Main Street sows seeds of doubt for gold gains, but Wall Street believes conflict will continue to propel prices

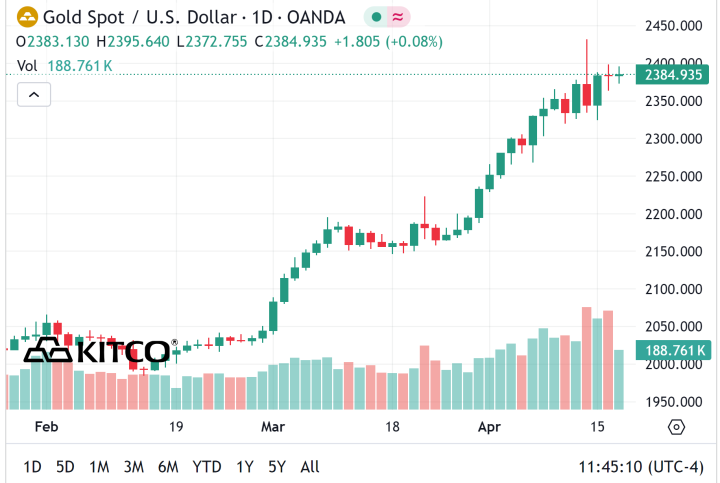

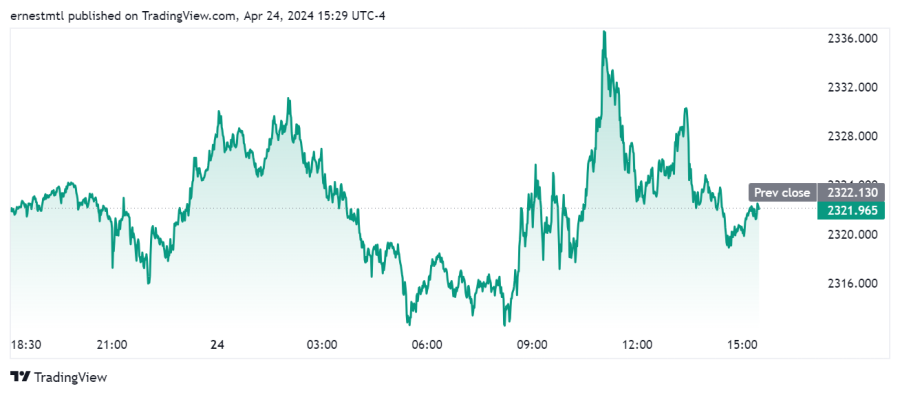

Gold prices followed a now-familiar pattern this week, trading in an elevated range until geopolitics shocked the market to highs, followed by retracement to a higher floor.

Spot gold opened the week trading at $2,367 per ounce, and other than a short-lived sharp drop to the weekly low of $2,332 a half-hour after the North American open on Monday morning, the yellow metal seemed content to oscillate between $2,360 and $2,390 per ounce.

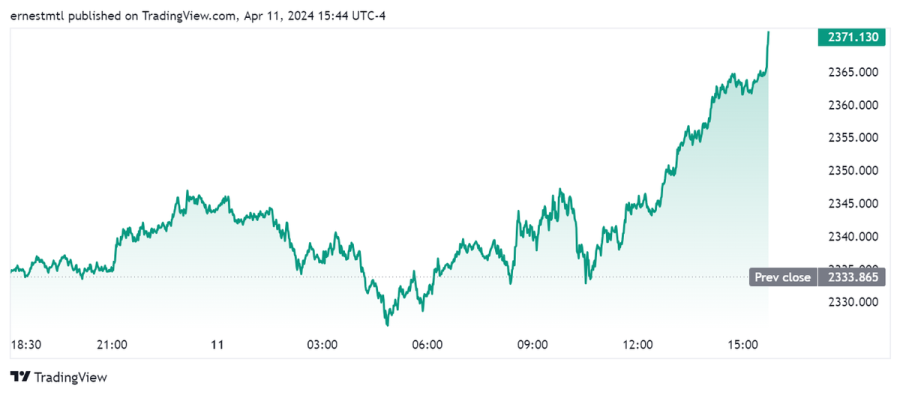

Then, a week after Iran’s drone and missile attack on Israel sent spot prices to an all-time high above $2,426 per ounce came Israel’s response, which once again pushed gold back above $2,400 late Thursday evening. The market returned to its prior range, however, once it became clear that like Iran’s attack, this one was more demonstrative than destructive.

