Crypto Strategist Says Bitcoin Futures Pushed BTC Price, As Bitcoin Cash and Litecoin Futures Volumes Soar

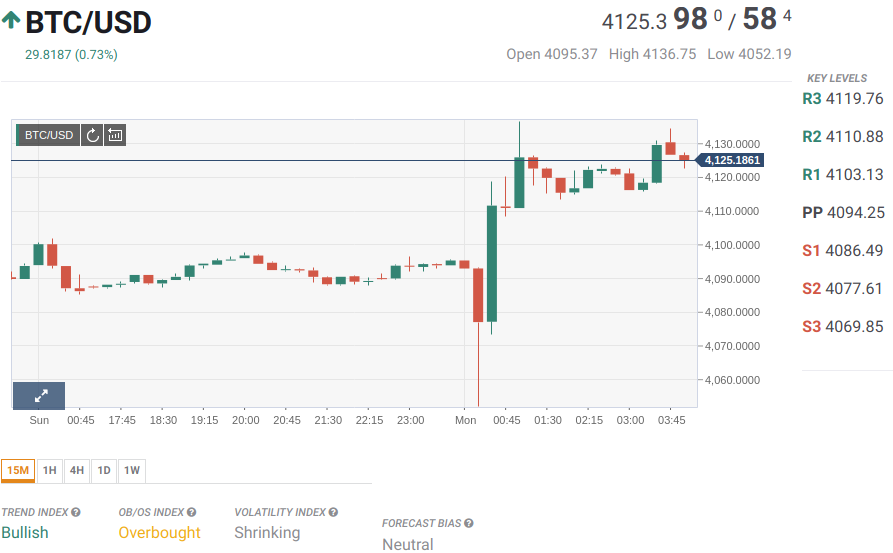

Bitcoin futures had a strong start on Tuesday as the Cboe and CME April contracts increased by over 16% to $4,805.

#Bitcoin futures soaring 16 percent to their highest levels since November pic.twitter.com/WLW4yDumYv

— CNBC Futures Now (@CNBCFuturesNow) April 2, 2019

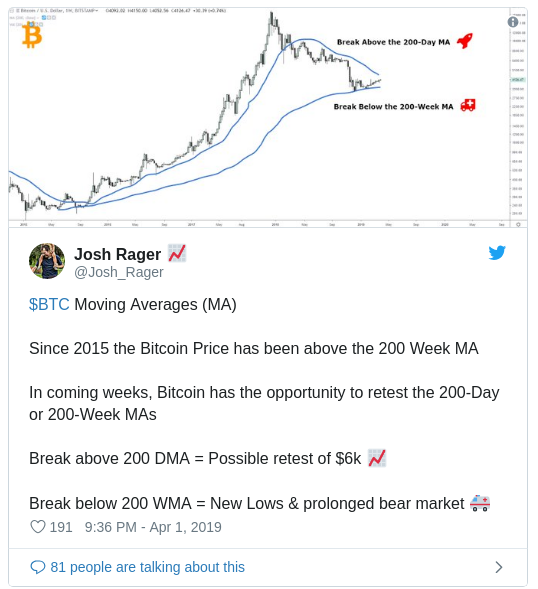

In a note to Barron’s, Gabor Gurbacs, digital asset strategist at VanEck, says he believes Bitcoin’s recent price spike to its highest level since November 2017 was triggered by the futures market.

Says Gurbacs,

“CME Bitcoin futures expired last Friday. A large chunk of positions were rolled (buying) into the new front month BTC futures contract. Over the weekend, heavy spot Bitcoin and over-the-counter buying followed the Bitcoin futures contract expiration pushing BTC price up slowly and gradually. As the price moved up in increments, over $500 million shorts have been liquidated on leveraged crypto derivatives trading platforms around the world.”

Bitcoin surged over 17%, reaching as high as $5,100 on Tuesday, followed by a widespread altcoin rally with double-digit gains. Bitcoin is currently trading at $5,012 at time of writing, according to data compiled by CoinMarketCap.

Trading volumes of altcoin futures including Bitcoin Cash and Litecoin have also experienced higher growth in recent weeks. Crypto Facilities, a subsidiary of San Franciso-based crypto exchange Kraken reports trading volume of $150 million for its crypto-derivative products.

Before Crypto Facilities was acquired by Kraken, its Litecoin futures contracts had an average notional volume of $15 million per month, and its Bitcoin Cash contract volumes were roughly $10 million per month.

Last month those volumes soared, reaching $100 million and $50 million for Litecoin and Bitcoin Cash, respectively.

In an interview with CoinDesk, Sui Chung, head of indices and pricing products at Crypto Facilities says,

“We began to onboard Kraken users … [and] that’s basically given us better exposure to the communities around Litecoin and Bitcoin Cash, and I think what we’re seeing is those communities have a pretty strong interest in trading derivatives for Litecoin and Bitcoin Cash, respectively,”

Based in London, Crypto Facilities is regulated by the Financial Conduct Authority. According to Chung, customer demand for regulated crypto futures that pay out in the underlying cryptocurrencies are driving the market.

“I think there was always demand from those communities for a strong derivatives contract that is collateralized and paid out in that coin because there are contracts in other markets … where the base asset is Litecoin but they pay out in Bitcoin. Our contracts are paid out in Litecoin and Bitcoin Cash.”

In February, after the Kraken acquisition, Crypto Facilitates reported that $1 billion in Bitcoin, Ethereum, XRP, Litecoin and Bitcoin Cash futures were traded on its platform.

David