Wall Street advises caution on gold prices next week, Main Street mashes the gas

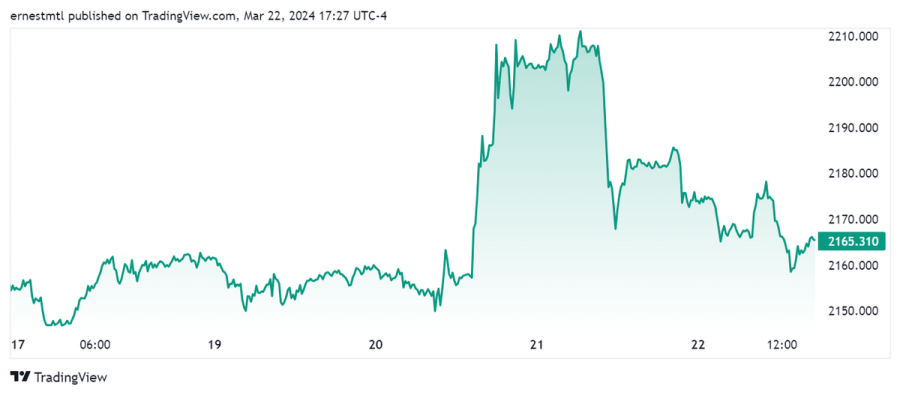

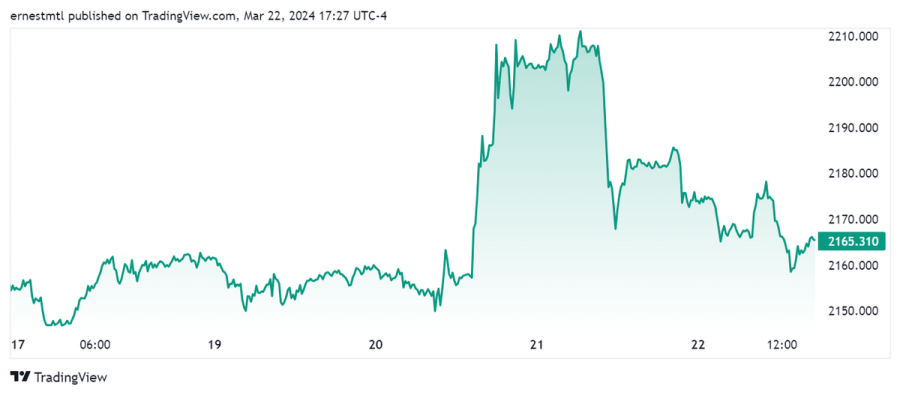

After last week’s price action was led by inflation data, gold markets were once again dominated by the Federal Reserve and interest rate expectations, though traders’ feelings seemed to evolve as the days went by.

In the immediate aftermath of Wednesday’s FOMC meeting, markets took the Fed’s maintenance of three projected rate cuts in 2024 and ran with it, weakening the greenback and driving the yellow metal to yet another all-time high in both futures and spot prices on Thursday.

Then, later trading brought a major bounce to the U.S. dollar and a significant retracement for gold, which continued through the Friday trading session.