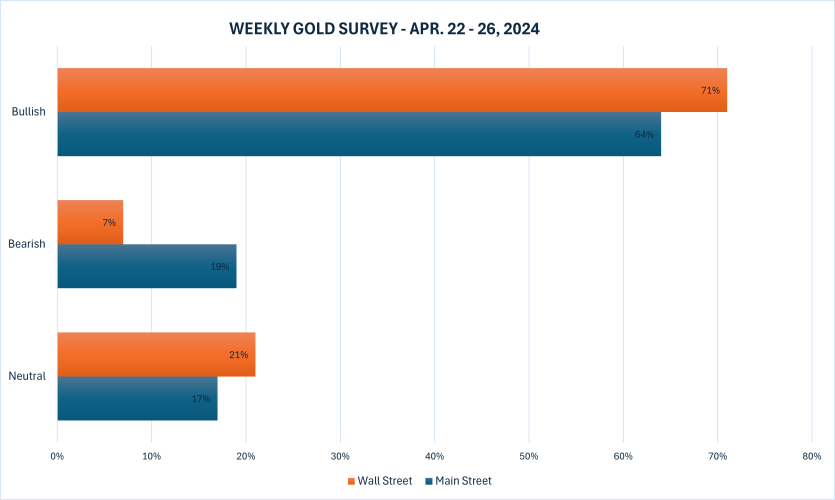

The latest Kitco News Weekly Gold Survey showed both Wall Street and Main Street still betting on bullion to make further gains despite its rapid runup and lack of retracement.

“I am bullish for the coming week,” said Colin Cieszynski, Chief Market Strategist at SIA Wealth Management. “At this point, macro risks remain high with so many political situations volatile at the moment. As we saw overnight, I would not take much to spark a rally in gold.”

Adrian Day, President of Adrian Day Asset Management, sees gold trading sideways next week. “Gold’s strength in the face of central banks deferring rate cuts is remarkable, but it is due for a short pause,” he said. “I do not expect a deep or long pullback, but at least a pause for a few days.”

Dennis Gartman, creator of the Gartman Letter, counts himself among the gold bulls for next week. “I wouldn't be surprised if gold took out its recent all-time highs in the next week or so,” he said. “Then it’s off to the races again.”

Daniel Pavilonis, Senior Commodities Broker at RJO Futures, said geopolitical conflict will continue to push gold prices higher even if there’s no immediate escalation.

“There's still a lot of geopolitical uncertainties, if [the Israel strike] is it, if everything is ended, or if there's going to be more behind this,” he said.

“I think that's one of the reasons why gold is still bid, I think that's probably the main reason,” Pavilonis added. “Next week, I would expect us to be at elevated levels, I would say probably higher. It's flight to safety right now, and I think gold is obviously a place where you want to be. I would imagine we continue to the upside.”

Pavilonis reiterated that the Israel-Iran conflict will be the driving force for gold and other markets in the near term. “I think everything is just Middle East right now,” he said. “This is either going to just fall to the wayside and not be cared about anymore, or this is going to be one of those things where it draws more countries in and gold really starts to take off.”

“That's really what's taking center stage right now.”

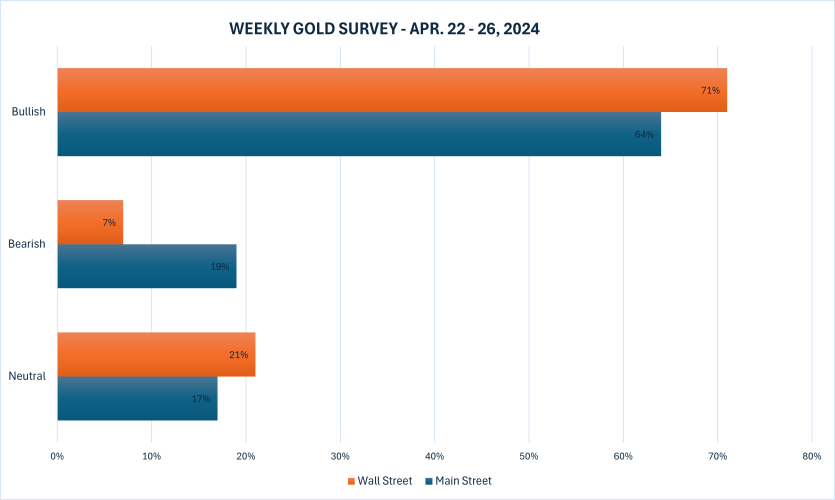

This week, 14 Wall Street analysts participated in the Kitco News Gold Survey, and while there was a noticeable shift to the sideways camp from last week, even fewer saw declining prices. Ten experts, or 71%, expected to see gold prices climb even higher next week, while three analysts, representing 21%, saw gold holding steady. Only one analyst, or 7% of those surveyed, predicted a price drop.

Meanwhile, 149 votes were cast in Kitco’s online poll, with Main Street investors showing some nervousness about the precious metal’s prospects at these elevated levels. 95 retail traders, representing 64%, looked for gold to rise next week. Another 29, or 19%, predicted it would be lower, while 25 respondents, or 17%, expect the precious metal to trend sideways in the week ahead.

