Gold, silver sell off on bearish reaction to hawkish Fed

Gold and silver futures prices are sharply lower in midday U.S. trading Thursday. The metals are reeling after a surprisingly hawkish report from the Federal Reserve Wednesday afternoon. February gold futures were last down $36.50 at $1,788.50 and March Comex silver was last down $1.05 at $22.11 an ounce.

The Federal Reserve's FOMC minutes that were released Wednesday afternoon indicated a "very tight" U.S. job market and rising inflation might require the central bank to raise interest rates even sooner than many already expected, and begin reducing its overall asset balance sheet. The minutes suggested inflationary concerns outweigh the economic risks posed by the rampant Omicron variant of the coronavirus. The probability that the Fed will raise interest rates in March rose to greater than 70%, according to the Fed funds futures market.

Rising U.S. interest rates as evidenced by rising U.S. Treasury yields are bullish for the U.S. dollar. Gold and the greenback many times move in the opposite direction on a daily basis. However, the U.S. dollar index has shown little reaction to the Fed minutes. Gold and the U.S. dollar compete with each other as a safe-haven store of value. Keep in mind, however, that the longer-term implications of rising interest rates and problematic price inflation are historically bullish for hard assets like the precious metals.

What does bitcoin at $100k mean for gold price? Goldman weighs in

The yield on the U.S. 10-year Treasury note is presently fetching 1.732%. U.S. bond yields have been on the rise for three weeks and have taken a big jump this week, including after the hawkish FOMC minutes. For perspective, the German 10-year bond (bund) is presently yielding -0.096% and the U.K. 10-year bond (gilt) yield is trading at 1.148%.

Global stock markets were lower overnight. U.S. stock indexes are mixed at midday.

The key "outside markets" today see Nymex crude oil futures prices higher, at a seven-week high and trading around $79.75 a barrel. The U.S. dollar index is slightly up today.

Attention turns to Friday's U.S. employment situation report for December, which is expected to see its key non-farm payrolls component show a rise of 425,000 after a rise of 210,000 in the November report. The overall unemployment rate is seen at 4.1% in December compared to 4.2% reported in the November report.

.gif)

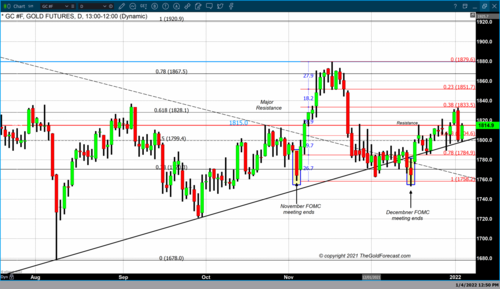

Technically, the February gold futures bulls have lost their overall near-term technical advantage as a three-week-old price uptrend on the daily chart has been negated. Bulls' next upside price objective is to produce a close in February futures above solid resistance at this week's high of $1,833.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at the December low of $1,753.00. First resistance is seen at $1,800.00 and then at the overnight high of $1,811.60. First support is seen at today's low of $1,785.40 and then at $1,775.00. Wyckoff's Market Rating: 5.0

.gif)

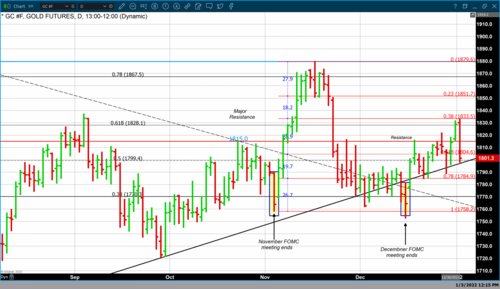

March silver futures bears have the firm overall near-term technical advantage and have regained power late this week. Silver bulls' next upside price objective is closing prices above solid technical resistance at the December high of $23.48 an ounce. The next downside price objective for the bears is closing prices below solid support at the December low of $21.41. First resistance is seen at $22.50 and then at the overnight high of $22.85. Next support is seen at $21.75 and then at $21.41. Wyckoff's Market Rating: 2.0.

By Jim Wyckoff

For Kitco News

Time to buy Gold and Silver on the dips

David

.gif)

.gif)

.gif)

.gif)

.gif)