Gold looks good again this week as both Wall Street and Main Street turn bullish

After last week's price action was dominated by Friday’s news from China and the employment report, precious metals markets were squarely focused on inflation data and the Federal Reserve’s interest rate path this week.

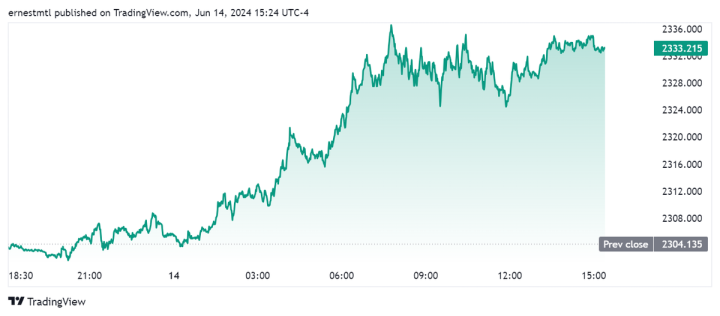

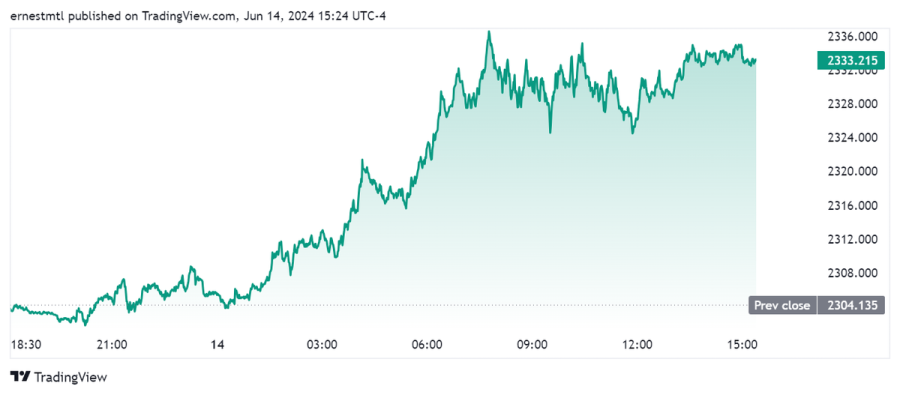

After kicking off the week trading at $2,293.70 per ounce during the Sunday evening Asian session, spot gold broke above the $2,300 level about two hours before the North American market open, and that level held throughout the rest of the week's roller coaster ride.

Gold prices chopped along in a relatively narrow $15 channel as market participants waited for Wednesday, which would bring the consumer inflation report in the morning, then the FOMC rate announcement, updated economic projections, and Chair Powell's press conference in the afternoon.

The CPI report finally shook the market out of its sideways trading, spiking spot gold from $2,313 per ounce just before the data release to its weekly high of $2,336.72 immediately afterward. By the time the Federal Reserve announced that they were keeping rates unchanged at 2:00 p.m., the price had pulled back to $2,326 per ounce, and spot gold continued to sell off steadily as markets digested Powell’s hawkish rhetoric and the FOMC's updated projection of only one rate cut in all of 2024.

By Thursday, spot gold had once again slid back down to support, but it saw a firm bounce just below the $2,300 level and by Friday morning the yellow metal was once again marching higher into the weekend.

The latest Kitco News Weekly Gold Survey has a majority of industry experts and retail traders seeing green for gold prices next week as they emerge from their bearish hibernation and return to bullish pastures.

“Gold snapped a three-week decline, encouraged by political uncertainty in Europe, and a sharp drop in interest rates,” said Marc Chandler, Managing Director at Bannockburn Global Forex. “It recovered about half of what it lost after the US jobs data on June 7 and on reports that the PBOC did not buy gold for reserves last month.”

Chandler noted that spot gold traded to around $2841 in the middle of last week before consolidating. “Gold was relatively restrained, perhaps pulled by conflicting signals—of a stronger dollar on the one hand, and lower rates on the other. Trendline resistance begins the new week near $2362. On a medium-term view, I suspect gold is nearer a bottom than a top and expected lower interest rates to underpin the yellow metal.”

“I’m sticking with ‘up’ for this week as bulls put in a strong defense of $2300,” said James Stanley, senior market strategist at Forex.com. “The pullbacks are getting more concerning, however, as that shows bulls taking advantage of strength to realize profits and square up positions. That’s helped to build a possible head and shoulders pattern. That formation requires a breach of the neckline, but if it does then I think we could be soon looking at a deeper pullback scenario. And for that, I’m tracking the longer-term range resistance, around the $2,075-$2,082 level for longer-term support to play in.”

“For now, support remains in play and I’m biasing bullish, but I’m ready to change if the neckline breaks,” Stanley said.

“Up,” said Adrian Day, President of Adrian Day Asset Management. “Gold is recovering from last week’s sell-off as U.S. economic news has been more ‘dovish’ – weaker producer inflation numbers and higher claims for unemployment – both helping the case for a cut in interest rates, and geopolitical tensions heighten – more attacks on Israel from Hezbollah and Russian warships in the Caribbean.”

