Gold holding $1,800 even as hedge funds liquidate bullish bets

The gold market is holding the line above $1,800. However, it is still unable to gain any upside momentum as hedge funds pair back their bullish bets, according to the latest data from the Commodity Futures Trading Commission.

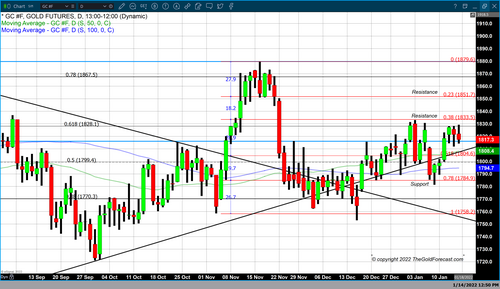

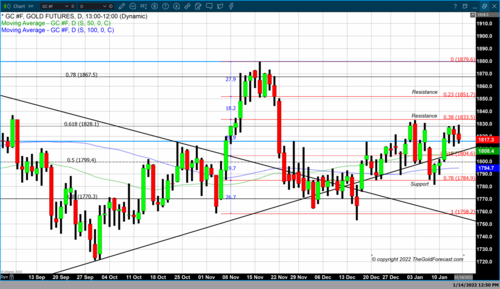

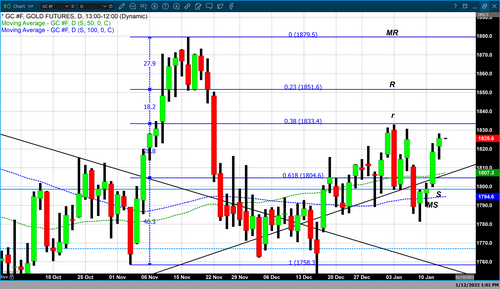

Although gold prices have been unable to break above critical resistance around $1,830 an ounce, many have noted the precious metal's resilience as real yields have pushed to their highest level in nearly two years.

The gold market has held steady as markets start to price in more aggressive action from the Federal Reserve as it tries to bring the rising inflation threat under control. This year, markets see the potential for four rate hikes, with lift-off commencing as early as March.

"Hawkish signals coming from the Fed, market expectations suggesting a March Fed funds hike is imminent, and increasing speculation that QT is in the cards over the next twelve months prompted specs to aggressively decrease their long gold exposure. Investors extended short positioning and sold longs, as yields across the curve moved convincingly higher," said commodity analysts at TD Securities.

However, TDS noted that there is a chance gold can catch a bid on short-covering as real interest rates are expected to remain low even as the U.S. central bank looks to tighten interest rates.

The CFTC disaggregated Commitments of Traders report for the week ending Jan. 11 showed money managers dropped their speculative gross long positions in Comex gold futures by 4,955 contracts to 119,297. At the same time, short positions increased by 243 contracts to 44,987.

Fed's Powell gives hope to gold bulls in Q1 2022, watch the $1,830 level – Pepperstone

Gold's net length now stands at 74,310 contracts, down more than 6% compared to the previous week.

During the survey week, gold prices managed to bounce off support above $1,780, pushing back above $1,800 an ounce.

While there are expectations that gold prices can eventually move higher, some analysts said that the current consolidation period could be in place until the next monetary policy meeting.

"In our opinion, market participants are likely to refrain from buying gold ahead of the US Fed's first rate hike. They may be hoping that the Fed's meeting next week (25/26 January) will give them further and/or clearer signals that the Fed will be commencing its rate hike cycle in March," said Daniel Briesemann, precious metals analyst at Commerzbank.

The silver market also struggles as hedge funds increase their bearish bets and liquidate their bullish positions.

The disaggregated report showed that money-managed speculative gross long positions in Comex silver futures fell by 1,279 contracts to 50,316. At the same time, short positions increased by 2,696

contracts to 32,514.

Silver's net length stands at 17,802 contracts, dropped more than 18% compared to the previous week.

During the survey period, silver prices managed to hold support around $22 an ounce and push back above $22.50 an ounce.

Looking ahead, some analysts are not optimistic that silver can withstand further technical weakness. Commodity analysts at Credit Suisse see silver prices testing support at $19.65 an ounce, potentially dropping to $18.64. The analysts added that silver prices have to clear $25 an ounce to attract new bullish attention.

"Our bias stays lower for an eventual sustained break of $21.42 to confirm a major top is in place and important change of trend lower," the analysts said.

By Neils Christensen

For Kitco News

Time to buy Gold and Silver on the dips

David

.gif)