Bitcoin could nearly double and reach $5,000 soon, says Standpoint Research

Bitcoin traded near $2,600 Wednesday, according to CoinDesk.

Standpoint Research founder Ronnie Moas said the digital currency could rise to $5,000 "in a few months."

"This is not something I could keep my hands off of," Moas said.

Stock research analyst Ronnie Moas said he bought bitcoin this weekend and thinks it could reach $5,000 within a year.

"$5,000 could happen in a few months. It's only starting to gain traction right now," Moas, founder of Standpoint Research, told CNBC in a phone interview Wednesday. "It's starting to spread like wildfire right now."

He pointed out that since only 21 million bitcoin can ever exist, increasing demand for the digital currency will naturally drive its price up.

Bitcoin briefly tripled in value this year, hitting a record $3,025.47 on June 11, according to CoinDesk. The digital currency traded Wednesday near $2,600, still more than double its Dec. 31 price of $968.

"This is not something I could keep my hands off of," Moas said. "What would be more painful than losing [money in cryptocurrencies] is not acting."

The research analyst said he invested a few hundred U.S. dollars each in bitcoin, ethereum and another digital currency called litecoin through Coinbase.com. After he releases a 40-page report on cryptocurrencies in the next few weeks, Moas said he plans to invest more in them.

The research analyst's view on bitcoin joins the optimistic views of others on Wall Street. On Sunday, Goldman Sachs' technical analyst Sheba Jafari said in a note that bitcoin could rise as high as $3,915.

300

Bitcoin could nearly double and reach $5,000 soon, says Standpoint Research Bitcoin could nearly double and reach $5,000 soon, says Standpoint Research

Stock research analyst Ronnie Moas said he bought bitcoin this weekend and thinks it could reach $5,000 within a year.

"$5,000 could happen in a few months. It's only starting to gain traction right now," Moas, founder of Standpoint Research, told CNBC in a phone interview Wednesday. "It's starting to spread like wildfire right now."

He pointed out that since only 21 million bitcoin can ever exist, increasing demand for the digital currency will naturally drive its price up.

Bitcoin briefly tripled in value this year, hitting a record $3,025.47 on June 11, according to CoinDesk. The digital currency traded Wednesday near $2,600, still more than double its Dec. 31 price of $968.

"This is not something I could keep my hands off of," Moas said. "What would be more painful than losing [money in cryptocurrencies] is not acting."

The research analyst said he invested a few hundred U.S. dollars each in bitcoin, ethereum and another digital currency called litecoin through Coinbase.com. After he releases a 40-page report on cryptocurrencies in the next few weeks, Moas said he plans to invest more in them.

The research analyst's view on bitcoin joins the optimistic views of others on Wall Street. On Sunday, Goldman Sachs' technical analyst Sheba Jafari said in a note that bitcoin could rise as high as $3,915.

Goldman Sachs says bitcoin could rise another 50% Goldman Sachs says bitcoin could rise another 50%

"In the next 6 to 12 months you're going to have a little bit of a hysteria," Moas said. However, "this has a long, long way to go before it gets to bubble territory."

Moas' reasoning is so little of global capital is in cryptocurrencies right now that the young digital currencies can absorb more of those funds without becoming overvalued.

McKinsey Global Institute estimated that the value of the world's stocks and debt rose to $212 trillion in 2010.

