Gold, silver hit hard by hawkish Fed, surge in greenback

Gold and silver prices are sharply lower in midday U.S. trading Thursday. The precious metals bulls were running for cover today amid sharp gains in the U.S. dollar index and in the aftermath the FOMC meeting that sees the Federal Reserve still leaning hawkish on U.S. monetary policy. February gold was last down $32.00 at $1,786.00 and March silver was down $0.836 at $23.305.

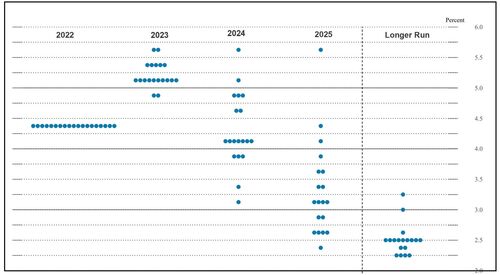

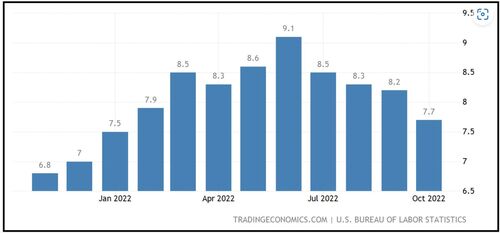

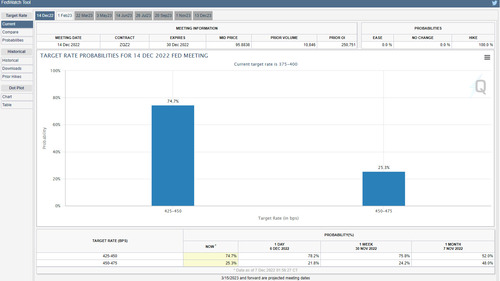

A still-hawkish Federal Reserve had traders and investors in a "risk-off" stance Thursday. Two months of better-than-expected U.S. inflation data were not enough to convince the Fed to let its foot off the monetary-policy-tightening gas. "Higher for longer" is the marketplace takeaway from this week's FOMC meeting—meaning higher interest rates for a longer period of time—to ensure the Fed tamps down hard on inflation.

Global stock markets were lower overnight. U.S. stock indexes are lower at midday.

The European Central Bank and the Bank of England monetary policy meetings on Thursday saw both the BOE and ECB raise their main interest rate by 0.5%. That follows the U.S. Federal Reserve's half-point rate hike. The central banks of Switzerland and Norway also raised their interest rates Thursday but also in smaller increments of policy tightening.

China and its fight against Covid remains near the front burner of the marketplace. Broker SP Angel this morning said in an email dispatch there is increasing evidence that China is now "allowing Covid to rip through the population." There is relatively little vaccination and almost no effective vaccination against Omicron in China. "That means the virus will bypass most of the Covid controls left in place." The Wall Street Journal said today that "China's economy took a big hit in November" due to strict Covid lockdown policies.

The ECB's aggressive monetary policy stance gives gold a lifeline as euro makes a move against U.S. dollar

The ECB's aggressive monetary policy stance gives gold a lifeline as euro makes a move against U.S. dollar

The key outside markets today see the U.S. dollar index sharply higher. Nymex crude oil prices are weaker and trading around $76.75 a barrel. Meantime, the yield on the benchmark U.S. 10-year Treasury note is presently around 3.45%.

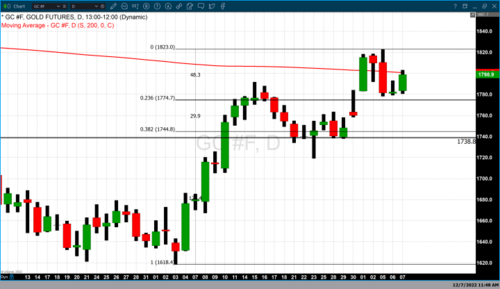

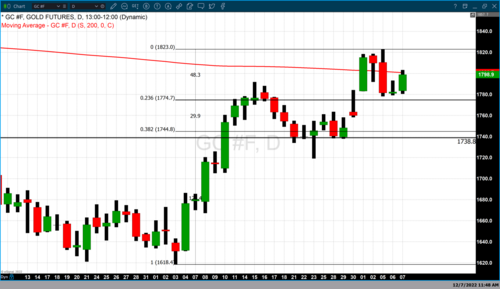

Technically, February gold futures bulls are fading late this week but still have the overall near-term technical advantage. However, a five-week-old uptrend on the daily bar chart is in jeopardy. Bulls' next upside price objective is to produce a close above solid resistance at this week's high of $1,836.90. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,750.00. First resistance is seen at $1,800.00 and then at today's high of $1,819.70. First support is seen at today's low of $1,782.00 and then at $1,778.10. Wyckoff's Market Rating: 6.0

March silver futures bulls have the firm overall near-term technical advantage. Prices are in a choppy 3.5-month-old uptrend on the daily bar chart. Silver bulls' next upside price objective is closing prices above solid technical resistance at $25.00. The next downside price objective for the bears is closing prices below solid support at $22.00. First resistance is seen at $24.00 and then at this week's high of $24.39. Next support is seen at today's low of $23.155 and then at $23.00. Wyckoff's Market Rating: 6.5.

March N.Y. copper closed down 1,125 points at 376.55 cents today. Prices closed nearer the session low today. The copper bulls have the slight overall near-term technical advantage. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at 400.00 cents. The next downside price objective for the bears is closing prices below solid technical support at 354.70 cents. First resistance is seen at today's high of 386.75 cents and then at this week's high of 392.90 cents. First support is seen at 370.00 cents and then at 360.00 cents. Wyckoff's Market Rating: 5.5.

By Jim Wyckoff

For Kitco News

David

Deutsche Bank wants back in the gold market after eight-year absence

Deutsche Bank wants back in the gold market after eight-year absence.gif)

Outlook 2023 LIVE with Gareth Soloway

Outlook 2023 LIVE with Gareth Soloway

Sentiment in gold evenly split as prices end the week at a four-month high

Sentiment in gold evenly split as prices end the week at a four-month high

.png)

.png)

.gif) JPMorgan, HSBC to share custody of GLD's 900 tonnes of gold

JPMorgan, HSBC to share custody of GLD's 900 tonnes of gold.gif)