Bitcoin Bottom? Two Strong Signs of a Crypto Market Trend Reversal

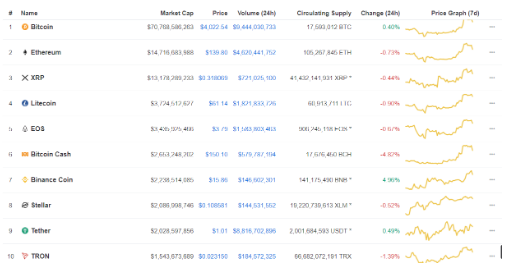

This past weekend the cryptocurrency market enjoyed a spectacular rally, reaching almost $140 billion in value. Leading crypto asset Bitcoin (BTC) soared past the critical $4,000 resistance level that has been holding it down for months, prompting many to ask – is the bottom in for Bitcoin?

Two crypto enthusiasts on Twitter have pointed out compelling arguments as to why they believe the bottom could be in for Bitcoin and the crypto market’s year-long bear run might be over.

High Volume

Crypto investor and creator of Twitter tipping app tippin.me, Kevin Rooke, recently posted a tweet detailing the huge increase in BTC’s daily exchange volume.

“Volume has increased by ~150% in the last 5 months,” he points out in the tweet. That’s the highest that Bitcoin’s daily exchange volume has been in over a year and the majority of the increases have been this month. In fact, Bitcoin’s daily exchange volume has exceeded $10 billion only nine times in the past year. “5 of those days have been in March 2019,” the tweet continues.

Last night’s massive injection of volume and the resulting rally that pushed BTC above $4,000 certainly backs up Rooke’s assertions. This is the second time in two days that BTC has tested and surpassed $4,000. A third test and break above will indicate a confirmed trend reversal and open up $4,850 as the next upside target.

Gold Chart Comparisons

Comparisons between Bitcoin and Gold are nothing new, with many crypto investors dubbing BTC “digital gold” over the years. However, Twitter user @CabSav9 recently made and an even more telling comparison between the two assets.

When comparing Bitcoin and the long-term chart of Gold since its peak in the late ’70s and the resulting decade long bear market, the two graphs look shockingly similar. After it’s crash in the early ’80s, Gold took almost two decades to stabilize and begin accumulating value again. Bitcoin, by comparison, appears to have followed a similar pattern but over a much shorter timeline. This accelerated correction makes sense considering the speed at which assets can be traded nowadays and the increased pace of life in general.

If @cabsav9’s comparison is anything to go by, Bitcoin should begin to build a decent rally soon. In fact, if one were to redraw the chart to follow the Gold trend, BTC could be on $10,000 as early as June this year.

The truth is, if you looked hard enough you would probably find several charts that coincidentally follow similar trend patterns when adjusted for time. However, the fact that Gold and Bitcoin have so often been compared in the past makes for a strong argument.

Bitcoin is currently trading just above $4,000 and as Asian markets opened strong this morning, it looks set to make some further gains throughout the day.

AUTHOR

Mark Hartley

March 18, 2019, GMT+0000, 5:06 am

David

![BITCOIN Bitcoin [BTC] volume drop could be linked with end of VeriBlock](http://seriouswealth.net/wp/wp-content/uploads/2019/03/flying-143507_1280-e1552308659638.jpg)