacts could trigger WW3 and drag the U.S. into conflict – it's not being covered by mainstream media teaser image

(Kitco News) – As geopolitics has become a key focus for markets, Hal Kempfer, CEO of Global Risk Intelligence & Planning (GRIP) and retired marine intelligence officer, pointed to a conflict zone that could activate several defense pacts, drag the U.S. into conflict, and trigger World War 3.

"We're not in World War 3; we're definitely in a world of wars," Kempfer told Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News. "Whether those things merge into one larger conflict, that's the big concern."

Kempfer zeroed in on the South China Sea, describing the area as at extreme risk of escalation and calling it the "center of gravity" due to the multiple mutual defense pacts that it could kick in. "It would effectively be World War 3 if the war breaks out in the Pacific," he said.

Kempfer pointed to recent clashes between Chinese and Philippine forces, saying that there's a risk that it could drag the U.S. into a war with China because this could trigger the U.S.-Philippine Mutual Defense Treaty and then spark a major global conflict with various countries. The treaty was signed in 1951 and requires both nations to support each other if attacked by another party.

"I don't ignore what's going on in Europe with the war in Ukraine and certainly what's happening in the Middle East and with Iran. But if you want to look at where there is a huge potential impact, not just in terms of the carnage, but also the impact on markets, you have to look at the South China Sea," he said.

For Kempfer's breakdown of the recent confrontation between China and the Philippines and the potential triggers for conflict, watch the video above.

Kempfer advised looking at the world through a geostrategic lens. "The great fear is that the U.S. gets pulled into a kinetic confrontation with China due to the Philippines, [for example], and then China responds in some ways and triggers our agreement with Japan or something like that," he said. "And next thing you know, you got all the countries in there basically pulled into a big war across the board. That is possible."

For more on potential defense pacts that could be triggered in the area, watch the video above.

Market impact: how crucial is the South China Sea route?

According to Kempfer, the South China Sea is massively important as a shipping area, with more than 20% of all global trade passing through there.

"It's a phenomenal impact," he told Kitco News. "If you look at container shipping, that is a preponderance of stuff that's impacted by what's happening in the South China Sea."

Furthermore, the South China Sea is located right next to the Sea of Japan, which means that a potential conflict with China could impact a larger waterway.

"It's not just material that comes from China or from Taiwan that could be disrupted. It's also the total impact that would have on places like Japan. Hence, Japan has broken out of decades of taking a more passive stance and moved to a much more active and aggressive stance. They are signing a mutual defense agreement with the Philippines, which is rather interesting when you look at the history of Japan and the Philippines and certainly the history of World War 2."

In terms of products, Kempfer added that the impact would also be massively disruptive.

"When people think of China, they think of the manufactured goods 'made in China.' And certainly, that is significant. So literally, store shelves will start going empty," he said. "But it's also much bigger than that. If you look at semiconductors, Taiwan, in certain categories, controls up to 80 percent of the semiconductor industry or market. That would be shut down completely. Certainly, any semiconductors coming from China would be shut down. It would have a phenomenal disruption of the supply chain around the world. It's difficult to think of anything these days that has any electronic components that aren't reliant upon semiconductors."

Rare earths are another area of impact. Watch the video above for Kempfer's outlook on this and China's dominance in this area.

For Kempfer's breakdown of other top geopolitical threats at risk of a flare-up, watch the video above.

U.S. election is 'a time of vulnerability'

Kempfer added that with the U.S. distracted by its own election on November 5th and all the uncertainty surrounding it, foreign actors could use this as an opportune time to stir things up on the geopolitical level.

"With this election coming up … it is a time of vulnerability. It's a time of transition. If somebody's going to try and do something – a foreign actor like China – that's the opportune time to do it," he said. "The election distracts the entire United States and the rest of the world. So it is a time of vulnerability or a window of vulnerability in terms of our ability to react."

The latest round of uncertainty came with the attempted assassination of former President Donald Trump that took place over the weekend. In a shocking incident on Saturday, a gunman opened fire on Trump during a rally in Butler, Pennsylvania. A bullet pierced the upper part of Trump's right ear. During the incident, firefighter Corey Comperatore was shot and killed and two other people were critically injured.

Trump said he was saved from death because he turned from the crowd to look at a screen showing off a chart he was referring to. "I rarely look away from the crowd. Had I not done that in that moment, well, we would not be talking today, would we?" Trump told the reporters.

Authorities have identified the shooter as Thomas Matthew Crooks, 20, from Bethel Park.

