Following the strong run-up in bitcoin prices yesterday, traders may now be eyeing another opportunity for further growth as the short trade is getting unusually crowded for the number one cryptocurrency.

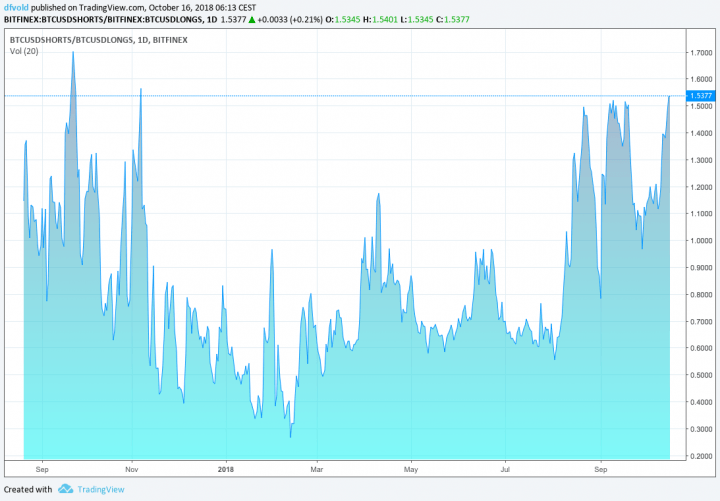

In what appears to be short-term traders positioning themselves for a further sell-off in bitcoin on the Bitfinex exchange, the ratio of short-to-long orders on the exchange reached 1.54 during the Asian trading session Tuesday morning, a level not seen since November last year.

Short-selling essentially involves speculating on lower prices in a market by borrowing an asset that a trader doesn’t currently own in order to sell it in the market. The asset can then be bought back at a lower price later, allowing the short-seller to profit from the difference between the selling price and the buying price.

While a high number of sellers in a market is generally considered a bad sign, it also opens up opportunities when it reaches extreme levels. This is what is known as a short-squeeze, and it is something we have seen repeatedly this year as the short-to-long ratio has hit the high levels we are at now.

If the market starts to move upwards in the near future, many of the short-sellers will exit their short positions by buying back bitcoins in the open market. As the price moves further up, even more short-sellers will get margin calls or hit their pre-set stop-loss levels, forcing them to cover their shorts, and creating a self-reinforcing mechanism that can cause sharp price increases. Whether this will happen again this time, however, still remains unclear.

Significant arbitrage opportunities

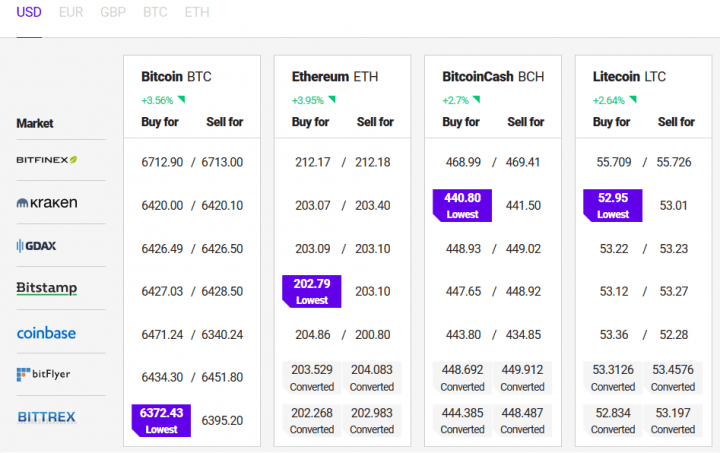

Another possible explanation is that there is a significant amount of arbitrage going on right now centered on the Bitfinex exchange, following the surge in the bitcoin price yesterday that brought the price on Bitfinex to nearly USD 7,800 at its peak. That was close to USD 1,000 higher than on other exchanges like Coinbase, where bitcoin reached a high of about USD 6,800 yesterday.

An obvious way for traders to take advantage of a situation like that is to short-sell bitcoin on Bitfinex, while buying bitcoin on Coinbase or another exchange. That way, a trader would be profiting as the price gap between the exchanges closes.

The bitcoin price was nearly unchanged across exchanges on Tuesday morning, and still remains significantly higher on Bitfinex than on other exchanges, which many in the community attributes to speculation and fear about the status of the popular stable coin Tether.

Price differences at exchanges:

By Fredrik Vold

October 16, 2018

David