'We expect a considerable drop in gold prices', says ABN Amro

Gold positioning remains very crowded, according to ABM Amro, which is why the Dutch bank is not recommending re-entering long gold positions at the moment.

“We continue to think that positions are too crowded and that prices are too high to recommend re-entering longs,” ABN Amro precious metals analyst Georgette Boele wrote in a report last week.

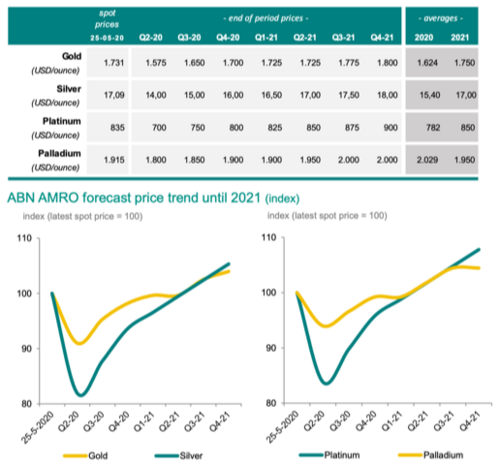

The bank is projecting a major drop in gold prices within the next three months, citing another risk-off wave in financial markets. ABN Amro’s outlook has gold ending Q2 at $1,725 an ounce.

“We also expect a considerable drop in gold prices,” Boele said. “Between now and 3 months we expect another risk-off wave in financial markets. We think that investors will close part of their positions (ETF and/or speculative positions) in gold, silver and platinum.”

At the time of writing, August Comex gold futures were trading at $1,750.30 an ounce, down 0.08% on the day.

Gold’s trading pattern this past month reveals resilience, with any price dips being bought up by investors and gold staying firmly above the $1,700 an ounce level, noted Boele.

“Each time there has been some price weakness it seems that investors are buying gold on dips. Gold ETF positions have made a new record and stand just under 100 million ounces. After some liquidation of speculative positions, speculators have also showed renewed interest in gold,” he said.

Long-term, ABN Amro is very bullish on gold, projecting the yellow metal to finish Q3 at $1,775 an ounce and Q4 at $1,800 an ounce.

By Anna Golubova

David