The Real Reason Bitcoin, Ethereum, Ripple's XRP, And Litecoin Suddenly Rocketed?

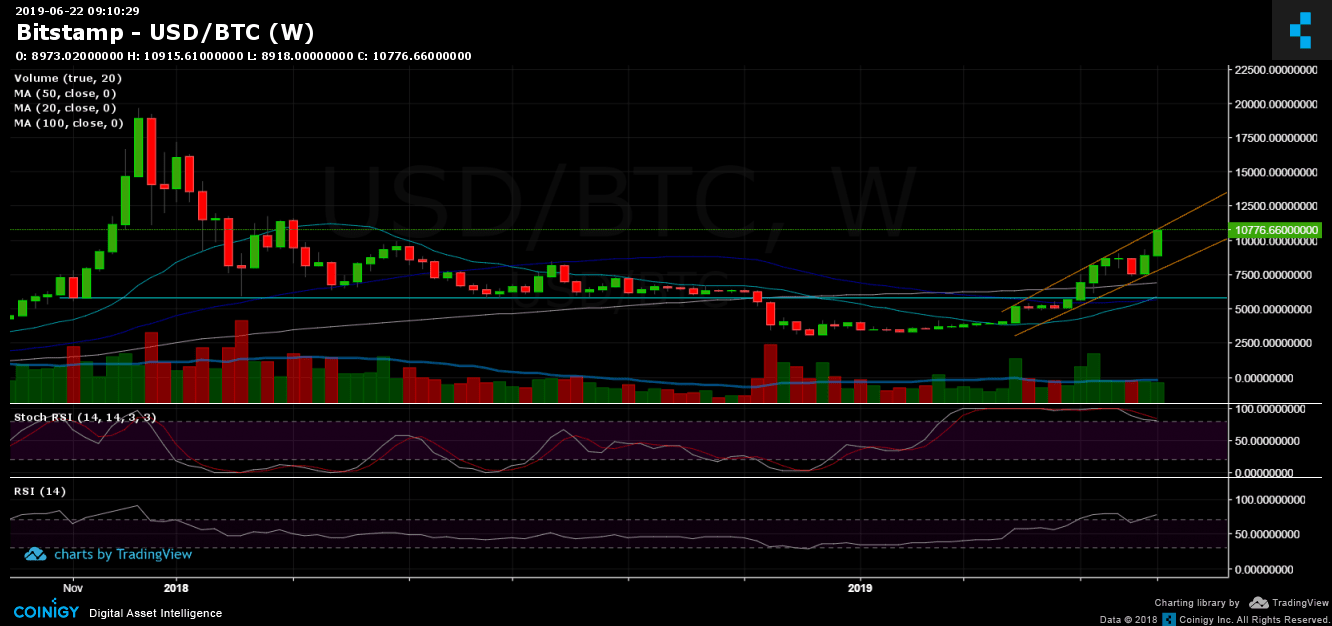

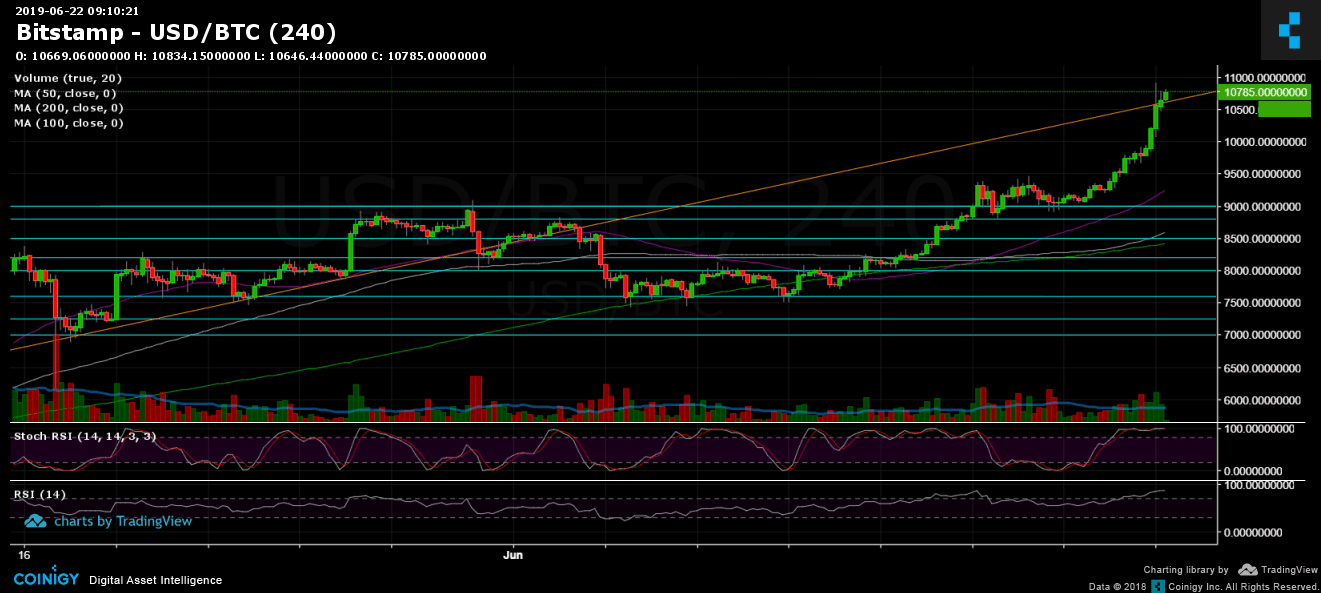

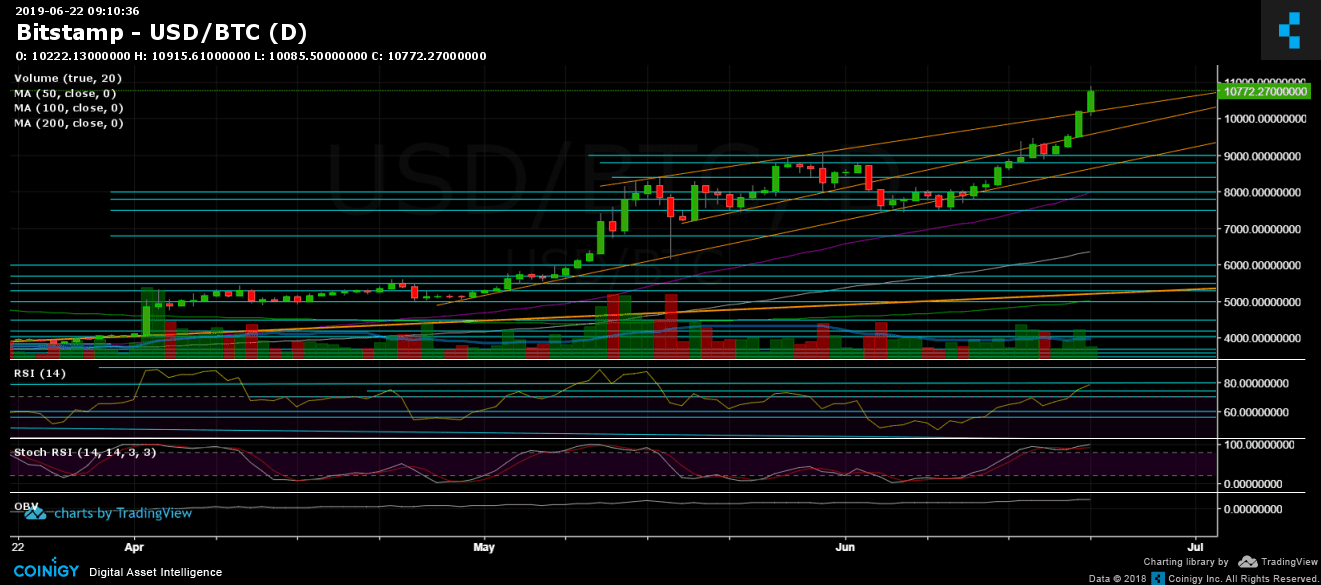

Bitcoin, ethereum, Ripple's XRP, and litecoin suddenly rocketed this weekend, with the largest cryptocurrency by market capitalization, bitcoin, shooting past the psychological $10,000 per bitcoin mark to highs of $11,200 on the Luxembourg-based Bitstamp exchange.

Ethereum, Ripple's XRP, and litecoin all made double-digit gains, meanwhile, with the sudden push higher causing many to recall the great bitcoin and cryptocurrency bull run of late 2017 which saw the bitcoin price go from $10,000 per bitcoin to almost $20,000 in under 20 days.

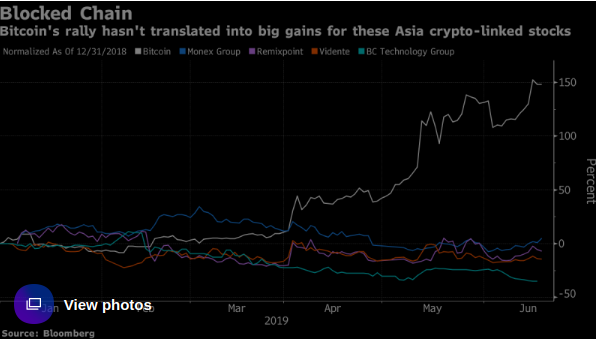

Bitcoin and cryptocurrency analysts have been closely looking for the cause of the sudden price spike, which added some $30 billion to the total value of the world's cryptocurrencies over just two days, with Facebook's potential rival to bitcoin and next year's bitcoin halvening event two commonly named potential catalysts.