With geopolitical risk sucking up all the oxygen in markets of late, it’s just as well that next week is another relatively light one for economic data. Still, traders will tear their eyes away from the news headlines to check New Home Sales for March on Tuesday, Durable Goods for March on Wednesday, Pending Home Sales, Jobless Claims and Advance Q1 GDP (including quarterly PCE) on Thursday, and March PCE and University of Michigan Consumer Sentiment on Friday.

Darin Newsom, Senior Market Analyst at Barchart.com, said gold is overdue for a pullback, but he still doesn’t see one coming.

“The market is overbought, and probably needs a selloff to release some of the pressure that could be building,” Newsom said. “But the trend remains up, and with geopolitical tensions expected to continue increasing from now through the US Presidential Election this coming November, gold will likely continue to find investment safe haven buying.”

James Stanley, senior market strategist at Forex.com, also sees the yellow metal continuing its climb.

“The $2400 level has stalled the move for now, but with two instances of failed breakout there, bulls have had an open door to take profit from the breakout – yet support still keeps getting bought,” he noted. “I’m not sure if this is accumulation from a bigger player or whether it’s just rate expectations around FOMC, but the fact that the move has continued to draw bulls in at support makes me think that Gold’s bullish trend isn’t over yet.”

Everett Millman, Chief Market Analyst at Gainesville Coins, said the Middle East conflict has taken charge of the gold market, and in the absence of major economic news events, it’s likely to stay that way for some time.

“I think the obvious catalyst for gold remaining this high after that selloff we saw last Friday, it's absolutely tied to the escalation between Iran and Israel in the Middle East,” Millman said. “We have this lull period until we get to the June FOMC meeting to get a clearer idea of if the Fed is actually going to stick to its guns and be more hawkish. So that goes on the back burner, the whole rates conversation, and even how the economy is doing, until we get a significant de-escalation.”

Millman said that he’s thankful it’s not World War III, but it's still a lot worse than it was only a week or two ago. “I think that geopolitical premium is absolutely keeping gold afloat right now near the all-time highs,” he said. “Any time I see gold and the dollar rising at the same time, that is usually a pretty strong indication that markets are being mainly driven by a flight to safety or a flight to quality, and I don't see any other strong reasons for them to do that, except for fears over a larger conflict in the Middle East, or even just an escalation between Iran and Israel.”

“I think that could be very short-lived,” he added “We could see gold sell off again if we do get a de-escalation. But right now, I think that's the main thing that I'd be looking at.”

Millman said that he expects the gold market to remain fairly volatile next week. “That being the case, I think that the price range that traders and investors should be looking at has to widen a little bit,” he said. “It would still be shocking if gold moves, let's say, another $200 an ounce next week, but I think $100 in either direction, $2,500 on the high end, and back down to maybe $2,250 or $2,200, I don't think those are outside the realm of possibility.”

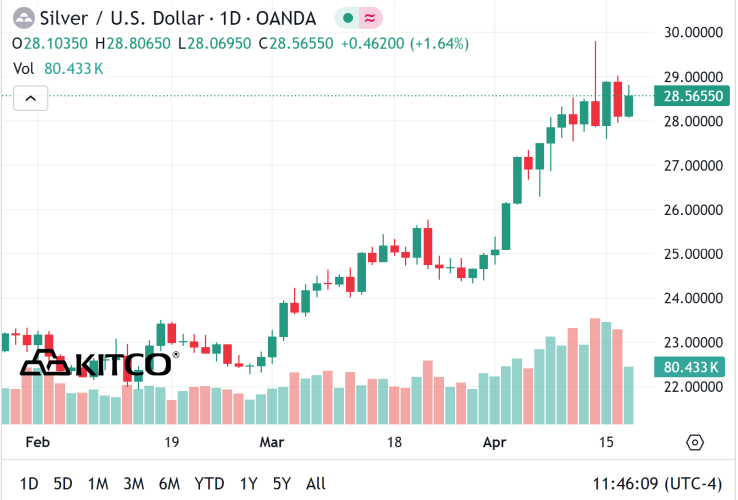

Mark Leibovit, publisher of the VR Metals/Resource Letter, said he remains bullish in the short and medium term, and sees even bigger gains for silver. “Still targeting Gold for $2700-2800,” he said. “Silver is the big catchup play. $30 then $50.”

And Kitco Senior Analyst Jim Wyckoff still sees potential gains for gold prices next week. “Steady-higher as geopolitics still in play and charts are still bullish,” he said.

Spot gold last traded at $2,392.07 per ounce at the time of writing, up 0.55% on the day and 2.04% on the week.

Kitco Media

Ernest Hoffman

Time to Buy Gold and Silver

David

.jpeg) The gold market is seeing solid selling pressure after failing to hold its ground at $2,400 an ounce. Although the market has room to fall lower during the summer, one market analyst says that the precious metal remains in a solid position to rally by year-end.

The gold market is seeing solid selling pressure after failing to hold its ground at $2,400 an ounce. Although the market has room to fall lower during the summer, one market analyst says that the precious metal remains in a solid position to rally by year-end..png)

.png)