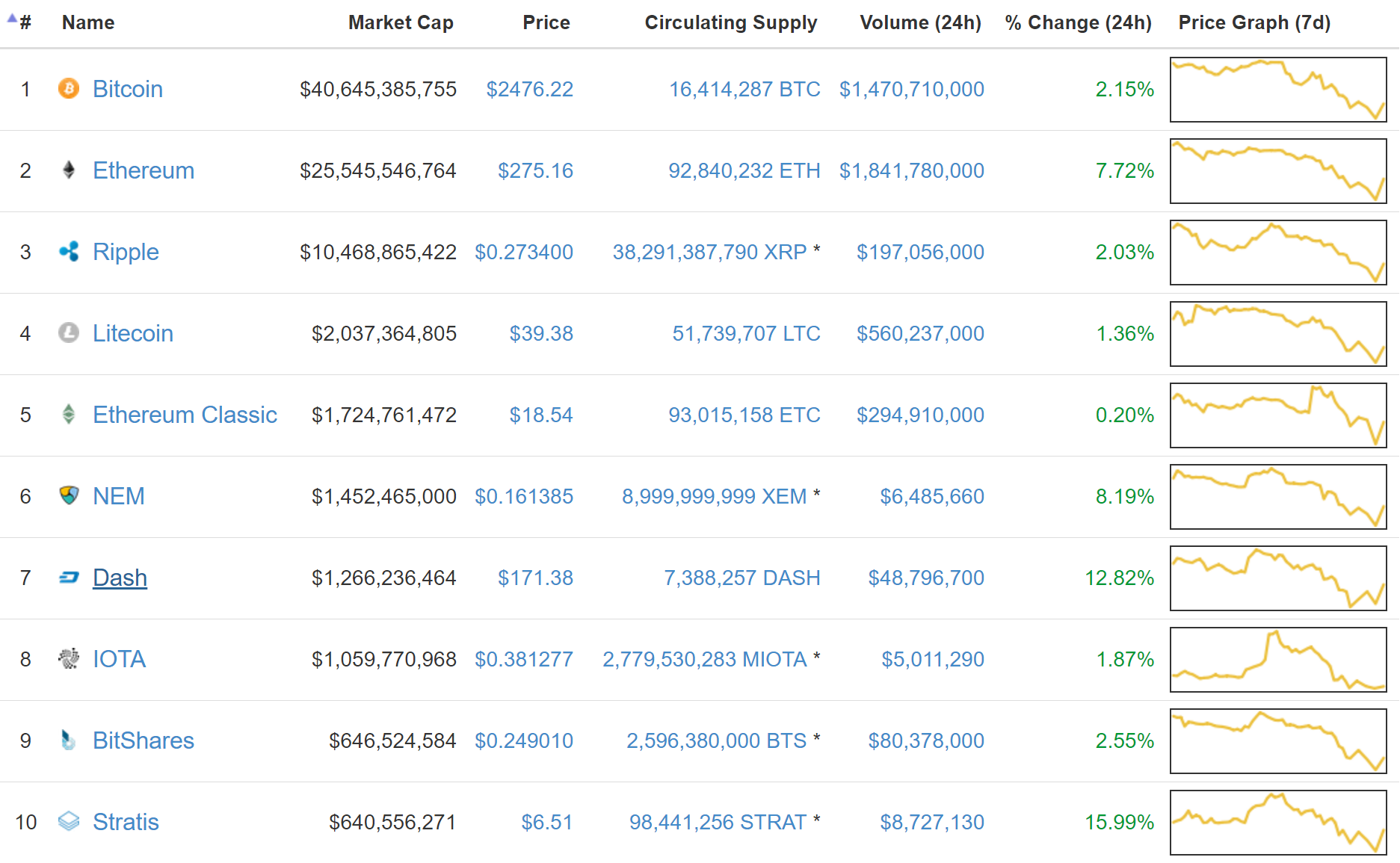

On the other hand, CoinMarketCap data showed the market capitalization of all cryptocurrencies has grown from below $20 billion at the start of this year to about $100 billion, still less than a tenth of a percent of global capital markets. Bitcoin has a market value of about $42 billion, according to CoinMarketCap.

"There will be scams, there will be accounts wiped out, there will be people that get hurt, like every other technology that is going on," Moas said. But "I think the cryptocurrency is here to stay. I think we're in the second inning of a 9-inning ball game."

Many, including some on Wall Street, believe that the blockchain technology behind bitcoin can fundamentally change the way the world operates, just like the internet did.

David Ogden

Entrepreneur

Author: Evelyn Cheng

David