Gold holds its ground as bond yields hit 2.5%

The gold market is ending the week just above $1,950 an ounce, a slightly more than 1% gain from last Friday; however, investors need to look past the raw numbers and the environment that gold is trading in.

Gold prices have established a new range above $1,900 as the U.S. dollar index holds near a two-year high. Even more incredible, gold is holding firm in the face of rising bond yields. Early Friday, the yield on 10-year notes rose to 2.5%, its highest level in three years.

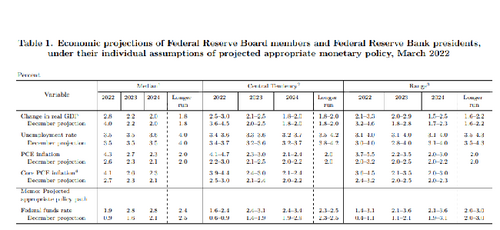

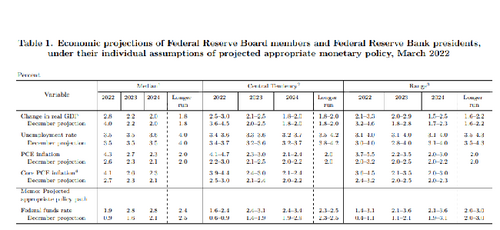

Some analysts suggest that bond yields have room to move higher as the Federal Reserve looks to tighten interest rates faster than expected. Tuesday, Federal Reserve Chair Jerome Powell shocked markets when he said that inflation is now too high. He signaled that the U.S. central bank could raise interest rates by 50 basis points in May. Markets also see the potential for a second 50-basis-point move in June.

However, the gold market is not taking these threats too seriously. To use an old cliché, some analysts have said that the Fed's bark is worse than its bite.

"It's easy to release an aggressive dot plot, and it's easy to talk tough in press conferences and speeches. But it's a lot harder to actually raise rates seven times in the course of one year and four times in the following year and increase the risk of choking off the economic cycle," said Kristina Hooper, chief investment strategist at Invesco, in a report.

Not only is the Federal Reserve talking tough, but analysts note looking at the big picture, even if the Fed meets its aggressive goals, interest rates will still be around 2%. Meanwhile, annual inflation is currently at 7.9%. Some economists expect that it could drop to between 4% and 6% by the end of the year, but the bottom line is that real interest rates are going to remain in deeply negative territory.

A weaponized U.S. dollar could prompt central banks to diversify with more gold – MKS' Shiels

But it's not just monetary policy driving investment demand into gold. Russia's war with Ukraine continues to support safe-haven demand for the precious metal.

The humanitarian crisis in Eastern Europe continues as the war rages. So far, more than 3.7 million refugees have left Ukraine, and about 6.5 million people have been displaced within the country.

Many geopolitical analysts do not expect the conflict to be resolved anytime soon, so market uncertainty and volatility will remain prominent in financial markets.

However, there is a new element to the conflict as western economic sanctions start to bite and the U.S. dollar is weaponized. Gold could assert itself as a new global currency.

By Neils Christensen

For Kitco News

Time to buy Gold and Silver on the dips

David

.gif)

.gif)

Gold has proven its value as a diversified asset – Invesco's Hooper

Gold has proven its value as a diversified asset – Invesco's Hooper

What's this year's 'potential end game'? Gold price at $2,500, oil price at $50 – Bloomberg Intelligence

What's this year's 'potential end game'? Gold price at $2,500, oil price at $50 – Bloomberg Intelligence

.gif) Consolidation after rising above $2,000 an ounce is a good thing for gold, said RJO Futures senior market strategist Frank Cholly.

Consolidation after rising above $2,000 an ounce is a good thing for gold, said RJO Futures senior market strategist Frank Cholly.