However, the bitcoin price spike has been led by India, with bitcoin trading at a $500 premium on the few remaining local exchanges as the government cracks down on internet services such as messaging app Telegram and news aggregator Reddit.

Earlier this month, an Indian government panel reportedly recommended banning bitcoin, which it branded a Ponzi scheme, and a blanket ban on the sale, purchase, and issuance of cryptocurrencies in the country.

Though the panel recommended banning bitcoin, some in the country are skeptical about its implementation, pointing to a previous recommendation that never came to pass.

However, India, under prime minister Narendra Modi, has had an unconventional approach to monetary policy, with the government plunging the country into chaos in 2016 by suddenly banning some higher value bank notes.

Some also think that Facebook's planned cryptocurrency has given legitimacy to bitcoin and other decentralized cryptocurrencies, making it more difficult for India to justify a complete ban.

"The panel report held weight before Facebook announced its plans. The tech giant launching a similar currency provides some sense of legitimacy,” Nischal Shetty, chief executive of Indian cryptocurrency exchange WaxirX told Quartz, a business news outlet.

"If Facebook is going to come up with this, then other tech companies may follow suit. It is hard to believe the government will say that such big companies are also into a Ponzi scheme."

Attempts to ban bitcoin and cryptocurrencies, decentralized internet services which are naturally resilient to censorship, could have a Streisand effect, proving the need for them and making people more aware they exist.

Meanwhile, analysts and trading experts believe Facebook's Libra cryptocurrency could give bitcoin a further boost and potentially push it back to the heady days of late 2017.

"Bullish investors believe if Facebook's crypto Libra becomes a trusted payment mechanism then people are also more likely to trust bitcoin as a reliable long-term store of value, a digital gold," said Glen Goodman, author of bitcoin and cryptocurrency trading advice book, The Crypto Trader.

"Many traders will be looking to take some profits off the table now, but it's worth remembering that last time bitcoin's price broke through $10,000 it then hit it's all-time high of nearly $20,000 just 16 days later."

Billy Bambrough

David