Gold fails to hold the key psychological level of $1,800

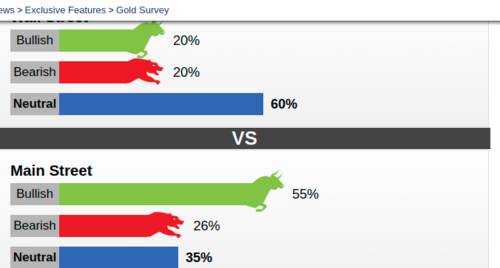

After yesterday's moderate upside move taking gold above $1,800, technical selling pressure resulted in gold breaking back below $1,800. Yesterday the Bureau of Labor Statistics released its inflationary report for August, indicating that the CPI (Consumer Price Index) increased by 0.3% last month. August’s rise in inflationary pressures came in under estimates by economists polled by the Wall Street Journal, who were expecting an increase of 0.4%. The Bureau of Labor Statistics report indicated that inflationary pressures are still prevalent and remain at an elevated level taking the CPI index to 5.3% over the last 12 months.

Today’s sell-off seems to have been the result of technical selling pressure. The fact that gold closed just under its 200-day moving average yesterday, which is the first level of technical resistance, and opened below that price point today was enough for short-term traders to take profit.

Reuters reported that David Meger, director of metals trading at High Ridge Futures, said, “There weren’t any particular headlines to prompt gold’s pullback and this was rather due to its “technical inability to trade up through the 200-day moving average on Tuesday.” Meger added that, “any good news is bad news for gold,” and if more positive economic data comes out, the Fed would be more willing to begin reducing asset purchases, and gold’s likely to move sideways heading into the FOMC meeting.”

Gold continues to be range bound and could continue to trade sideways until the conclusion of the Federal Reserve’s September FOMC meeting on the 22nd of the month. Market participants are waiting for more clarity in regards to the Federal Reserve’s timeline to begin tapering. Currently, it is believed that the Fed will not announce when tapering will begin until the November FOMC meeting. One unique component market participants will focus upon and glean insight from this month’s FOMC meeting is the release of a revised “dot plot,” which will include anticipated interest rates (Fed funds rates) up to the year 2024.

Given that we did see gold give back gains from yesterday’s move above $1,800, the risk to any major continuation of selling is limited. Analyst Ole Hansen of Saxo bank said, “Risk to the downside for gold is also limited since the slowdown in inflation thereby reduces the pace with which tapering can be carried out.”

The one thing that seems to be exceedingly clear is that traders and market participants are waiting for further information from the Federal Reserve when the FOMC meeting concludes exactly one week from today. Up until that point, we could see gold trade sideways and consolidate either just below or just above $1800 per ounce.

By Gary Wagner

Contributing to kitco.com

Buy Sell and Store Gold and Silver for Free

David

.png)

.png)