Wall Street sees green lights for gold next week; Main Street jumps back on the bullish bandwagon

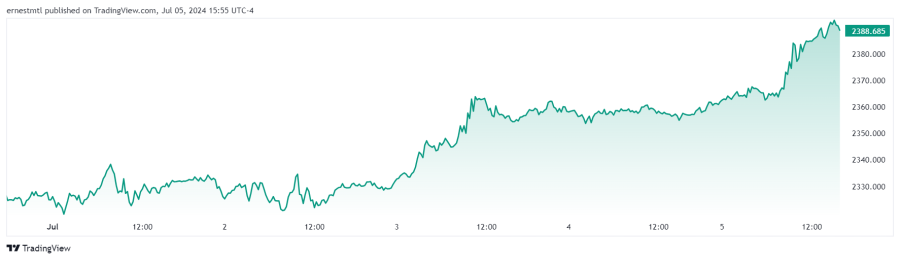

Gold finally shook itself out of its summer doldrums this week, as weak employment data helped the yellow metal rocket out of its recent holding pattern as it once again approached the $2400 price level.

Spot gold opened the week trading at $2,326.72 per ounce, remaining within a $15 range of that level on Monday and Tuesday. Then, Wednesday brought a raft of economic data and news events, with ADP employment, weekly jobless claims, and the ISM services PMI all released in the morning ahead of the July 4th Independence Day holiday in the United States, along with the minutes from the June FOMC meeting in the afternoon.

The data suggested a weakening jobs market in the United States, and the Fed’s minutes showed little inclination to raise rates. This combination helped to propel gold from flat on the week to its then-high of $2,363.77 shortly after 10:30 am EDT.

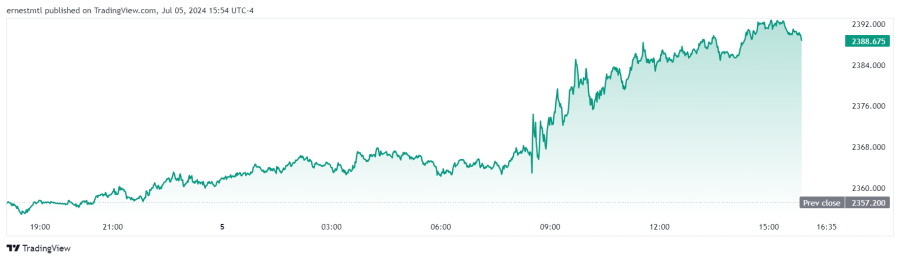

The yellow metal trended within a few dollars of its new high through the Independence Day holiday. Then, traders returned on Friday morning to receive definitive confirmation of what the week's earlier data had told them: employment, as per the non-farm payrolls report for June, was indeed faltering, with revisions subtracting over 100,000 jobs from the prior two months, while the unemployment rate ticked up unexpectedly to 4.1%.

This was all precious metals traders needed to see, and they proceeded to propel gold from $2,367 per ounce in the minutes before the release to fresh weekly highs above $2,390 by early afternoon.

.png)

At the time of writing, spot gold continues to trade at its highest levels in over a month, and within a few dollars of $2,400 per ounce.

The latest Kitco News Weekly Gold Survey shows virtually all industry experts seeing green for gold prices next week, while retail sentiment has also turned solidly positive once again.

“I like gold higher next week on lower interest rates and anticipation of a weaker US dollar,” said Marc Chandler, Managing Director at Bannockburn Global Forex. “A small shelf is near $2350. The early June high was near $2388, and that may be the initial target on the way to test the air above $2400.”

“Momentum indicators are favorable, and the five-day moving average crossed back above the 20-day average,” Chandler added.

Darin Newsom, Senior Market Analyst at Barchart.com, also sees further gains in gold’s near-term future. “August gold is nearing a possible end to its short-term uptrend, though early Friday morning finds it still has time and space up to the next target of $2,390.80,” he said. “While the intermediate-term trend remains down on the contract’s weekly chart, a higher close this week would be the second consecutive, setting the stage for a higher weekly close next week before resuming the downtrend.”

Mark Leibovit, publisher of the VR Metals/Resource Letter, was the lone voice of dissent this week. “Keeping my inverse index hedges on,” he warned. “Risk in gold in the weeks (possibly months) back to 2000 area.”

Analysts at CPM Group said in a note on Friday that their recommendation is to buy, with an initial target of $2,410.

“Gold prices could move higher in the next couple of weeks before potentially retreating,” they wrote. “There is building support for prices from the political environment in the U.S., Europe, the Middle East, and from many other parts of the world. There appears to be rising concern about President Biden’s ability to be reelected and, if reelected, manage the duties of the President. This rising uncertainty is supportive of gold prices. As the Democratic Party moves to find a replacement candidate would elevate uncertainties and concerns among investors, likely to be reflected in gold purchases.”

“Economically, the world continues to fare well, but the slowing down in economic output in many countries and regions is creating an underpinning of concern about economic trends in the near future,” they added. “Additionally, there are some rising expectations in financial markets that interest rates could move lower in the months ahead. Inflation has cooled and unemployment has risen only slightly.”