pic

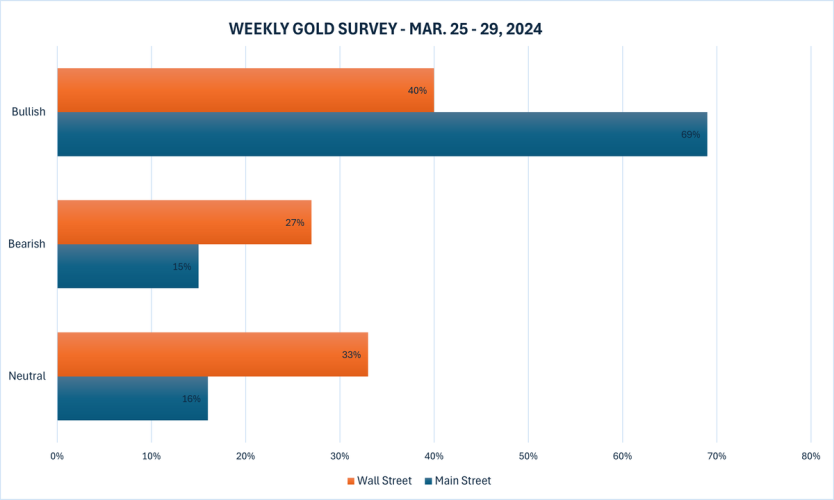

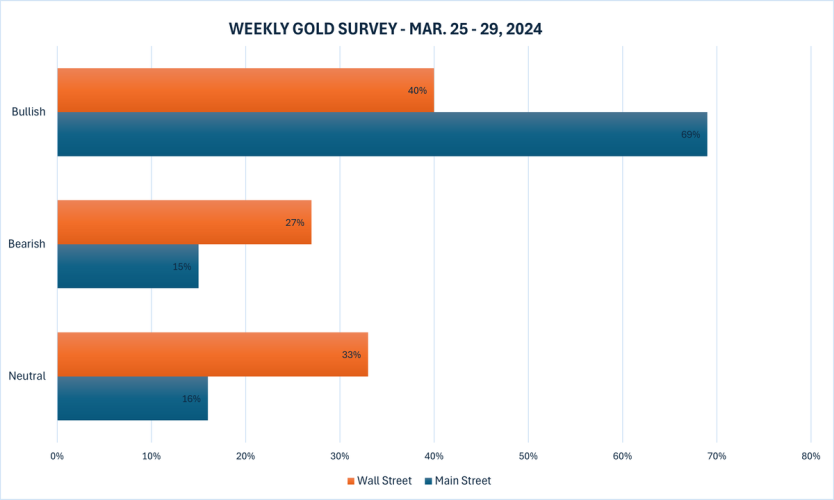

The latest Kitco News Weekly Gold Survey showed market experts divided and cautious on gold’s direction heading into the final week of the first quarter, while retail traders are very much back on the bullish bandwagon.

Colin Cieszynski, Chief Market Strategist at SIA Wealth Management, captured the zeitgeist among market participants at the conclusion of Fed week. “I am neutral on gold for the coming week,” Cieszynski said. “It has had a big move lately, and may consolidate in the coming days with the US Dollar strengthening, and it being month-end, plus a short trading week next week.”

Darin Newsom, Senior Market Analyst at Barchart.com, said he’s keeping his downward bias for next week. “I’ll stick with this for a third consecutive week,” he said. “It was looking a bit questionable Thursday, until the April contract dropped more than $40 off its session high through the close. With daily stochastics continuing to indicate more downside potential in the market, and the US dollar index gaining strength, April gold could work lower over the next week.”

“The key will be its previous 4-day low, theoretically sitting at $2,150.20 next Monday, depending on what happens Friday,” Newsom added.

“Despite surging to a fresh all-time high on Thursday, gold bulls seem tired and weighed down by a stronger dollar as the week comes to an end,” said Lukman Otunuga, senior market analyst at FXTM.

Everett Millman, Chief Market Analyst at Gainesville Coins, said he thinks that despite Powell’s vote of confidence on the overall economy, and the employment situation in particular, it was the rate cut forecast that drove the optimism coming out of the FOMC on Wednesday.

“I think it does go back to the dot plots, the fact that they haven't shifted to a less dovish stance, at least not in their forecast,” he said. “There is definitely some reason to be skeptical of the dot plots themselves, they haven't always played out according to what the Fed is forecasting. But I think that's really the main reason why gold moved higher, why it seemed to like the news, even though it really wasn't all that dovish.”

“We're not going to say it was the same type of stance the Fed had coming into this year, where they tried to be talking tough about inflation,” he added. “We didn't really see any of that.”

