Gold edges lower as investors opt for cash amid deepening virus fears

Gold prices edged lower on Monday as a flight to cash to cover losses in equities overshadowed measures by global central banks to contain the economic fallout from the coronavirus epidemic.

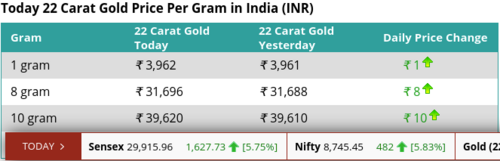

Spot gold was down 0.2% to $1,614.46 per ounce by 0346 GMT after Friday's 0.7% drop. U.S. gold futures fell 0.4% to $1,646.60 per ounce.

"The worse the situation gets the stronger the link between stocks and gold because if we see further economic deterioration that will drag gold down with the share markets," said Michael McCarthy, chief strategist at CMC Markets.

Asian shares slid and oil prices took another tumble as fears mounted the global shutdown for the virus could last for months.

The pandemic has already driven the global economy into recession and countries must respond with "very massive" spending to avoid a cascade of bankruptcies and emerging market debt defaults, the head of the International Monetary Fund warned on Friday.

The U.S. House of Representatives on Friday approved a $2.2 trillion aid package – the largest in history – to help cope with the virus-inflicted economic downturn.

The weekend brought more bad news on the virus front, with the global death toll reaching nearly 34,000. The United States has emerged as the latest epicentre, with more than 137,000 cases and 2,400 deaths.

The European Central Bank chief urged wrangling EU leaders to act more decisively to cushion the economic hit of the pandemic, three sources familiar with the matter said. Weighing on gold was a halt in the dollar's slide that came with a broader risk-averse mood, after the greenback surged amid a scramble for cash and then subsided as central banks launched unprecedented liquidity measures.

"The U.S. fiscal stimulus package is positive for the dollar and probably an element of that is coming through the moment. There is negative correlation between the dollar index and gold prices," IG Markets analyst Kyle Rodda said.

Holdings in the world's largest gold-backed exchange-traded fund, SPDR Gold Trust , rose 1.2% to 964.66 tonnes on Friday.

"I wouldn't say gold's status as safe-haven is over but if things continue to deteriorate economically it could become a funding source and that will offset its safe haven status," said CMC Markets' McCarthy.

Palladium fell 0.7% to $2,253.84 per ounce, platinum slipped 3.3% to $717.07, while silver slid 3.9% to $13.91.

By Asha Sistla

Monday March 30, 2020 01:37

David

.gif)

.gif)