Gold Reaches New Record High Following Powell's Historic Speech

In a remarkable turn of events, gold futures have once again traded to a new record closing price of $2,533.60, following Federal Reserve Chairman Jerome Powell's pivotal speech at the Economic Symposium in Jackson Hole, Wyoming. The speech, which signaled a shift in monetary policy, has sent ripples through various financial sectors, including precious metals and U.S. equities.

Chairman Powell's declaration that "the time has come for policy to adjust" marks a significant turning point in the Federal Reserve's approach. He noted that inflation has contracted closer to the Fed's 2% target while expressing concern over the labor market's well-being.

Powell emphasized that current “labor market conditions are less tight than pre-pandemic levels in 2019, a year when inflation ran below 2%”. He further stated that it seems unlikely the labor market will be a source of elevated inflationary pressures in the near future, adding that he does not seek or welcome further cooling in labor market conditions.

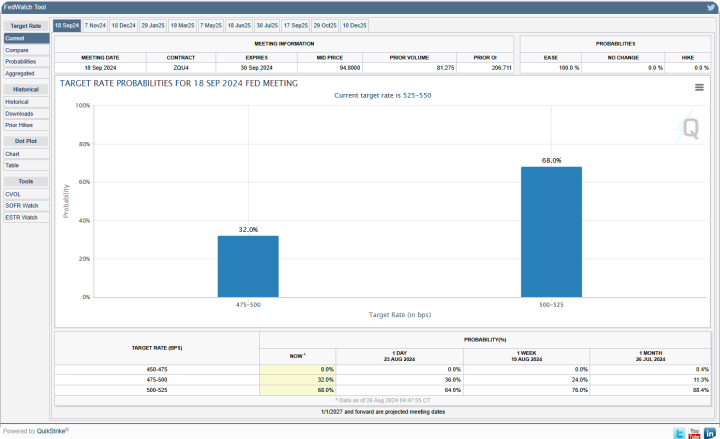

The financial world has interpreted Powell's remarks as a clear indication that the Federal Reserve is prepared to begin a series of interest rate cuts. While no specific timeline was provided, market expectations are high for a rate cut at the upcoming Federal Open Market Committee (FOMC) meeting on September 18-19. The CME's FedWatch tool currently indicates a 71.5% probability of a 25-basis point cut and a 28.5% chance of a more aggressive 50-basis point reduction.

.png)

In response to these developments, gold futures continued its ascent, with the most active December contract reaching an intraday high of $2,561.20. By late afternoon, it had settled at $2,553.60, representing a modest gain of $4.90. This upward movement occurred despite a slight strengthening of the U.S. dollar, which gained 0.20% to reach 100.87 on the dollar index.

The dollar's performance is worth noting, as it experienced a sharp -0.83% decline on Friday, resulting in a -1.69%weekly decline. This took the dollar index its lowest value this year. Technical analysis suggests that the dollar could find support just below the 100 level on the index, based on lows observed in July 2023.

Today's continued strength in gold prices demonstrates that while the market had anticipated dovish comments from Chairman Powell and had partially priced in a September rate cut, the full impact of these expectations had not been fully realized. This is evidenced by the moderate price advance witnessed today.

The gold market's reaction to Powell's speech and the subsequent anticipation of policy shifts underscores the intricate relationship between monetary policy, economic indicators, and precious metal valuations. As investors and analysts digest the implications of the Fed's potential move towards monetary easing, gold's role as a safe-haven asset and hedge against economic uncertainty appears to be reinforced.

As we approach the September FOMC meeting, all eyes will be on the Federal Reserve's decision and any further guidance provided regarding the pace and extent of future rate cuts. The coming weeks promise to be a critical period for gold prices and the broader financial markets as they adjust to the evolving economic landscape and the major pivot that was announced by Powell regarding the monetary policy of the Federal Reserve.

Kitco Media

Gary Wagner

David