Bitcoin futures suggest breakneck rise in price to slow

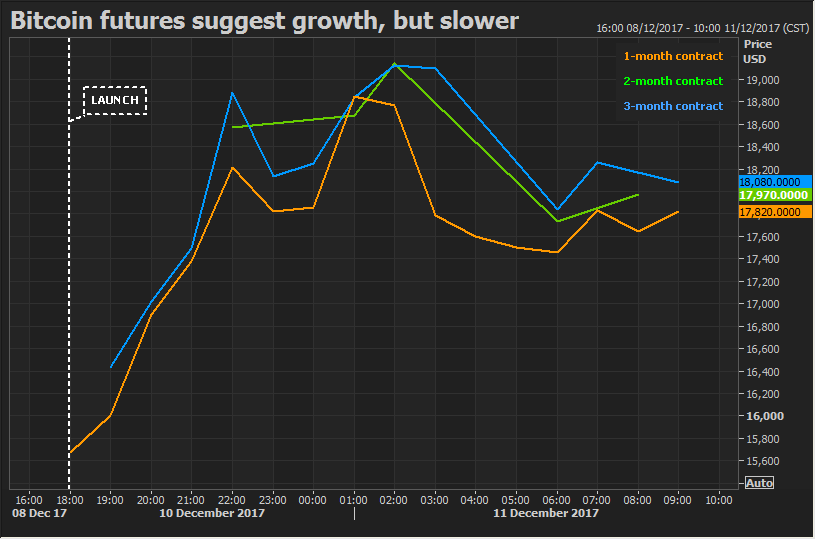

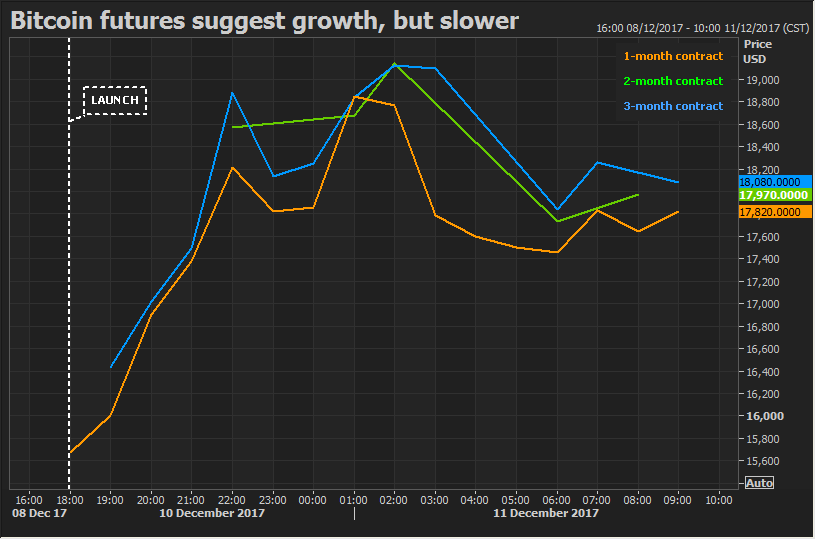

NEW YORK/LONDON (Reuters) – Newly launched bitcoin futures on Monday suggested that traders expect the cryptocurrency’s blistering price gains to slow in the coming months, even as it blasted above $17,000 to a fresh record high in the spot market.

Chicago-based derivatives exchange Cboe Global Markets launched the futures late on Sunday, marking the first time investors could get exposure to the bitcoin market via a large, regulated exchange.

The one-month bitcoin contract <0#XBT:> opened at 6 p.m. local time (2300 GMT) on Sunday at $15,460. By late afternoon on Monday in New York, it was trading at $18,650, roughly 8 percent above bitcoin’s spot price of $16,900 on the Bitstamp exchange.

Bitcoin earlier hit a record high of $17,270.

Its steep gains and rapid rise have attracted investors around the world as well as intense scrutiny from government regulators, which is the very opposite of what its creators wanted when it first launched bitcoin more than eight years ago.

“The bitcoin founder should be horrified seeing it rise so quickly, as any serious focus on it and its recent explosive move higher will soon end its freedom,” said John Taylor Jr, president and founder of research firm Taylor Global Vision in New York.

Taylor believes that based on his charts, bitcoin has not yet peaked, but as soon as the “upmove ends, it will crash.”

Given bitcoin has almost tripled in value over the past month, and was up more than 15 percent on Monday alone, the futures pricing suggested investors see price increases moderating.

Bitcoin futures were already offered on some unregulated cryptocurrency exchanges outside the United States, but backers said the U.S. market debut would confer greater legitimacy on the volatile cryptocurrency and encourage its wider use.

The CME Group (CME.O) is expected to launch its futures contract on Dec. 17.