The analysts noted that gold prices have traded between $2,285.20 and $2,448.80 since early April, which has created firmer support and resistance levels. “The length of time that gold has traded within this range perhaps makes it more difficult for prices to break out,” they said. “Technical trading suggests a continuation of trading in this range until there is a catalyst to move prices outside of this range.”

“Prices are in an uptrend now, likely to test resistance levels before easing thereafter,” they concluded. “The seasonal weakness that typically takes hold of markets around this time of year appears to be on hold for the moment.”

This week, 12 Wall Street analysts participated in the Kitco News Gold Survey, and the overwhelming majority see green lights for the yellow metal. Ten experts, representing 83, expect to see gold prices climb higher next week, while one analyst, or 8%, predicts a price decline, and one other saw gold trending sideways in the week ahead.

Meanwhile, 164 votes were cast in Kitco’s online poll, showing Main Street investors walking on the sunny side of the street again. 108 retail traders, or 66%, look for gold prices to rise next week. Another 26, or 16%, expected the yellow metal to trade lower, while 30 respondents, representing the remaining 18%, saw prices trading sideways during the week ahead.

The Federal Reserve remains in the spotlight next week, with Fed chair Jerome Powell testifying before the Senate Banking Committee on Tuesday, and then the House Financial Services Committee on Wednesday.

Markets will also be paying close attention to U.S. CPI for June along with weekly jobless claims on Thursday, followed by the Friday release of U.S. PPI for June, followed by the preliminary University of Michigan consumer sentiment survey.

Adam Button, head of currency strategy at Forexlive.com, said the political environment is providing a unique bid for gold prices. “We are likely living through one of the all-time great moments in U.S. politics,” Button said. “It takes a great deal to move gold on U.S. politics, but Biden dropping out would do it.”

Colin Cieszynski, Chief Market Strategist at SIA Wealth Management, said he wasn’t so sure that the weak jobs data had increased the likelihood of a Fed cut, but weakness among other asset classes was providing renewed bullish momentum for gold prices.

Cieszynski agreed that there were no surprises for markets in the June minutes. “The Fed was pretty clear when it came out with its forecasts that they're only cutting rates once this year, maybe before the election, maybe after, and that there's a lot of inflation still kicking around out there,” he said. “That hasn't gone away. Today's employment numbers were very stagflationary because the second you looked under the hood of the jobs data, it wasn't very good. The last month was revised down more than this month beat by, and wages and hourly earnings didn't go down, so there's really no reason to think that there's any change here.”

“The Fed is still on hold,” he added. “They only seem to talk dovish at all just to prop up the market, and otherwise, they're stuck.”

Cieszynski said that based on gold’s reaction on Friday, he thinks markets are dialing down the chances of further rate hikes, but they may be premature. “I think at this point it's just working down the odds of a rate hike,” he said. “I think there's just more conviction that even though the Fed wants to leave the door open to a rate hike to scare people, realistically they're probably not going to raise rates. They may not cut anymore. But it depends, right? If inflation starts to take off, then they may have to raise rates. It's very mixed here.

Cieszynski believes the biggest booster of gold this week was Bitcoin’s decline. “Bitcoin is just getting absolutely smoked again today, and I think we're starting to see some of that money coming back into gold and silver,” he said. “I consider them [both] alternative currencies, and when people are feeling aggressive and want to take on risk, they go charging off and buy Bitcoin. Now, I know there's also an event around this, why Bitcoin's getting depressed, but it was rolling over anyways, and when people are starting to feel more concerned, they go back into gold. I think that's what we're starting to see a little bit of here.”

Cieszynski also said he’s seeing broad-based weakness in equities, even if the strength of a handful of tech stocks continues to mask it. “The market seems to be crumbling underneath the top, and that's more favorable for gold,” he said.

He also agreed with the prevailing view that markets are growing more confident about a September rate cut but cautioned that this week’s moves could be misleading due to the holiday.

“I don't think much has really changed this week,” he said. “A lot of the trading has been distorted with all the holidays, and it's just generally a week that people go away on vacation. We can't really glean much out of this week given all the distortions.”

Cieszynski said that, on balance, he still sees gold in a strong position to make further gains.

“I'm bullish on gold for next week,” he said. “It looks like money's coming back in, and there's places for it to come from, because money's moving out of cryptos and money's moving out of equities, so it's clearly looking to go somewhere else.”

Michael Moor, Founder of Moor Analytics, was looking at the upside and downside potential for the yellow metal. “The trade above 23276 (-2 tics per/hour) warns of decent strength—we have attained $30.3,” Moor wrote. “The trade above 23437 (-1 tic per/hour) projects this upward $15 minimum, $45 (+) maximum—we have attained $14.2; but if we fail back below decently, look for decent pressure.”

And Kitco Senior Analyst Jim Wyckoff said improving odds of a Fed cut have boosted the technical picture for gold prices. “Steady-higher as the near-term chart posture for gold has improved, and the Federal Reserve is leaning a bit easier on its monetary policy,” he said.

Spot gold last traded at $2,388.51 per ounce at the time of writing for a gain of 1.33% on the day and 2.81% on the week.

Kitco Media

Ernest Hoffman

David