Gold solidly down Thursday, following sell off in U.S. equities

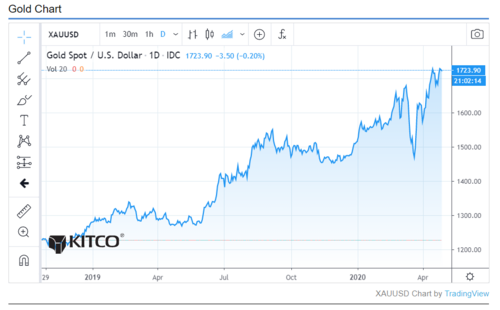

Gold prices are posting solid losses in midday U.S. trading Thursday and were near daily lows, following the U.S. stock indexes lower as they also extended daily losses. Bullish outside markets today–a lower U.S. dollar index and sharply higher crude oil prices—offered no support to the precious metals. Some more profit taking in gold and silver from the shorter-term futures traders is featured today. June gold futures were last down $18.00 an ounce at $1,696.50. May Comex silver prices were last down $0.18 at $14.98 an ounce.

Thursday’s weekly jobless claims report, which has become the focal point of the marketplace in recent weeks, showed a rise of 3.84 million in new claims. The number was forecast to be 3.5 million. The report is a reminder of the dour state of the U.S. economy. The U.S. stock market lost its overnight gains after the release of this report.

Global stock markets were mostly firmer in overnight trading. Some upbeat news Wednesday on a drug trial that lessens the effects of Covid-19 and a big rebound in crude oil prices prompted some better trader and investor risk appetite as April winds down. Many U.S. states are now partially reopening their businesses.

In other news, the European Central Bank left its monetary policy unchanged at its regular meeting Thursday. However, the ECB also painted a very bleak picture for the Euro zone economy. The Euro zone gross domestic product contracted by 3.8% in the first quarter from the fourth quarter of 2019, and was down 14.4%, year-on-year, it was reported overnight. Those numbers are a record for the 14-nation bloc. The year-on-year decline in Euro zone GDP was much greater than the 4.8% drop in U.S. GDP in the same period, and reported on Wednesday.

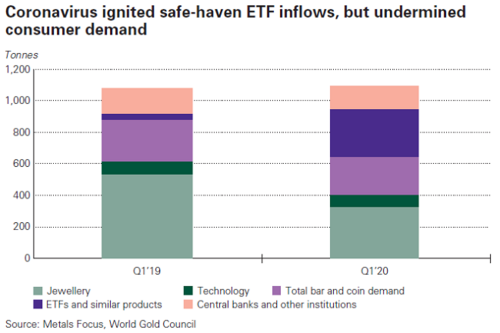

A Reuters (Refinitiv) survey just released shows global jewelry fabrication volumes, which typically account for around 55% of total physical demand for gold, fell 40% in the first quarter, year-on-year. Investment demand was mixed, with retail investment, which consists of bars and coins, posting an 11% year-on-year drop. Physical gold demand fell to 753 metric tons in the first quarter, the lowest levels since 2009 as higher gold prices led to a drop in consumption. The biggest declines were recorded in Asia at down over 43% year-on-year. Chinese demand recorded a 62% decline in jewelry fabrication in the period.

The important outside markets see Nymex crude oil again solidly higher and trading around $17.50 a barrel. The U.S. dollar index is solidly lower today. The greenback bulls are fading fast this week, partly on notions other major countries’ economies are coming back to life faster than that of the U.S. The 10-year U.S. Treasury note yield is trading around 0.6% today.

.gif)

Technically, June gold futures scored a bearish “outside day” down on the daily bar chart today. The bulls still have the firm overall near-term technical advantage amid a six-week-old price uptrend still in place on the daily bar chart. Gold bulls' next upside near-term price objective is to produce a close above solid technical resistance at the April high of $1,788.80. Bears' next near-term downside price objective is pushing prices below solid technical support at last week’s low of $1,666.20. First resistance is seen at $1707.80 and then at $1,725.00. First support is seen at today’s week’s low of $1,687.50 and then at 1,675.00. Wyckoff's Market Rating: 7.0

.gif)

May silver futures also scored a bearish “outside day” down on the daily bar chart today. The silver bulls have the slight overall near-term technical advantage. However, a four-week-old uptrend on the daily bar chart has stalled out. Silver bulls’ next upside price objective is closing prices above solid technical resistance at the April high of $16.30 an ounce. The next downside price breakout objective for the bears is closing prices below solid support at $14.00. First resistance is seen at $15.25 and then at $15.50. Next support is seen at today’s low of $14.795 and then at $14.56. Wyckoff's Market Rating: 5.5.

May N.Y. copper closed down 285 points at 234.60 cents today. Prices closed near the session low today on profit taking after hitting a six-week high early on. The copper bulls still have the overall near-term technical advantage. Prices are in a five-week-old uptrend on the daily bar chart. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at 250.00 cents. The next downside price objective for the bears is closing prices below solid technical support at last week’s low of 214.95 cents. First resistance is seen at today’s high of 240.80 cents and then at 243.00 cents. First support is seen at Wednesday’s low of 233.40 cents and then at 230.00 cents. Wyckoff's Market Rating: 6.0.

By Jim Wyckoff

David

.gif)

.gif)