VOLATILITY CONCERNS

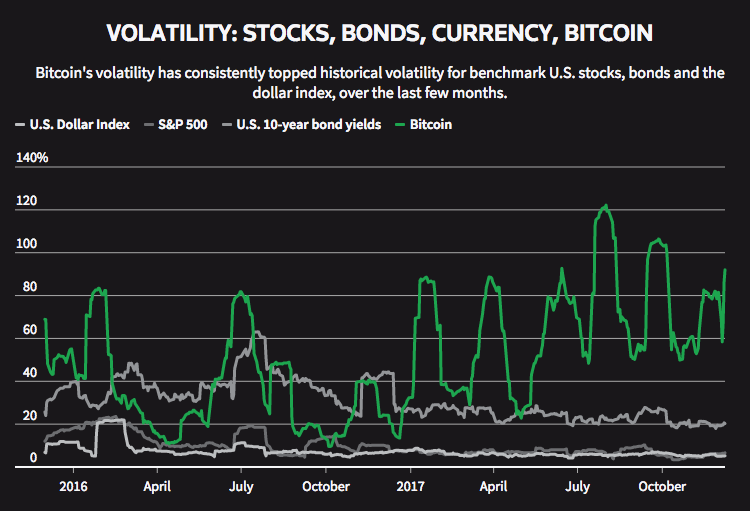

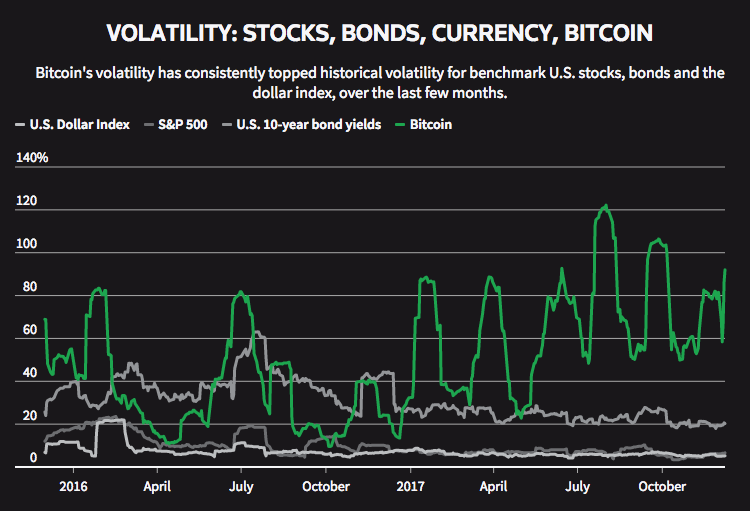

Although there are hopes that the futures will draw in new investors, most fund managers at larger asset managers and institutional investors said bitcoin remains too volatile and lacks the fundamentals that give other assets value.

“There’s no place for bitcoin in a multi-asset portfolio given the very high volatility,” said Robeco Chief Investment Officer Lukas Daalder.

The two-month contract was trading at $18,750, an 11 percent premium over the spot price, while the three-month contract was changing hands at $18,140, a roughly 12 percent premium.

While modest when compared with bitcoin’s 270 percent increase over the past three months and 230 percent rise in the last two months, those levels still indicated a lack of large “short” positions betting against bitcoin.

“Anyone, especially a professional trading outfit, would be crazy to actually short sell this bull market,” said Nick Spanos, founder of Bitcoin Center NYC. “But just because it doesn’t happen on day one doesn’t mean it won’t in the future.”

Bitcoin was up more than 1,600 percent so far in 2017, having started the year at less than $1,000.

‘MARCH TOWARDS LEGITIMIZATION’

As of early afternoon trading in New York, 3,951 one-month contracts had changed hands, meaning around $73.1 million had been notionally traded. That compares with daily trading volumes of more than $21.5 billion across all cryptocurrencies, according to trade website Coinmarketcap.

There had been speculation that the futures launch would trigger more gyrations in the market. But while volatile compared with traditional currencies or assets, the rise on Monday was relatively tame for bitcoin.

Bitcoin surged more than 40 percent in 48 hours last week, before tumbling 20 percent in the following 10 hours.

“(Bitcoin futures) will speed up the march towards legitimization of an asset class that only a few years ago many law enforcement agencies would have argued had limited legitimate reasons for people to use,” said Jo Torode, a financial crime lawyer at Ropes & Gray in London.

The futures are cash-settled contracts, allowing investors exposure without having to hold any of the cryptocurrency.

The futures are based on the auction price of bitcoin in U.S. dollars on the Gemini Exchange, which is owned and operated by virtual currency entrepreneurs and brothers Cameron and Tyler Winklevoss.

DRAMATIC GAINS

Bitcoin was set up in 2008 by an individual or group calling themselves Satoshi Nakamoto, and was the first digital currency to successfully use cryptography to keep transactions secure and hidden, making traditional financial regulation difficult if not impossible.

Central bankers and critics of the cryptocurrency have been ringing the alarm bells over its surge in price and other risks such as whether the opaque market can be used for money laundering.

“It looks remarkably like a bubble forming to me,” the Reserve Bank of New Zealand’s Acting Governor Grant Spencer said on Sunday.

Somebody who invested $1,000 in bitcoin at the start of 2013 would now be sitting on around $1.2 million.

Heightened excitement ahead of the launch of the Cboe futures gave an extra kick to the cryptocurrency’s scorching run this year.

The launch has so far received a mixed reception from big U.S. banks and brokerages.

Several online brokerages, including Charles Schwab Corp (SCHW.N) and TD Ameritrade Holding Corp (AMTD.O), did not allow trading of the new futures immediately.

The Financial Times reported on Friday that JPMorgan Chase & Co (JPM.N) and Citigroup Inc (C.N) would not immediately clear bitcoin trades for clients.

Goldman Sachs Group Inc (GS.N) said on Thursday it was planning to clear such trades for certain clients.

Additional reporting by Chuck Mikolajczak and John McCrank in NEW YORK; Michelle Chen in HONG KONG and Helen Reid in LONDON; Graphics by Ritvik Carvalho in LONDON and Reuters Graphics team; Editing by Meredith Mazzilli

Posted by David Ogden Entrepreneur

David