Gold trades sharply lower

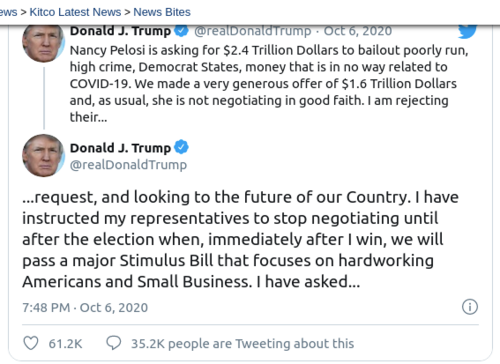

As the probability of the House and Senate agreeing upon a fiscal stimulus bill continues to diminish, traders and market participants were active sellers in both gold and silver today. Coupled with dollar strength spot gold lost approximately $30, while gold futures basis the most active December 2020 Comex contract lost $33.80.

The majority of today’s price decline is directly attributable to selling pressure. Spot gold is currently fixed at $1892.10 after factoring in today’s decline of $29.80. According to the KGX (Kitco Gold Index) only $10 of today’s price decline is directly attributable to dollar strength, with the remaining decline of $19.80 attributable to traders bidding the precious yellow metal lower.

Gold futures lost a total of 1.73%, and is currently fixed at $1895.30. The U.S. dollar gained +0.46% taking the index to 93.53. Simple math reveals that selling pressure was responsible for a -1.27% price decline in gold futures.

The largest percentage of today’s price decline was based on selling pressure. This clearly indicates that many investors believe that the greatly needed major fiscal stimulus bill is unlikely to be implemented prior to the election.

Based upon the current polls the incumbent candidate, President Trump is lagging behind the Democratic candidate, former Vice President Joe Biden. If in fact former Vice President Biden wins the election it is believed that a much larger stimulus package will be forthcoming. It also appears that the House and the Senate are too far apart for a compromise to take place.

According to MarketWatch, “Pelosi appears to be betting on Democrats winning the presidency and is unlikely to budge unless the Trump White House agrees to most of her party’s demands. McConnell has said the two parties remain too far apart to strike a deal with the election so close. Republicans in the Senate prefer a smaller bill that’s more narrowly tailored.”

Although recent data has indicated that there is economic growth in the United States, that growth appears to be much slower than anticipated. That being said, there are many sectors that are experiencing dramatic declines in revenue, in particular the airlines and travel related industries. The fallout without fiscal stimulus could result in more massive layoffs raising the number of unemployed Americans.

Chairman of the Federal Reserve Jerome Powell, last week said that the U.S. economy needs more fiscal support even though the recovery from the “natural disaster” of the coronavirus pandemic so far has been strong. In a speech to the National Association for Business Economics Chairman Powell said, “Too little support would lead to a weak recovery, creating unnecessary hardship for households and businesses.”

The chairman’s speech was a break from the long-standing tradition of the Federal Reserve not commenting on political issues. The fact that he broke with this long-standing practice indicates how concerned he is about the potential for a dramatic economic contraction.

Wishing you as always, good trading and good health,

By Gary Wagner

Contributing to kitco.com

David

.gif)