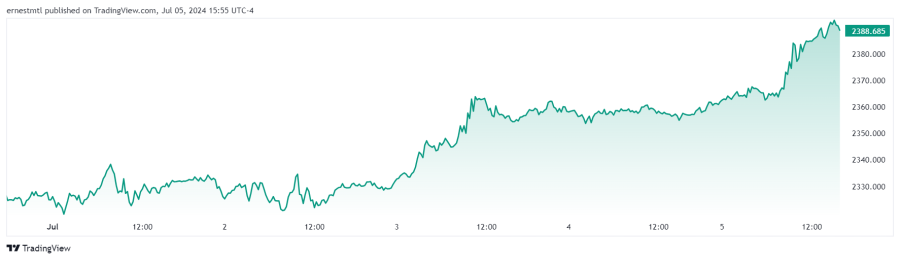

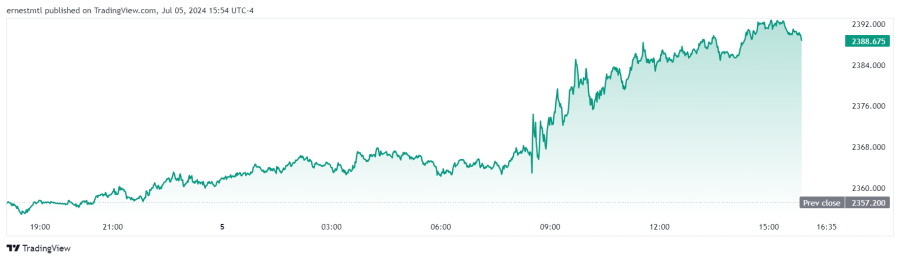

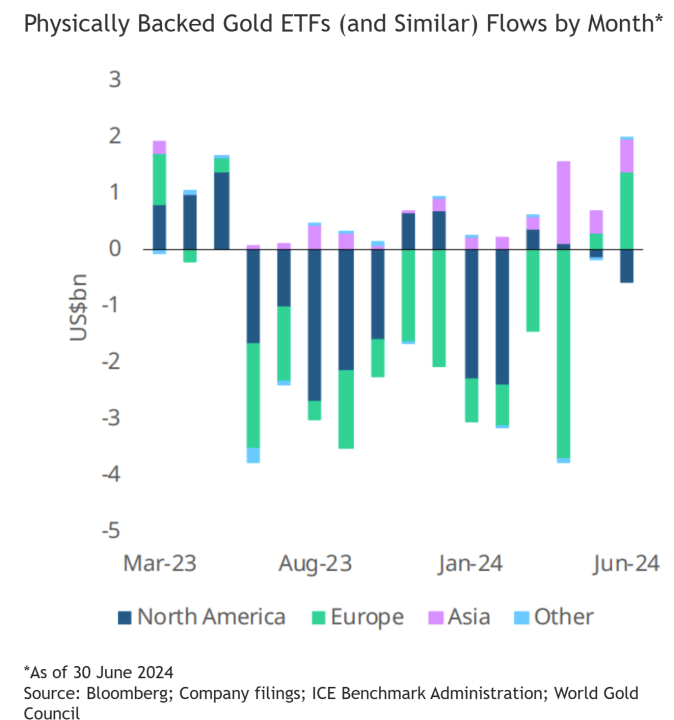

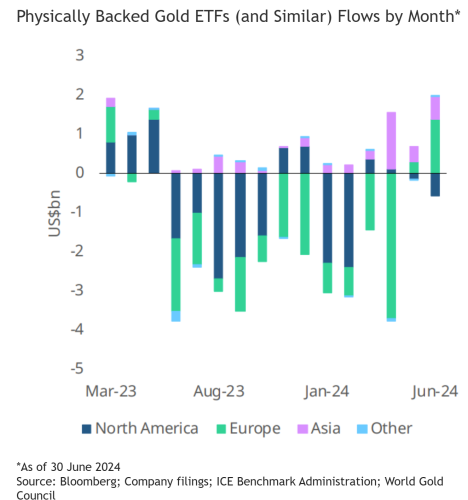

Gold price hits new record highs, Bitcoin surges

Safe-haven assets advanced early this week as markets digested the failed assassination attempt. Gold hit new record highs on Tuesday, boosted by safe-haven demand and expectations of the Federal Reserve opting to cut rates more than previously expected.

Spot gold was trading at a new record high of $2,470.20 an ounce at the time of writing. Bitcoin also climbed, hitting a daily high of $65,046.18.

Kempfer examined investment strategies amid global tension. Watch the video above for his advice on preparing for a greater level of uncertainty and his outlook on gold and Bitcoin.

Swan Bitcoin IRA – Start Saving Now ð https://Swan.com/retire

Kitco Media

Anna Golubova

David

.png)