Bitcoin Falls as Facebook Warns Libra Might Never Launch

Investing.com – Bitcoin fell on Tuesday in Asia after Facebook (NASDAQ:FB) said in a report that Libra might not “be made available in a timely manner, or at all.”

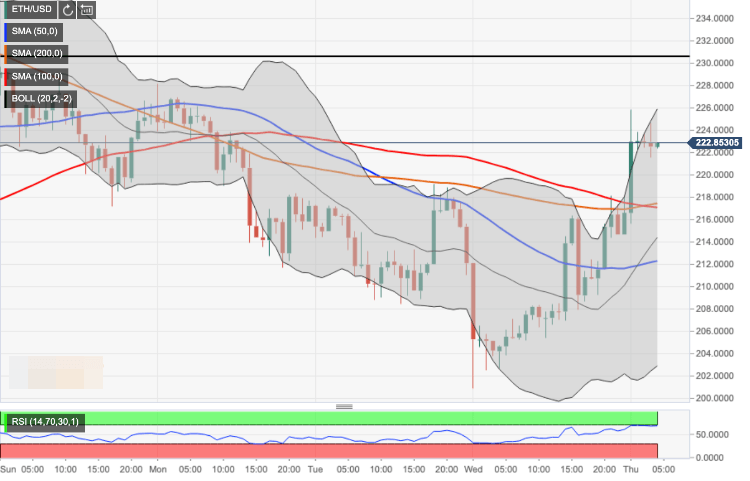

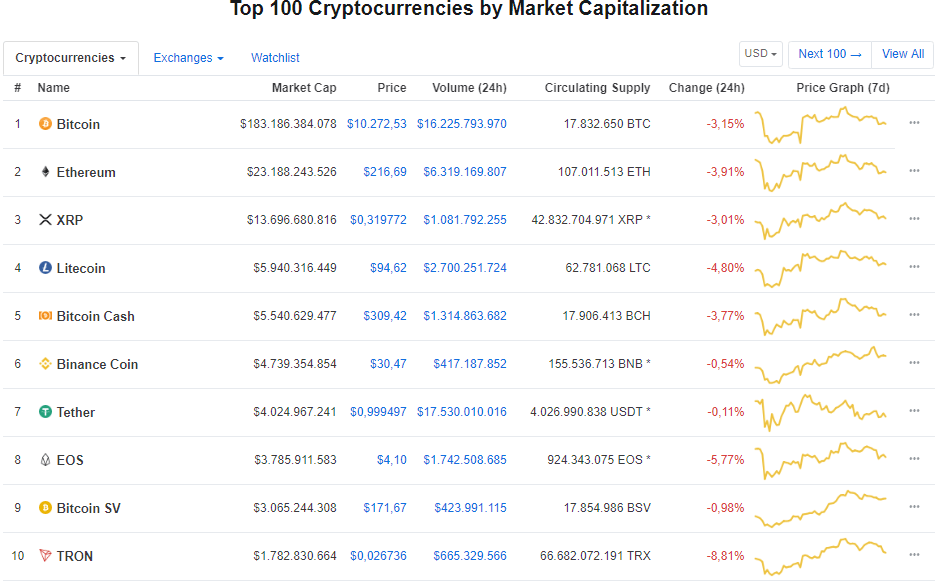

Bitcoin dropped 2.6% to $9,517.9 by 12:15 AM ET (04:15 GMT). Litecoin fell 1.6% to $89.133, while Ethereum was down 3.3% to $205.25. XRP slipped 1.2% to 0.30800.

In its latest quarterly report, Facebook warned a number of factors could hinder the expected launch of its own cryptocurrency, Libra.

The company originally planned to launch the digital coin in 2020.

“Libra has drawn significant scrutiny from governments and regulators in multiple jurisdictions and we expect that scrutiny to continue,” Facebook said in its filing with the Securities and Exchange Commission.

“In addition, market acceptance of such currency is subject to significant uncertainty. As such, there can be no assurance that Libra or our associated products and services will be made available in a timely manner, or at all. We do not have significant prior experience with digital currency or blockchain technology, which may adversely affect our ability to successfully develop and market these products and services,” the social media giant added.

In other news, the Iranian cabinet authorized crypto mining as an industrial activity with the move taken as a first step towards legalizing cryptocurrencies, according to Mehr News Agency.

The government cautioned that users of alt coins were solely responsible for the risks involved and that the use of digital currency was still not permitted.

David