Gold bull Peter Schiff regrets not getting into bitcoin, and now its too late as its days are numbered

Prominent gold bull Peter Schiff is once again making waves in the crypto economy after saying in a recent podcast that he regrets not buying bitcoin when he first heard about it; however, he added that it is now too late to get into the digital currency as its future is limited.

In a conversation with Natalie Brunell during her Coin Stories Podcast, Schiff, chief economist and chief global strategist at Euro Pacific Capital and chairman of Schiff, said that people started talking to him about bitcoin when the price was under $10 a token. He added that the concept behind the digital currency was intriguing.

He explained that the idea of having a decentralized currency sounded appealing; however, he saw some faults in the fledging market and couldn't see its potential.

"I did not at that point in time foresee that it could be so widely adopted by so many people. Certainly, I didn't foresee major uh companies or investment banks getting involved. I know that I was mistaken that this thing could ever get to such a big bubble," he said during the podcast. "I mean, I appreciated what it was trying to do. As a hard money guy, as a libertarian, I appreciated it. I just was more focused on the underlying flaws."

Although Schiff shows some regret for missing the initial bitcoin boat, he said that he has moved on and it wouldn't invest in it now as he expects the digital currency market to eventually become worthless.

"I wouldn't even consider buying it now. As far as I'm concerned, it's all risk. The upside is limited, and the downside is huge," he said.

While people are still making money on bitcoin as an investment, Schiff said that bitcoin is in a bubble and its future is limited. He compared the crypto market to the early 2000s dot-com rally and the 2008 housing market.

"There are a lot of smart people that are in bitcoin. There are a lot of smart people in dot com stocks that went bankrupt in 2000. There were a lot of smart people in the mortgage market," he said. "there's always a lot of smart people on the wrong side of the trade. But there's also a lot of smart people who have completely rejected bitcoin. I think there are more smart people on my side."

When it comes to real value, Schiff said that he still prefers gold. He said that he doesn't believe that bitcoin's popularity is taking momentum away from the precious metal.

He added that bitcoin can't compete with gold's 5,000-year history as a store of value.

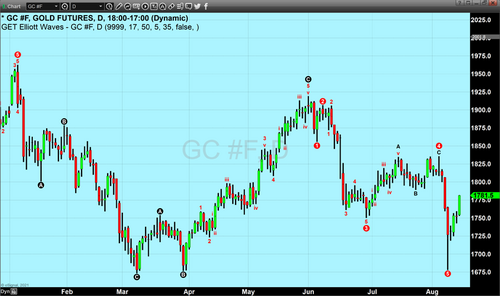

"The headwind for gold right now, temporarily, is the false belief that inflation is transitory; that the Fed is going to normalize interest rates and shrink its balance… that it's going to bring inflation back down to 2%. I think that view is completely wrong, but that is the view that dominates the market. At some point, that view is going to change either because the Fed admits that it's not going to do those things or the market figures it out on its own."

By Neils Christensen

For Kitco News

Kinesis Money the cheapest place to buy/sell Gold and Silver with Free secure storage

David