“I am bullish on Gold for next week,” said Colin Cieszynski, Chief Market Strategist at SIA Wealth Management. “It’s looking ready for a technical bounce up off of support.”

Sean Lusk, co-director of commercial hedging at Walsh Trading, was reflecting on what traders had learned from both last week and this one.

“I think this recent drop is just a reflection of two things in gold,” Lusk said. “Obviously, last week China just shot an arrow across the bow when nobody was looking, that they were backing off some gold purchases. They said that stuff so they can buy it cheaper, that’s how I view that. And China can say whatever the hell they want, but they have to back up all their money printing.”

“We also had what was deemed to be a blowout unemployment report by some media outlets,” he said. “What a laughable joke that was; not a blowout employment report, it wasn't even close to that. A lot of the gains were government-created, not in the private sector, and if you look within the numbers, and the revisions lower the prior two months, it wasn't that much of a gain, if any.”

Lusk said last Friday’s sharp correction downward wasn’t justified based on those releases. “But the market's going to do what it's going to do, and sometimes you can't fight it,” he said.

“Then CPI came in [this week], hit the dollar one day, and then they brought it back up on PPI,” Lusk observed. “It's just a mixed bag of nonsense, really. But I think for gold's price here, it's a pure consolidation. We held the weekly low down at $2,304. There's a lot of uncertainty all over the place, and I think that the path of least resistance for metals is still higher.”

Lusk said that since last Friday, the August futures contract dropped from $2,406 all the way to $2,304. “You dropped $100 in a day,” he noted. “That's pretty steep, right? But you haven't revisited that low. So now the key resistance is going to be that big ‘drop day’ high. You can draw a trend line from the May high the week before Memorial Day weekend at $2,477 to $2,406. Wherever that line's coming in, that's your trend line that you’ve got to watch. If they blow through last Friday morning's high before China made that announcement, then we're going up to $2,485, if not $2,500.”

“Now, should we blow through $2,304, then we're going down to $2,280 and we might go down to $2,200,” he cautioned. “But I think the trend is still up overall, no doubt about that. You've come off the highs a little bit, but you've had a hell of a run since the February lows. From $1,996 you ran up to $2,454 on the continuous. That’s a $458 move in three months.”

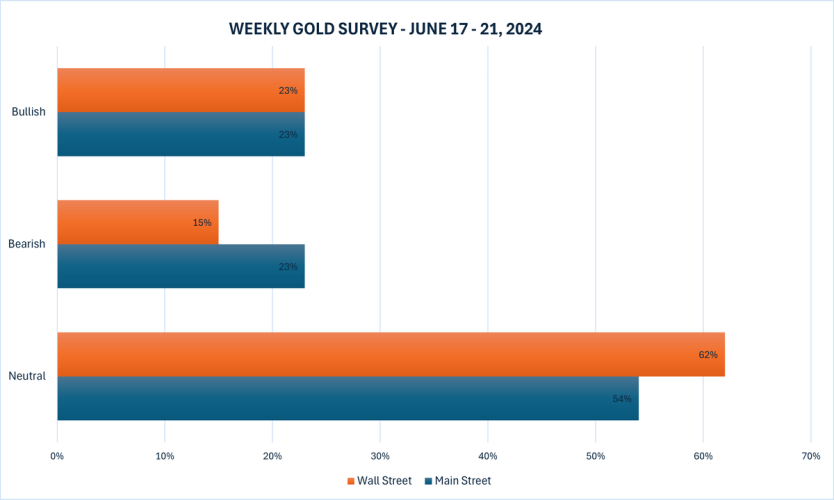

This week, 13 Wall Street analysts participated in the Kitco News Gold Survey, and after this week’s performance, they were considerably more optimistic about the precious metal’s near-term prospects. Eight experts, representing 62%, expect to see gold prices climb higher next week, while only two analysts, or 15%, predicted a price decline. The remaining three, or 23% of the total, expect gold to trade sideways during the coming week.

Meanwhile, 216 votes were cast in Kitco’s online poll, with Main Street investors somewhat more cautious than their institutional counterparts, but positive on balance. 117 retail tradSpot gold last traded at $2333.21 at the time of writing, up 1.26% on the day and 1.71% on the week.ers, or 54%, look for gold prices to rise next week. Another 49, or 23%, expected the yellow metal to trade lower, while 50 respondents, representing the remaining 23%, saw prices chopping sideways during the week ahead.

With the Federal Reserve’s monetary policy decision in the books, markets will shift their focus to Europe next week as the Swiss National Bank and the Bank of England will both announce their monetary policy decisions on Thursday morning.

Markets will also receive the Empire State manufacturing index on Monday, and retail sales for May on Tuesday. Then, Thursday brings housing starts and building permits for May, as well as weekly jobless claims and the Philly Fed manufacturing index. The week’s data wraps up with existing home sales on Friday morning.

