Financial markets and precious metals meltdown, as U.S. dollar trades higher

As of 4:00 PM EST the equities markets are closing for the day and still settling. Today’s market action can best be described as brutal, with all three major indices and the entire precious metals complex trading dramatically lower. Currently the Dow Jones industrial average is trading 510 points lower, and currently fixed at 27,147.24. The Dow was down well over 800 points before slightly recovering in the last couple hours of trading.

The Standard & Poor’s 500 and the NASDAQ composite also lost value today. The S&P 500 gave up 53 points (-1.59%) and is currently fixed at 3267.09. The NASDAQ composite traded lower on the day but sustained the smallest percentage drawdown of all three indices. Currently the tech heavy index is down 39 points and fixed at 10,754, this is a decline of approximately -0.36%.

.png)

The precious metals also sustained major drawdowns with gold, silver, platinum and palladium all trading lower today in the futures and spot markets. Gold futures basis the most active December contract is well off of its lows achieved earlier in trading today, but still sustained damage to the tune of a – 2.23% decline in value. December futures are currently fixed at $1918.30 which is a net decline of $43.70 on the day. However, in trading today gold actually went to an intraday low of $1885.40 before recovering and moving back above $1900 per ounce.

Dollar strength was only a small component of today’s massive decline in gold pricing. Spot gold is currently fixed at $1912, which is a net decline of $36.90 on the day. On closer inspection according to the KGX (Kitco Gold Index) only $11.30 is the direct result of dollar strength. The remaining decline of $25.60 was the result of traders and market participants bidding the precious yellow metal lower.

Platinum futures lost approximately -5 ½%, taking that precious metal to $886.60, after factoring in today’s decline of $51.90. Palladium futures lost -3 ½% in trading today, this resulted in a decline of $83.80 taking that precious metal to $2,297 per ounce.

The largest percentage drawdown for the precious metals occurred in silver futures, with the most active December contract trading – 8.38% lower on the day. After factoring in today’s decline of approximately $2.26 silver futures are currently fixed at $24.86. According to the KGX, spot silver lost $2.07 in trading today with dollar strength accounting for only $0.15 of todays losses, and the remaining drawdown of a $1.92, the direct result of selling pressure.

.png)

According to analysts and reported by Kitco News there were three basic factors which took the precious metals dramatically lower today. These factors were pandemic fears, U.S. dollar strength, and uncertainty about the upcoming presidential election in the United States. In an article penned by Neils Christensen, Editor of Kitco News, he said,

“A perfect storm is brewing that has pushed gold and equity markets down nearly 3% on the day, analysts said. The two markets are seeing their fortunes tied to stimulus measure expectations, which have significantly declined in the last few days.”

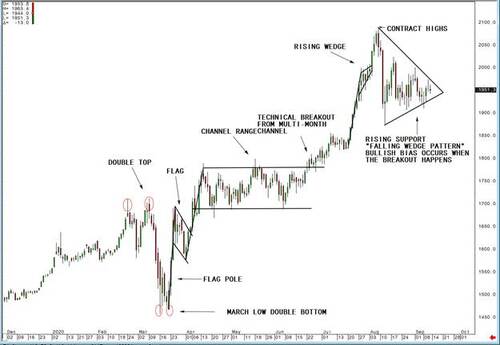

On a technical basis gold did sustain major chart damage as it traded and closed below the 50-day moving average for the first time since June of this year, when prices moved below the 50-day moving average for a total of two trading sessions.

The question gold and silver traders must ask is whether or not today’s dramatic selloff in both gold and silver are signaling lower pricing ahead? And whether today’s selloff will allow traders an opportunity to buy the dip? Considering that gold traded to an intraday low of $1,885, there were certainly market participants buying the dip at the intraday lows. With the 50-day moving average currently at $1,940, we would need to see gold rise by approximately 22 ½ dollars before prices would have moved back above the 50-day moving average.

.png)

By Gary Wagner

Contributing to kitco.com

David

.gif)

.gif)

.gif)