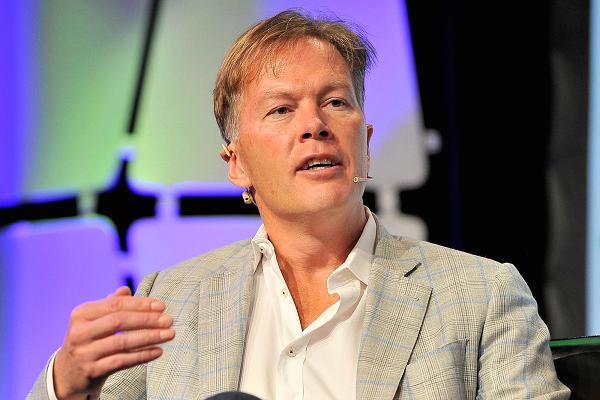

Selling Bitcoin [BTC] for fiat is “reverting to the past”, says Tim Draper

Tim Draper made another bullish prediction about the price of Bitcoin [BTC]. He also believes that fiat currencies will become a thing of the past.

He said:

“Price-wise, we’ll continue to see Bitcoin move higher. I’ve revised my estimate up to $250,000 four years out, so we’ll see Bitcoin trade around the $250,000 mark in 2022.”

He said that he is placing his bets on cryptocurrencies increasing the velocity of money, predicting that the cryptocurrency market will hit $140 trillion within the next decade. He said:

“I expect that since cryptocurrencies will increase the velocity of money, the current $86 trillion global market for currency will grow to be about $140 trillion in the next 10 years, and that growth will be in crypto. In fact, I estimate that fiat currencies will actually decrease in use, and that crypto will become as much as $100 trillion of that market. I expect Bitcoin to be about 10% of that market, or $10 trillion. There is a lot of room to grow there.”

He expects that the world would move into the cryptocurrency space, not for storing value, as it is used for today, but as a means of transacting value. He stated that in four years people will start paying in cryptocurrency all over the world.

Draper quoted the problem with Bitcoin as being the small block size which resulted in its inability to conduct microtransactions. He referred to second-layer scaling solutions such as Lightning Network to make the Bitcoin blockchain more suitable for smaller payments. He stated:

“Fiat currency will eventually become as passé as trying to pay for coffee with pennies.”

He also stated that liquidating his portfolio would be moving back to the past, adding that he has no interest in doing so. He said:

“I have no interest in selling my Bitcoin. What would I sell it into anyway? Moving from crypto to fiat is like trading shells for gold. It is reverting to the past. I’m thinking long term I’ll use it, spend it, invest it, or just keep it.”

Author Anirudh VK June 16, 2018

David Ogden (Entrepreneur) I agree with these sentiments, there is only one way forward.

David

![Bitcoin [BTC] has niche investors, Apple and Twitter CEOs invest!](http://seriouswealth.net/wp/wp-content/uploads/2018/06/000-e1528207887194.jpg)

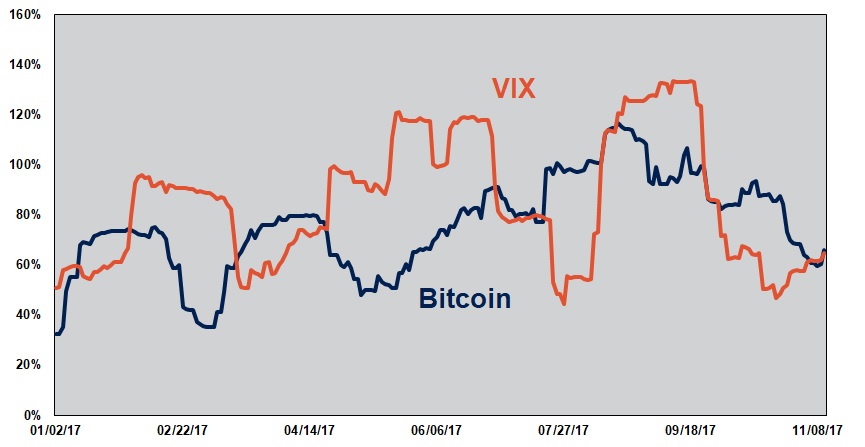

Bitcoin Price May Be ‘Fear Gauge’ for Stock Market -VIX Analyst

Bitcoin Price May Be ‘Fear Gauge’ for Stock Market -VIX Analyst