It's a 'challenging time' for gold companies that need to grow – B2Gold

B2Gold (TSX:BTO) is a mid-tier gold company with mining operations in diverse locations: Philippines, Mali, Namibia and Nicaragua. The Vancouver-based company forecasts between 1,000,000 and 1,055,000 ounces in 2020.

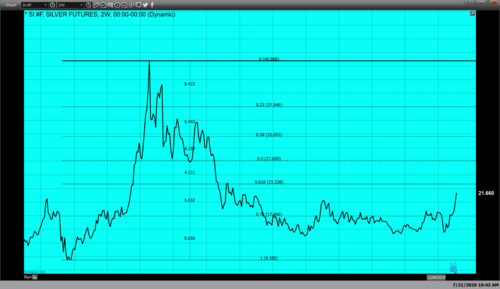

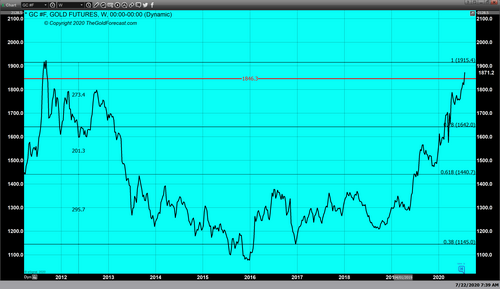

Johnson said the low precious metal prices of the past decade, plus the overhang from the industry's last spending splurge has diminished the gold supply

"There's been a lack of exploration and a lack of development, so I think the supply of gold probably peaked a couple of years ago," said Johnson.

Johnson said he is not a "gold bug", but the extreme financial stress has favored the metal.

"You can't print gold and there's a finite amount of gold in the world," said Johnson.

He said producers are constrained by several factors if they want to add more production now through acquisitions.

"When you talk about M&A, it's kind of interesting because there aren't many great development projects out there. Investors are nervous about people paying premiums to take over companies, because that didn't go so well in the past. Barrick set an example with the Barrick-Randgold deal where there was no premium in that deal. So I think that it's an interesting and a challenging time for those companies that really need to grow today," said Johnson.

However, some mergers could better for all.

"We're not desperate to go run out and do a deal. We've got great projects, a great pipeline of additional projects. I think you will probably see some more mergers of equals and I think that's good for the industry. I think we need fewer and better run gold mining companies," said Johnson

A future project that should grow B2Gold's production is the Gramalote project in Colombia, a joint venture with AngloGold Ashanti. A feasibility study is planned for the first quarter of 2021. The indicated mineral resource for Gramalote is 2.14 million ounces.

B2Gold announced a fundraising initiative. The company is producing 1000 limited-edition ` Gold Bars to support conversation efforts for the critically-endangered black rhino.

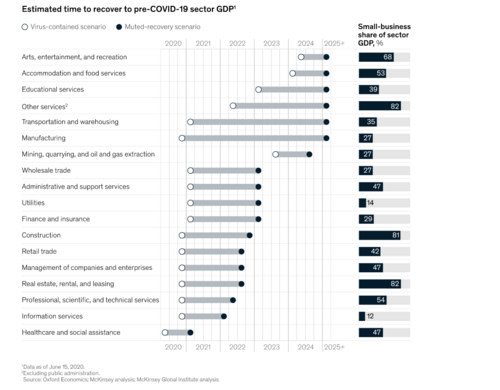

As COVID-19 devastated the tourism industry, wildlife parks across Africa have taken a hit and are in danger of being shut down.

“That’s affected the ability to protect these species. So that’s why the Rhino Bars and the money generated from that is so important to assist today, in protecting the wild and supporting the communities that are doing this work. A lot of budgets would have been cut had it not been what we’re doing,” said Clive Johnson, CEO of B2Gold.

By Michael McCrae

For Kitco News

David

.png)