Bitcoin Price Analysis – Bitcoin Stands on its Feet by Gaining Almost 3.5%

-

Bitcoin has shown five huge price swings in the last one month.

-

The next resistance point is likely to be 10,000 USD.

After being hit by a steep push to the ground, Bitcoin has been partly successful in getting on its feet again. It lost almost 14% overnight yesterday, but over the last 24 hours, it has added almost 3.5% to its price. As per the experts’ views, the coin is likely to have a bullish ride till the end of this year. The price target for 2019 should be 15,000 USD. Let us look at the current details now.

Statistics-BTC Price S

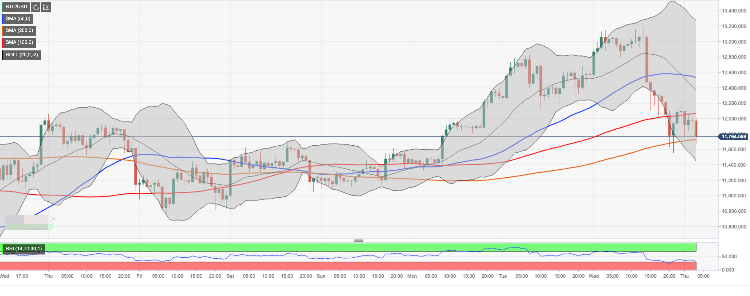

Bitcoin (BTC) 18th July 02:30 UTC

Rank 1st

ROI (Return on Investment) 7,119.85%

Coin Circulation 17,823,575 BTC

Market Cap 174,167,969,639 USD

Value in USD 9,793.00 USD

All-Time High 20,089 USD

24h Volume 24,064,315,046 USD

BTC to USD Price Comparison- Over the last 30 days, BTC has shown five major price variations. The first variation was a hike of 54.19% and the coin gained 4850 USD between 18th June and 26th June. This hike was followed by a steep fall of 28.96% between 26th June and 02nd July. This fall cost the coin 3999 USD. And over the next one day and 16 hours, the coin again gained 22.41%. The next variation happened over five days from 05th June. This hike added 20.68% to the coin. It was followed by a steep fall of 29.48% between 10th June and 17th June. This fall cost the coin 3853 USD. The Market Cap on 18th June was 162,798,824,411 USD, and the value of each coin was 8951.39 USD. The current market cap and the value of each coin are respectively 6.98% and 9.40% more than the figures for the last month.

Over the last 30 days, BTC has shown five major price variations. The first variation was a hike of 54.19% and the coin gained 4850 USD between 18th June and 26th June. This hike was followed by a steep fall of 28.96% between 26th June and 02nd July. This fall cost the coin 3999 USD. And over the next one day and 16 hours, the coin again gained 22.41%. The next variation happened over five days from 05th June. This hike added 20.68% to the coin. It was followed by a steep fall of 29.48% between 10th June and 17th June. This fall cost the coin 3853 USD. The Market Cap on 18th June was 162,798,824,411 USD, and the value of each coin was 8951.39 USD. The current market cap and the value of each coin are respectively 6.98% and 9.40% more than the figures for the last month.

Bitcoin Price Prediction-

Bitcoin is likely to have a bullish run until the end of 2019. The coin may reach 15,000 USD by the end of 2019. The next resistance points are 10050.24 USD, 10406.68 USD, and 10850.24 USD. The support levels are 9250.24 USD, 8806.68 USD, and 8450.24 USD. Bitcoin is likely to have a good time in the coming days.

Mehak Punjabi 21 hours ago

David