There are now more than 120 hedge funds focused solely on bitcoin, digital currencies

-

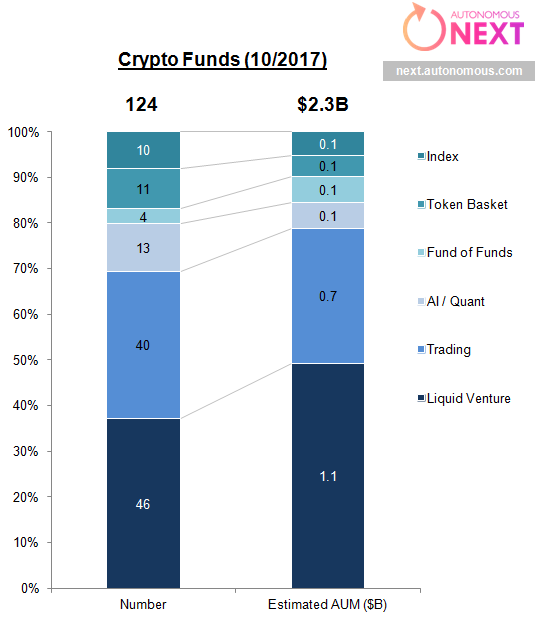

Data shared exclusively with CNBC from financial research firm Autonomous Next shows the number of funds investing in digital assets like bitcoin has grown rapidly to 124.

-

Autonomous Next also estimates that the "crypto-funds" have about $2.3 billion in total assets under management.

-

While several leading Wall Street banking executives remain skeptical about bitcoin, more seasoned money managers are moving into digital assets management.

More than 90 funds focused on digital assets like bitcoin have launched this year, bringing the total number of such "crypto-funds" to 124, according to financial research firm Autonomous Next.

Data shared exclusively with CNBC Friday showed that the largest share of the funds, 37 percent, used venture capitalist-type strategies and had about $1.1 billion in assets under management. Funds focused on trading digital assets came second at 32 percent, with about $700 million in assets under management.

Funds specifically using machine learning, data science or statistical arbitrage on digital currencies came in third at 10 percent and $100 million in assets under management, the data showed.

Total assets under management by crypto-funds now stands at $2.3 billion, according to Autonomous Next's estimates.

Source: Autonomous Next

Source: Autonomous Next

This year's surge in the price of bitcoin and another digital currency, ethereum, have drawn attention to the cryptocurrencies and the potential of their blockchain technology. Proponents say blockchain could transform the world as much as the internet did, and several major banks are researching or developing blockchain projects.

Digital currency enthusiasts also attribute much of the latest surge in bitcoin to record highs above $6,100 to increased interest from institutional investors. While several leading Wall Street banking executives remain skeptical about bitcoin, more seasoned money managers are moving into digital assets management.

Notably, former Fortress hedge fund manager Michael Novogratz is launching a $500 million digital assets fund through his new firm, Galaxy Investment Partners. The fund is expected to be the largest of its kind.

Besides investing in digital currencies like bitcoin and ethereum, enthusiasts are betting on a slew of new digital coins for projects built on the same blockchain technology. The tokens are launched through a process called an initial coin offering and have raised just over $3 billion, according to Autonomous Next.

That said, many of the digital coin projects are still in very early stages. China has banned initial coin offerings, while the U.S. Securities and Exchange Commission has warned investors about the risks of investing in them.

The overall number of crypto-funds and their assets under management is also still minuscule compared to the record $3.15 trillion held by the hedge fund industry in the third quarter, according to HFRI.

WATCH: What is an ICO?

Author: Evelyn Cheng

Posted by David Ogden Entrepreneur

David