Will Investing in Cryptocurrency Make You Rich

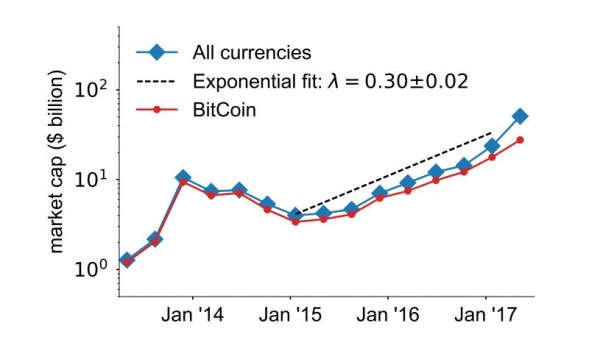

Have you heard? Cyptocurrency is so hot right now. Bitcoin's price has been climbing for the better part of a year, topping $2,000 per coin for the first time in May, and rising to a record high above $2,500 — before dropping down just above $2,400 a coin as of Friday afternoon, per CoinDesk.

Those numbers mean nothing to you? This one might: If you had made a small investment in bitcoin back in 2010 — buying just $100 worth, when each unit was worth a fraction of a cent — your stash would be valued today at more than $70 million. Talk about an early retirement!

Even if you had been late to the party and bought bitcoin last year, you would be feeling pretty good. At one point, bitcoin prices were up roughly 180% for the year, as CNBC reported. Compare that with the broad stock market, which returned between 7.9% and 15%, depending on which index you look at.

Other cryptocurrencies have been on a tear as well. Ethereum, launched in 2015, is a software platform that has a cryptocurrency of its own, called "ether." Ether, or "ether tokens," hit a new all-time high Wednesday after climbing more than 35% in 24 hours, per CoinDesk. (There's also litecoin, which is similar to bitcoin but easier to obtain, more transactional, and seen as less valuable.)

So does that mean you should buy cryptocurrency today? Some say yes: One bitcoin proponent told CNBC he expects its value to keep rising and hit $100,000 within the decade. While digital currencies may seem alien now, it serves to remember that when Apple and other tech brands began gaining steam in the 1980s, people were skeptical anyone would have use for a personal computer. That story had a happy ending for early Apple investors.

Then again, hindsight can be 20/20, and just because an asset's price is going up doesn't mean it's actually getting more valuable. Just ask someone who bought U.S. real estate in 2007, or a tulip bulb during the infamous Dutch tulip bubble. If all that is driving prices to rise is hype, it's a good time to remember that what goes up must come down.

What are bitcoin and ether, exactly?

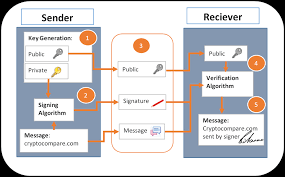

For the uninitiated, cryptocurrencies like ether and bitcoin are digital forms of money that live online, embedded in algorithms that record their movements. Bitcoin was the first major cryptocurrency, invented by an anonymous hacker known as Satoshi Nakamoto, in 2008. In a paper about the technology, Nakamoto envisioned a "peer-to-peer electronic cash system" that would let people conduct business directly, without the need of any outside institution.

The idea can be an exciting one: No more bank fees, for one, and you wouldn't need credit cards or debit cards, either. You also wouldn't need central banks or treasuries, since the price of currency would be set on the global stage by computers. Proponents of bitcoin, and its underlying technology, blockchain, hope that it could make most middlemen irrelevant by making all transactions instantly trustworthy and automated by Bluetooth.

If you needed a ride somewhere? You'd just summon your self-driving car, it would automatically read your digital wallet and take its fee, and you'd get out. It's a future that could save billions in transaction fees, protect identities and be a whole lot more sanitary. But we're not there yet, not by a long shot.

Currently, the system of using bitcoin relies on programmers to record transactions and build out what's known as a blockchain in exchange for a small bitcoin bounty. That process is called "bitcoin mining," and anyone can participate, although the reward will diminish over time

The case for investing in cryptocurrency

Cryptocurrency has come a long way from bitcoin's roots as the shadow currency favored by criminals on the Silk Road. Skepticism over bitcoin reached a boiling point in 2014, when Mt. Gox, the largest bitcoin exchange in the world, abruptly declared bankruptcy after than $460 million in bitcoin essentially disappeared.

Despite a rocky start, bitcoin has arguably entered the mainstream. For one, you can actually use it to buy stuff now. Many retailers, like Microsoft and Overstock, have started accepting bitcoin directly, and for the retailers that don't — notably Amazon — proponents have found a workaround by buying gift cards with their bitcoin and making purchases that way.

"The vast majority of bitcoin proponents are now either in finance or government," said Ian Bogost, an author, professor and game designer who has written about bitcoin for the Atlantic. "And for them, the speculative aspect is like a repurposing. The speculatists couldn’t give a shit what they’re speculating on, what the object is. Just that there is the possibility of substantial gain."

