Gold Defies Headwinds of Dollar Strength, Higher Yields, and Jobless Claims

Amidst a confluence of factors typically bearish for the precious metal, gold prices managed to post solid gains on Thursday. This resilience in the face of economic data and market dynamics that would normally weigh on the yellow metal suggests the recent price correction may be nearing its end.

According to the U.S. Labor Department, initial jobless claims fell to 233,000 last week, down from 249,000 the prior week and below the 240,000-consensus forecast. This decline in new unemployment filings is generally seen as a positive economic indicator, one that would normally put downward pressure on safe-haven assets like gold.

Similarly, the U.S. dollar gained 0.05% on the day, reaching an index level of 103.01. A stronger dollar tends to make gold, which is priced in the U.S. currency, more expensive for foreign buyers, thereby reducing demand. Treasury yields also rose, with the 2-year note climbing 9.3 basis points to 4.061% and the 10-year note gaining 5.2 basis points to 4.018%. Higher yields make non-yielding gold less attractive in comparison.

Typically, the combination of a stronger dollar, higher yields, and improving employment data would be enough to send gold prices lower. Yet, defying these typical market dynamics, gold for December delivery settled $30.90 higher at $2,463.30 per ounce, a 1.27% increase.

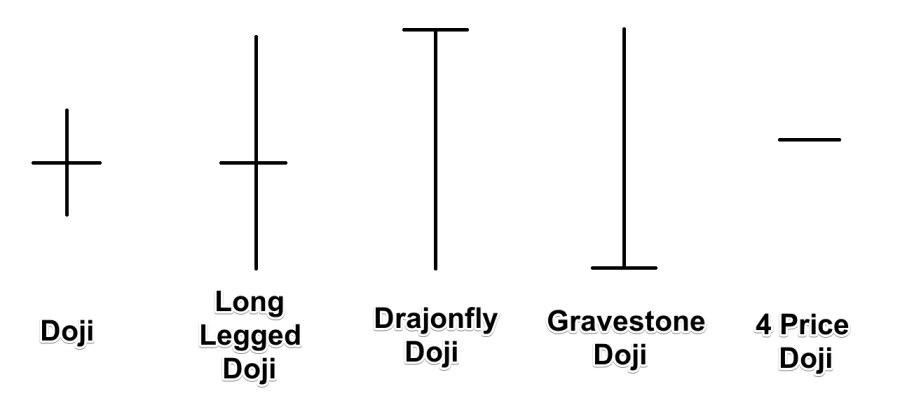

This resilience was foreshadowed on Wednesday, when gold futures traded largely unchanged, closing just $0.20 below the opening price. This price action created a Japanese candlestick pattern known as a "doji," which occurs when a commodity or stock opens and closes at virtually the same price. To Eastern technical analysts, the doji candlestick can signal a potential key-reversal or pause in a trend.

The fact that gold was able to rebound strongly in the face of these apparent headwinds suggests the recent price correction may be drawing to a close. Over the past several weeks, gold had declined from its August highs near $2,500 per ounce, leading some to wonder if the precious metal's remarkable rally since the start of 2023 was running out of steam.

However, Thursday's performance, combined with the preceding doji candlestick, indicates that gold may be finding its footing. The ability to advance in the face of a stronger dollar, higher yields, and improving economic data points to underlying strength and resilience in the gold market.

For those who would like more information simply click on one of the links below:

Information, Track Record, Trading system, Testimonials, Free trial

Wishing you as always good trading,

Kitco Media

Gary Wagner

David