Darin Newsom, Senior Market Analyst at Barchart.com, expects gold to build on this week’s rebound and make further gains. “While August gold’s intermediate-term trend remains down, its short-term trend has turned up,” he said. “This means the contract should take out its previous high of $2,358.80 with the next upside target near $2,370, then $2,391.”

“As we head into the weekend, I’m looking for increased investment buying tied to the political chaos in France,” Newsom added. “We can’t call it a Black Swan event given it was predictable as the China/Russia coalition gets more desperate ahead of the global 2024 election cycle.”

Alex Kuptsikevich, senior market analyst at FxPro, said he thinks gold’s support at $2,300 looks extremely fragile and unreliable.

“Firstly, last Friday, Gold went over 4% from peak to bottom, on high volumes and with a horrendous amplitude falling under the 50-day moving average,” he said. “All other dynamics of this week may well be considered as consolidation of liquidity by bears for a new blow to the metal. This thesis is reinforced by the fact that this 50-day average is already actively working as resistance.”

“Secondly, the dollar has been rising since last Friday, as if switching into a ‘buy on the downturn’ mode,” Kuptsikevich said. “The dollar index has pushed back from its 200-day moving average since the beginning of the month. And a rising dollar with attractive bond interest yields makes dollar bonds an effective competitor to gold.”

The third factor weighing on gold is the ongoing slide in stocks. “Separate from the short-squeeze-backed gains in individual stocks in the Nasdaq100 and S&P500, there is noticeable heaviness in the Dow Jones and Russell 2000 indices, not to mention the 5% loss by the French CAC40 for the week,” he said. “Politics was back to spooking the markets as we heard of new barrages of trade wars and the risks of increased protectionism.”

Adam Button, head of currency strategy at Forexlive.com, was also reflecting on the shifting political landscape and its short- and long-term implications for precious metals and the dollar.

“The consensus around open borders and open trade was built with the U.S. dollar at the heart of it,” Button said. “Breaking that system will have impacts, and we're seeing them, on the U.S. dollar, especially now that the U.S. is wielding tariffs as a tool. Trump the other day was talking about replacing income tax with tariffs. That's an attack on even a country like Canada, potentially. I don't think it's realistic, but 10 years from now, who knows? And what does 2028 look like? Does it look like two reasonable human beings in an election fight?”

“That's the way the pendulum is swinging,” he added. “And if it is, what are you doing holding Treasuries? When they say you're cheating on your tariffs, or you're cheating on imports, and they decide to steal your money, like they did to Russia?

“That seems outlandish, but in a world like that, what's gold worth?” Button asked. “$10,000? $20,000?”

Turning to Europe, Button said that the Franco-German consensus that has governed Europe since the dawn of the euro is ending. “What happens to the Eurozone from here? And the EU, what's the point of the whole thing if that's broken?” he asked. “We're seeing that in French bonds right now. It's not hard to envision the next German election, the next Hungarian election again, even the Dutch swung that way.”

“Political turmoil is the theme right now,” he said. “And that's a classic gold driver.”

That said, Button still doesn’t expect gold to rise in the near term. “Do I want to be long gold next week? No, I don't,” he said. “If something can't rally on good news, then it's not going to rally. That was the best CPI report that gold bulls could have hoped for, and gold didn't rally. It's having a decent day today, but maybe that's the push and pull of the political side.”

“I don't like the price action this week, that's what it comes down to for me,” Button added. “If $2,300 breaks, what's the downside? Probably like $2,150, something like that. Maybe I'm interested there.”

The other thing he’d like to see is whether gold prices can withstand some real pain in equities.

“No one has forgotten how poorly gold did at the outset of COVID,” Button said. “And I'm not to say that we'll see equities puke like that, but it hasn't been a counter-cyclical trade. So I just want to see what gold looks like in a poor day for equities, a real poor day, which I think we're headed toward. We just need one bad NVIDIA headline. It's really carrying the whole market here.”

Michael Moor, Founder of Moor Analytics, was breaking down the technical picture from gold’s recent price action in the lower and higher timeframes.

“On a lower timeframe basis: The trade below 24343 (+1.3 tics per/hour) has brought in $130.1 of pressure,” Moor wrote. “The trade below 24216 (+4 tics per/hour) projects this downward $60 (+)—we have attained $117.4. These rolled from (M) into the (Q). The trade back below 23642 (-1.2 tics per/hour) in (Q) has brought in $60.0 of pressure. Decent trade above 23489 (-1.2 tics per/hour starting at 7:00am) should bring in decent strength.”

“Areas of possible exhaustion to contend with below come in at 65216-4785, 62926, and 60280-59628; and we have entered into the ideal timeframe for one of these to hold more than temporarily – if we settle below the lower of these, this should be a larger, higher timeframe correction,” he said.

And Kitco Senior Analyst Jim Wyckoff holds a balanced view toward gold going into next week. “Choppy and sideways as bulls and bears are on a neutral near-term technical playing field,” he said.

Kitco Media

Ernest Hoffman

David