Another Bitcoin Indicator Signals Price Bottom May Be Forming

A technical indicator that incorporates both bitcoin’s price and trading volume is signaling the cryptocurrency may have bottomed in December.

The money flow index (MFI), also known as the volume-weighted relative strength index, is used to identify buying and selling pressure and oscillates between zero to 100. A rising MFI indicates an increase in buying pressure, while a falling MFI is considered a sign of increasing selling pressures.

Essentially, the MFI validates or confirms price trends. Many times, however, the indicator diverges from the prevailing market trend.

For instance, BTC dashed hopes of a long-term bullish reversal with a break below $6,000 on Nov. 14 and hit a 15-month low of $3,122 on Dec. 15. The 14-week MFI also nosedived from the high of 43.00 in mid-November, confirming the sell-off in prices.

The indicator, however, bottomed out with a higher low at 22.00, contradicting the lower low in bitcoin’s price. That bullish divergence is widely considered an early warning of a bearish-to-bullish trend reversal. Supporting that argument is the fact BTC snapped its record six-month losing streak with a 10 percent gain in February and the MFI rose from 25 to 44.

Other indicators like the moving average convergence divergence (MACD) and the bearish crossover of the 50- and 100-week moving average are also signaling long-term bearish exhaustion. These tools, however, don’t incorporate trading volumes. The MFI, therefore, stands out as a more reliable technical tool.

That said, with a number of indicators pointing to bullish reversal, the probability of BTC picking a strong bid a year ahead of the mining reward halving appears high.

As of writing, BTC is trading at $3,785 according to CoinDesk data.

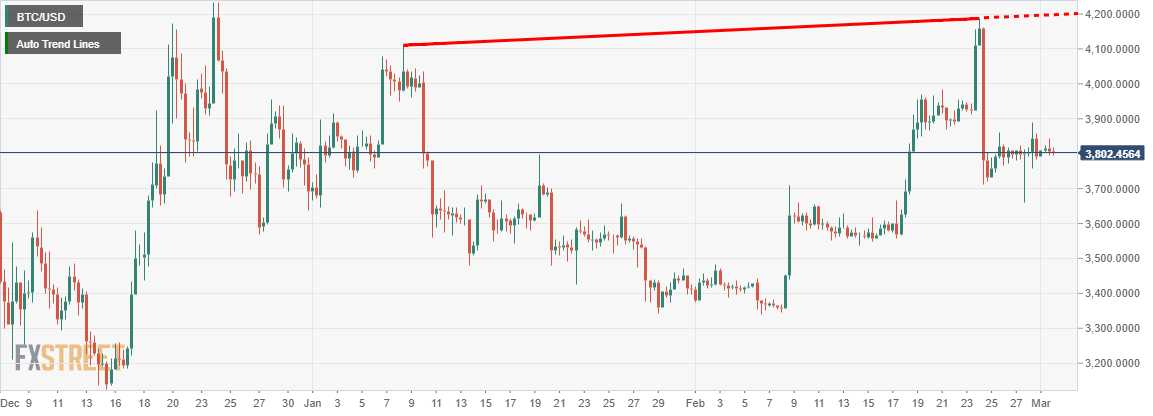

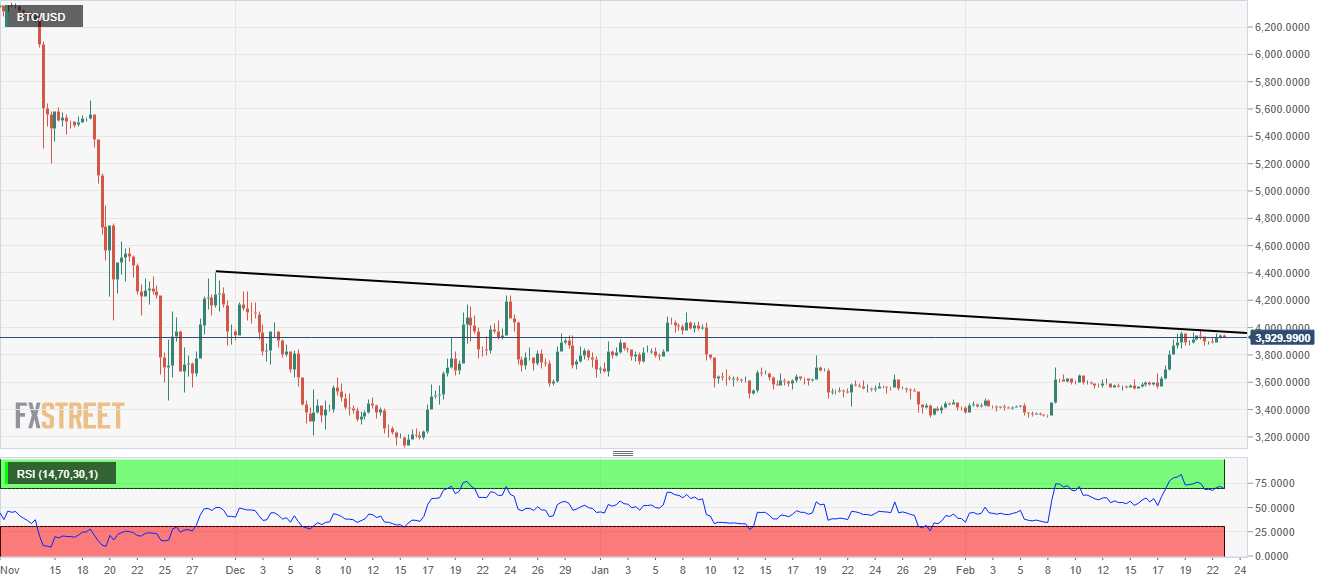

Weekly chart

As seen above, the MFI diverged in favor of the bulls in mid-December, despite BTC sliding to lows near $3,100. Further, it carved out another higher low at 25 at the end of January and is now rising toward the upper edge of the channel. A breakout on the MFI, if confirmed, would reinforce the bullish divergence witnessed in December.

When it comes to BTC, $4,190 is the level to beat for the bulls, as it is the high of the inverted bullish hammer carved out last week. That candlestick pattern indicates the bulls are beginning to test bears’ resolve to keep prices low – a sign the market is bottoming out.

A convincing move above $4,190, if backed by a rise in the money flow, could yield a rally toward the psychological resistance of $5,000.

The bullish case presented by the MFI would weaken if the February low of $3,328 is breached with high volumes.

Omkar Godbole

Mar 4, 2019 at 05:00 UTC

David