Gold futures fill gap with profit-taking, dropping $30 today

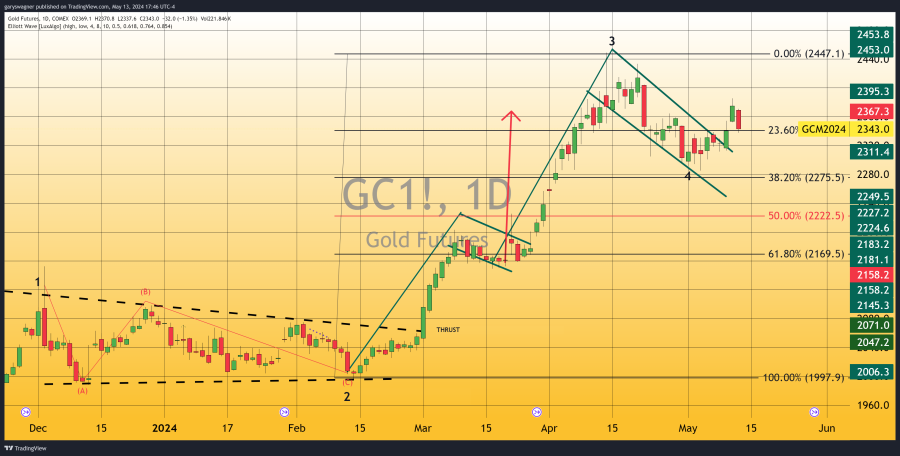

As of 5:15 PM ET, gold futures based on the most active June 2024 contract traded $32 lower, settling at $2,343. Today's price decline effectively filled the gap created between last Thursday's closing price and Friday's opening price. On Thursday, May 9, gold futures opened at $2,316.50 and closed at $2,340.30. On Friday, gold opened at $2,353.50 and closed just below $2,375, creating a price gap.

While Thursday's intraday high of $2,354.20 was above Friday's intraday low of $2,352, a true gap existed between the real bodies of those days' Japanese candlesticks. A candlestick's body represents the open and close, so last week saw a price void between Thursday's $2,340.30 close and Friday's $2,353.50 open. A gap "fills" when the price revisits the pre-gap level. It must be noted that the chart used for this analysis is based upon the closing settlement price in New York.

According to Investopedia, "In volatile markets, traders can benefit from large jumps in asset prices if they can be turned into opportunities…" Gaps offer enterprising traders’ chances to interpret and exploit price movements for profit.

Today's decline essentially filled last week's gap as market participants likely took profits ahead of Wednesday's April Consumer Price Index (CPI) report, awaiting further inflation data.

Piero Cingari of Benzinga notes, "Analysts foresee a drop in both the overall Consumer Price Index (CPI) and its 'core' component…" Wall Street economists anticipate the headline annual inflation rate will decline from 3.5% in March to 3.4% in April. The yearly core inflation rate, excluding food and energy volatility, is expected to fall from 3.8% to 3.6% year-over-year, the lowest since April 2021.

If the actual figures come in above predictions, the Federal Reserve may implement fewer than the currently projected two rate cuts this year. Conversely, lower-than-forecast CPI data could prompt the Fed to cut rates before September, as two-thirds of economists surveyed by Reuters currently anticipate.

However, the Fed seeks evidence of a sustained trend, so unless subsequent months corroborate Wednesday's report, policymakers are unlikely to drastically alter their stance based on a single data point.

Kitco Media

Gary Wagner

David