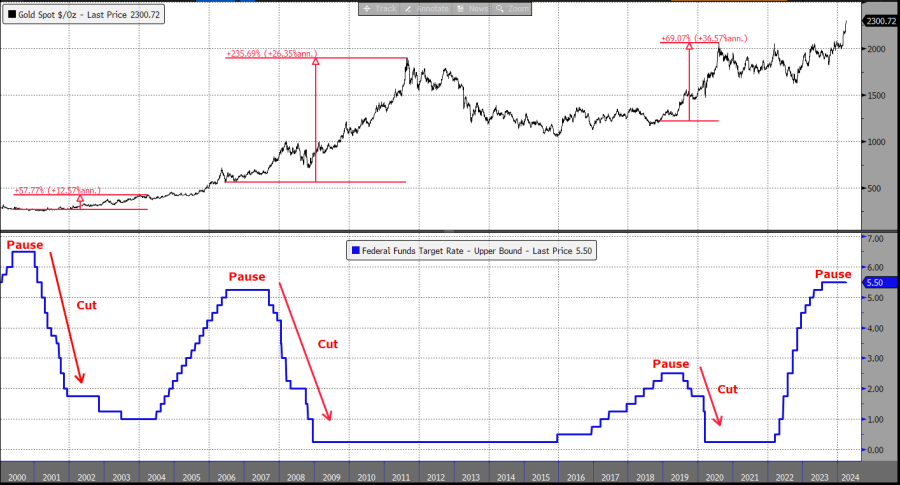

Looking beyond the FOMC, Millman said that there may just be a momentum trade going on with gold right now. “The fact that we have continued to maintain close to all-time highs, that's going to push a lot of trend-following traders and tactical investors into going long gold or covering their shorts,” he said. “I think that’s probably having a larger effect on the gold price action we're seeing, more so than people's expectations of the Fed, although obviously that's always going to be percolating in the background.”

Millman said that the technical picture is not confirming a continuation of this major pullback. “From what I've seen, most of the technical patterns in the gold chart are fairly bullish,” he said. “Having said that, I’m a big believer in mean reversion, and the fact that gold was almost certainly a little bit overbought when it got close to that $2,200 level, I think this is a routine correction that we should expect to see after gold had a month where it posted triple digit gains. So it doesn't surprise me, and I think we're going to have to see how it plays out in these coming weeks.”

Millman agreed that now is a perfect time to sit still and wait for things to settle a bit. “My vote is certainly neutral or sideways,” he said. “I think it would be extremely encouraging if gold could just hold on to most of its gains, given that we've already moved so much higher. When I do look out a little further, towards the third quarter, fourth quarter, by year-end, I do expect gold prices to be higher than they are now. I do expect them to be at new all-time highs. But in the short term, I think that the market just needs a breather.”

This week, 15 Wall Street analysts participated in the Kitco News Gold Survey, and their views were spread fairly evenly across the spectrum. Six experts, or 40%, expected to see higher gold prices next week, while four analysts, or 27%, predicted price declines. Five experts, representing 33%, predicted sideways trading for the precious metal, or suggested they would sit on the sidelines next week.

Meanwhile, 170 votes were cast in Kitco’s online polls, with the vast majority of Main Street investors anticipating further gains for gold next week. 117 retail traders, representing 69%, looked for gold to rise next week. Another 25, or 15%, predicted it would be lower, while 28 respondents, or 16%, were neutral on gold’s near-term prospects.

Next week will see the release of new home sales on Monday, durable goods, consumer confidence, and the Richmond Fed survey on Tuesday, and MBA mortgage applications on Wednesday. Thursday, however, will be the busiest day next week due to the long Easter weekend, with final Q4 GDP, jobless claims, pending home sales and the University of Michigan’s consumer sentiment survey.

Sean Lusk, co-director of commercial hedging at Walsh Trading, was surprised at the positive sentiment from both Powell and the markets, and he doesn’t believe the Fed will be able to deliver 75 basis points of cuts this year.

“I really can't believe what I'm hearing, to be quite honest with you,” Lusk said. “I suppose I shouldn't be that surprised. Are they saying the economy's not as strong as it's perceived to be, given where the indexes are? Or are they saying that there's no inflation, or not as much inflation as it appears to be for the rank-and-file at the grocery store, because it does exist there.”

