Bitcoin (BTC) Following Parabolic Trend, $50,000 By 2022 Expected

Bitcoin Holding Parabolic Trend, Even In Crypto Winter

Over the course of 2018, Bitcoin (BTC) broke a number of key technical levels. In some cases, the cryptocurrency fell so fast (and hard) that its moving averages didn’t catch up to it for months. And while nearly every notable support line, like the $10,000 and $6,000, have been snapped, an analyst argues that BTC remains in its most essential uptrend to date, one that could bring the digital asset to the moon.

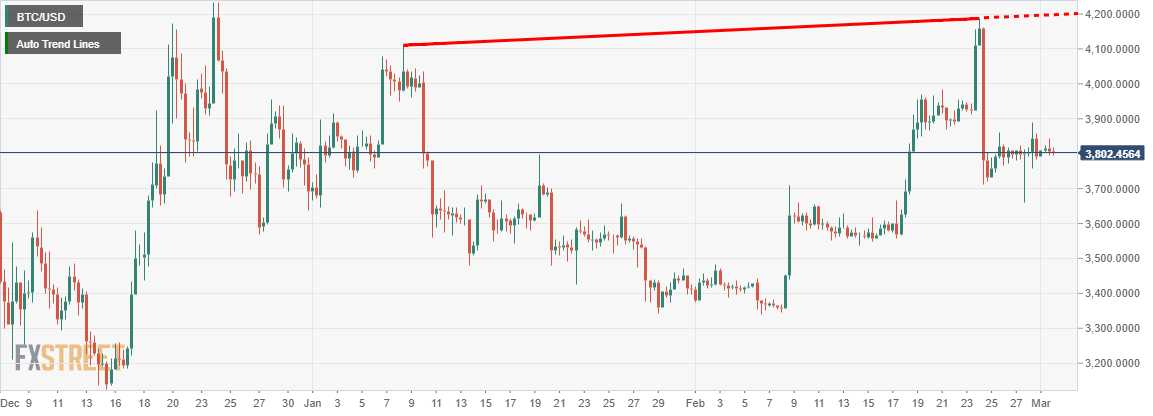

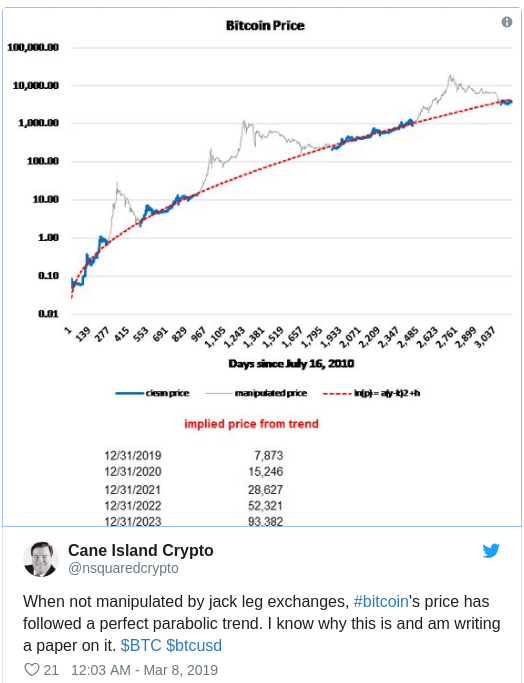

Cane Island Crypto, the creator of Network Value to Transactions (NVT), a popular fundamental measure used for cryptocurrency valuation models, recently took to Twitter to explain that when BTC isn’t “manipulated by jack leg exchanges,” it remains in a perfect parabolic trend. Giving his point further credence, he posted a chart, which showed that since BTC started trading at sub-$1, it has held a consistent uptrend, save for a few nuances here and there that came after a significant drawdown.

Extending the trend, the Texas-based analyst determined that if Bitcoin’s implied price for 2019’s end will be $7,800, 2020’s end will be $15,426, and so on and so forth. The Cane Island investment manager noted that if Bitcoin continues to hold this line, by the end of 2022, BTC will be valued at $52,321 and just under double that just 12 months later.

The Cane Island analyst isn’t the only industry commentator to claim that BTC remains in a multi-year uptrend. Magic Poop Cannon, a seeming BTC permabull, recently took to TradingView to explain why he believes that the leading cryptocurrency remains in a “very clear cyclical uptrend,” in spite of the downturn seen last year.

He argues that the logarithmic uptrend line (seen in pink below), which is kept in place by two upper bound and lower bound trendlines, is still being held. Doing some calculations and historical analysis, Magic argued that while Bitcoin will range between $3,000 and $5,000 for much of 2019, the asset could begin to rally as the uptrend line begins to gain steam, as it were.

In fact, he notes that by August of 2023, if BTC holds above the aforementioned key level of support, it will be worth right around $150,000 a piece. This is bounds ahead of the aforementioned $93,382, but more and more analysts seem to be coming to the conclusion that the sky’s the limit for Bitcoin.

But, some have made it clear that the journey past $20,000 and beyond won’t come easy. Leah Wald, for instance, who subscribes to the Hyperwave theory, claims that BTC moving under $2,000 is far from off the table. To accentuate her belief in this theory, the popular trader recently took up a one BTC bet with Filb Filb, as she believes the Bitcoin price will hit $1,500 before it trades above $6,500 on Bitstamp.

By Nick Chong March 8, 2019

David