Beginning All-Out Price War

Saudi Arabia plans to boost oil output next month to well above 10 million barrels a day, as the kingdom responds aggressively to the collapse of its OPEC+ alliance with Russia.

The world’s largest oil exporter engaged in an all-out price war on Saturday by slashing pricing for its crude by the most in more than 30 years. State energy giant Saudi Aramco is offering unprecedented discounts in Asia, Europe and the U.S. to entice refiners to use Saudi crude.

At the same time, Saudi Arabia has privately told some market participants it could raise production much higher if needed, even going to a record 12 million barrels a day, according to people familiar with the conversations, who asked not to be named to protect commercial relations. With demand ravaged by the coronavirus outbreak, opening the taps would throw the oil market into chaos.

“Saudi Arabia is now really going into a full price war,” said Iman Nasseri, managing director for the Middle East at oil consultant FGE. The Saudi Energy ministry didn’t respond to a request for comment.

Aramco’s unprecedented pricing move came just hours after the talks between the Organization of Petroleum Exporting Countries and its allies ended in dramatic failure. The breakup of the alliance effectively ends the cooperation between Saudi Arabia and Russia that has underpinned oil prices since 2016. Production limits agreed to by OPEC and its erstwhile partners expire at the end of the month, opening the way for producers to ramp up output.

The company’s shares plunged 9% in Riyadh on Sunday, the first time the stock slumped below its initial offering price. Aramco traded at 29.95 riyals as of 1:57 p.m., giving it a market value of 6 trillion riyals ($1.6 trillion). The Saudi government sold 1.5% of the energy giant’s shares at 32 riyals each in December.

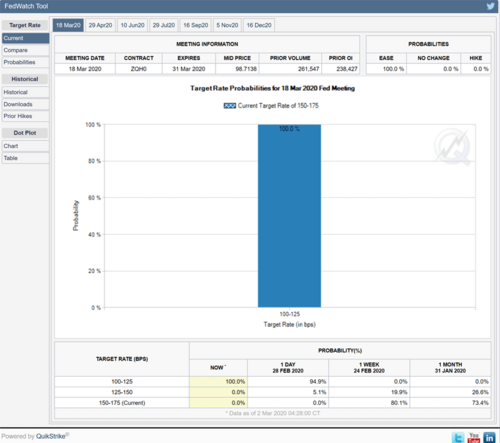

Brent crude, the global oil benchmark, closed down 9.4% on Friday, its biggest daily drop since the global financial crisis in 2008, settling at $45.27 a barrel.

Saudi production is initially likely to rise to between 10 million and 11 million barrels a day in April, from about 9.7 millions a day this month, according to people familiar with Saudi thinking. The final figure would depend on the response of refiners to the price cuts, the same people said.

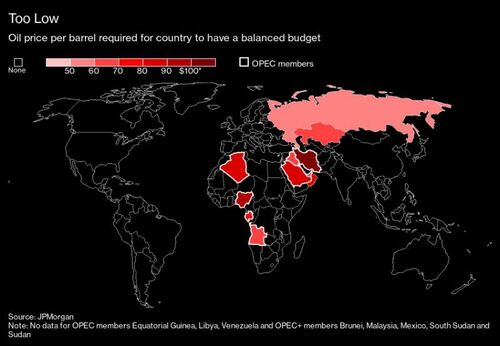

Maximum Pain

The shock-and-awe Saudi strategy could be an attempt to impose maximum pain in the quickest possible way to Russia and other producers, in an effort to bring them back to the negotiating table, and then quickly reverse the production surge and start cutting output if a deal is achieved. In a sign that both sides remain in talks, the OPEC+ Joint Technical Committee, a body of senior oil officials who advise ministers, plans to meet on March 18 to review the global oil market, according to delegates. Saudi and Russian officials are part of the JTC.

“It’s certainly a high-risk, high-stakes approach,” Tim Fox, chief economist at Dubai-based lender Emirates NBD PJSC, said Sunday in a Bloomberg Television interview. “It didn’t come together on Friday and I think market confidence that it will at some point in the next couple of weeks is actually quite low.”

The production increase and deep discounts mark a dramatic escalation by Prince Abdulaziz bin Salman, the Saudi oil minister, after his Russian counterpart Alexander Novak rejected an ultimatum on Friday in Vienna at the OPEC+ meeting to join in a collective production cut. After the talks collapsed, Novak said countries were free to pump-at-will from the end of March.

Record Discounts

With jet-fuel, gasoline and diesel consumption rapidly falling due to the economic impact of the coronavirus outbreak, the energy market now faces a simultaneous supply-and-demand shock.

After the failure in Vienna, Riyadh responded within hours by slashing its so-called official selling prices, offering record discounts for the crude it sells worldwide. Aramco tells refiners each month the prices for its crude, often adjusting the OSPs by a few cents or as much a couple of dollars.

But in a notice to buyers sent Saturday, Aramco announced it was slashing most official prices by $6-$8 a barrel across all regions. The dramatic move will resonate beyond Saudi Arabia. The kingdom’s pricing decision affects about 14 million barrels a day of oil exports, as other producers in the Persian Gulf region follow its lead in setting prices for their own shipments.

Bloomberg

Javier Blas and Anthony DiPaola

Bloomberg March 8, 2020

David

.png)