Lusk said that as far as the greenback is concerned, it's been a ‘buy-the-rumor, sell-the-fact’ event, which he found interesting. “The dollar shot up for two days in a row here, and that's kind of an odd reaction when you get, I would say, neutral to dovish commentary,” he said. “But you also have to recognize, at least in gold's case, volume was ticking up to 300,000, 400,000 contracts in the April contract. Now it's down about 150,000 a day, but you’ve got option expiration on the April contract Monday, and then you're going to roll to June.”

“I think this is all this is, today's weakness, maybe yesterday, they got up to some obscene high and they're yanking back and that's the normal ebb and flow in the markets,” he said. “Plus, you're coming into month and quarter-end, and we've had a hell of a performance here for the better part of two months, since the February lows.”

“They're going to back off here and take some profits, but I don't see any technical damage being done to the charts,” he added. “This thing could fall back to $2,125 and we're still in a bullish posture. We hit our 5 percent marker, that's where we're kicking around, maybe we're just a little bit below it today. I still think once June goes most actively traded, which it will next week, it has a chance to get to and surpass its contract high at $2,246 and then spike up to about $2,270, $2,280, in that area. That'll be 10 percent higher on the year, so that's the target. But if we start slipping underneath some [Fibonacci] numbers here at $2,125, then it can go down to halfway back from the February lows."

“Could they wipe this out at any moment?” he asked rhetorically. “Yeah, but what's changing? Why would they? You're just not going to go up every darn day at these levels, but you are consolidating in some higher ranges, and that's really the more important thing here. You’ve got June gold consolidating between $2,190 and $2,210 for the most part, and that's what I'm keying on here. The market still is in a pretty deep contango here, pretty steady, and should that remain, it just tells you the price is going higher.”

“Listen, my gut feeling here is that seasonally, we'll have some dips and valleys into the end of the quarter, and a three-day weekend next weekend, but the wild card is going to be what the wild cards have been: the Middle East, Eastern Europe, there's always black swans circling with the banking crisis,” he said. “In April, we'll get a second round of earnings, we'll see what those are. Then you're probably going to have a pullback in May when realization starts to hit that they’re not going to cut three times, maybe once at best.”

“Gold rallied through $2220 on the back of the initial dovish read of the FOMC as the dollar and US rates fell,” said Marc Chandler, Managing Director at Bannockburn Global Forex. “However, the market took another look, and rallied the dollar and steadied US rates. Gold pulled back to almost $2162.”

“I look for a firm dollar in the coming days and this may weigh on the yellow metal,” Chandler added. “Support is in the $2145-50 area. While many focus on the central bank gold buying, Chinese and Turkish retail investors also reportedly have been keen buyers. The momentum indicators are stretched but could be relieved by extended sideways activity.”

Mark Leibovit, publisher of the VR Metals/Resource Letter, is also expecting USD strength to push gold lower. “As Dollar rallies, look for a pullback.,” he

James Stanley, senior market strategist at Forex.com, said he believes gold is due for a pullback next week.

pic

“The trend is starting to feel frothy and even with the Fed going dovish and sticking with three cuts in the forecast, bulls weren’t able to do much beyond $2,200 yet,” he said. “There was an open door for a pullback as gold was holding a descending triangle very near the highs, but the Fed was surprisingly dovish (imo) at the FOMC rate decision and that brought a jolt to the USD which has largely been priced-out since.”

And Kitco Senior Analyst Jim Wyckoff sees gold prices rangebound next week. “Sideways, as bulls have run out of gas on a near-term basis,” he said.

Spot gold last traded at $2,165.31 per ounce at the time of writing, down 0.74% on the day but up 0.43% on the week.

Kitco Media

Ernest Hoffman

Time to Buy Gold and Silver

David

.png)

.gif) Royal Mint sees record bullion demand in 2022 as sales increase 25% for gold, 29% for silver

Royal Mint sees record bullion demand in 2022 as sales increase 25% for gold, 29% for silver