Ironically, given its roots, many of bitcoin's recent wins have been thanks to governments. Most recently, Japan voted to make bitcoin an officially sanctioned currency, and other countries like Barbados are looking into whether they should start purchasing bitcoin of their own.

Interestingly, many fans of cryptocurrency argue that the real value might not be in the currency itself, but in the technology that enables it — ways to safely and securely move value, for example, or trustworthy ways to validate identity.

"Bitcoin basically operated in obscurity until 2012, when media began reporting on its pseudonymous payments on Silk Road and it hit $1,000 before crashing," said Amanda Gutterman, chief marketing officer of ConsenSys, a blockchain studio which builds products on Ethereum. "As interest picked up, there was a desire to create more sophisticated financial products."

Bitcoin started as an experiment in monetary theory, Gutterman said, but it has already started to inspire real technology. ConsenSys, for example, is working with the city of Dubai to leverage blockchain and make the city government paperless by 2020. Because it's easier to build products around, many experts believe Ethereum could soon supplant Bitcoin.

The case against buying cryptocurrency

While the price of cryptocurrencies might be going up, there are still a lot of reasons to be wary, not least because it's virtually impossible to determine what a fair price for bitcoin or ether might be.

Part of what makes currencies and other assets valuable is that they have a history of appreciation, which cryptocurrencies do not share. Then there's the fact that people don't exactly agree on what the rules for bitcoin should be. It's not really a currency, since currencies are backed by a government, which issues them. It's also not really like a stock, either — cryptocurrencies don't report earnings or generate profits, and earnings and profits are how people try to determine what a "fair price" for a given stock might actually be.

Now, a few people have developed formulas to figure out the fair price for bitcoin: The Financial Times spoke to one anonymous London financial analyst who developed a model for pricing bitcoin based on the assumption that its "core utility value" is as the currency for shadow markets. By comparing the total amount of money that's laundered around the world with the overall GDP, he estimates that bitcoin's current price is about 238% higher than it should be. Other skeptics say that bitcoin has no real underlying value at all.

Despite being embraced by corporations and governments, bitcoin is still associated with criminal activity: When the WannaCry ransomware attack hit computers all over the world in May, the hackers involved requested their bounties in bitcoin. That means that even as some governments embrace bitcoin, others are cracking down: In Florida, for example, the state legislature recently passed a law that would make it easier to prosecute criminals who use bitcoin for money laundering.

Somewhat paradoxically, these types of criminal activity might actually be part of what's making bitcoin more valuable at the moment. Confronted with a rise in bitcoin ransoms from hackers, Bogost noted that a very natural response for a company is to buy a little bitcoin in case it happens again.

Bogost said she fears that bitcoin is particularly susceptible to monopoly — as hackers have very successfully cornered the market in the past. "We’ve seen with these sort of ups and downs, these small groups of mostly Chinese pools end up with more than 50% of the capacity. And we don’t know anything about these organizations. Are they state controlled?" Bogost said. "The moment [there is too much consolidation in the mining pools] then effectively the platform is dead, at least as a currency."

Finally, there's the possibility people are unwisely romanticizing a future without middlemen. The people who lost their bitcoin in the 2014 Mt. Gox hack are still trying to get their money back, and are unlikely to. After all, when the value of your cash is held in anonymous, poorly-understood algorithms, it's hard to hold somebody accountable if you lose it.

If you still feel like investing a small amount of money in cryptocurrency, be sure not to dip into your emergency savings. It's rarely a good idea to buy something when its price is at its all-time high. And remember that there are a lot of horses in this race: In addition to bitcoin, ether, and litecoin there's also ripple, namecoin and peercoin.

How to buy and store cryptocurrency

If you have some "play" money and want to make a bet on cryptocurrency, you should absolutely feel 100% comfortable with the idea of losing all that money. Cryptocurrencies have crashed before, often, and probably will again in the future. They're also historically expensive — if you must buy some, you might be served by waiting a bit for prices to drop, so you're more likely to get a deal.

There are lots of ways to buy cryptocurrencies, and some countries have even set up ways to purchase them via an ATM.

Coinbase is one of the more well-known bitcoin brokers, and often recommended for beginners. Coinbase allows you buy bitcoin and other cryptocurrencies by linking to your debit or credit card account. Business Insider reports that the mobile app is buggy, and banks will sometimes lock a card after making these transactions. To that end, BI recommends letting your financial institution know before trying to make a purchase.

There are a few other options, though they have less of a track record: Kraken is one reputable alternative; it has been around since 2011 and works with a wide range of traders and governments. There's also Gemini, but it is not yet available in every state.

Finally, because exchanges, even the largest ones, have crashed abruptly, it's also important to get yourself a safe place to store your bitcoin, in case your provider goes out of business or suffers a hack. These devices are often referred to as bitcoin "wallets." Ledger is a popular option.

by James Dennin

David Ogden

Entrepreneur

David