Post-Trump era? Gold price to see $2,000 next week as attention shifts to coronavirus – analysts

The gold market is reaping the benefits of a lower U.S. dollar in an uncertain environment, where markets are betting on a Biden win.

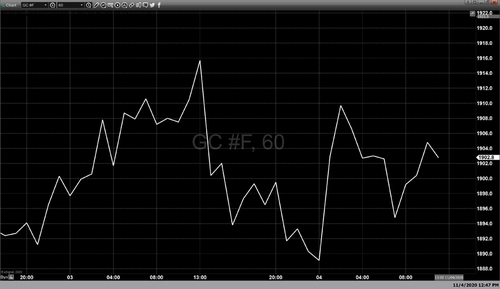

The precious metal began its rally Thursday with prices rising more than $50 amid uncertainty and weaker U.S. dollar as Democratic candidate Joe Biden maintained his lead against U.S. President Donald Trump.

Based on the latest Electoral College count, Biden has 264 votes versus Trump's 214. Ballots from swing states, such as Nevada, Georgia, and Pennsylvania, are still being counted as of Friday afternoon.

At the time of writing, December Comex gold futures were trading at $1,954.80, up 0.41% on the day, seeing their best weekly gains since late-July.

"Gold has been really following the dollar, the COVID-19 crisis, and stimulus talk," Afshin Nabavi, vice president at precious metals trader MKS SA, told Kitco News on Friday. "There was a mixture of safe-haven buying. The dollar has been pretty much in free-fall, which helped the precious on Thursday. Everybody under the sun was interested in the safe-haven."

With all this election uncertainty amid a second coronavirus wave, gold could climb back to the $2,000 an ounce level next week, said Nabavi.

"We are now at around $1,950-55. If we can get above that, I think $2,000 is in the cards," he said. "Economy is in deep trouble around the world because of the pandemic, stimulus packages will keep on printing money, and the precious metal will benefit on the upside."

More litigation news and vote recounts could shake markets next week, Nabavi warned. "I expect a lot of resistance coming from Trump, even if elections are saying the contrary. It could be a bit of a mess, and it will help precious go higher as well."

Gold's $1,980 has been identified as key resistance by TD Securities commodity strategist Daniel Ghali, who sees gold as overbought for the moment.

"The reason behind that is because gold prices outperformed real rates," he told Kitco News on Friday. "The most likely outcome is Biden presidency with Republican Senate, which means less fiscal stimulus and gridlock in the near term."

Election expectations

For next week, markets are pricing in a Biden win and a Republican-controlled Senate, which means a split government.

"While not official, Biden is likely to be the next President with 306 electoral votes. Margins are too wide for recounts or litigation to likely reverse that. The Senate seems likely to result in a 52-48 Republican majority, a net gain of just one seat for Democrats. However, the race is likely deadlocked at 50-48 (R/D) pending a Jan 5 runoff in the two seats in GA, which will likely garner huge media, political, and financial attention over the next two months to see if Democrats can win both seats and gain control of the Senate," said TD Securities strategists on Friday.

What this means for policy going forward is less dramatic changes, including a smaller fiscal stimulus. "Divided government should mean fewer significant policy changes, but we expect a small ($500bn) stimulus package to pass in Dec-Jan," TD's strategists added.

The U.S. dollar is likely to continue to lose steam as the year-end approaches, analysts added.

"Markets are confident Biden will win as final votes are counted, and rallying risk assets don't seem too concerned by President Trump's moves to challenge the result," said ING FX strategist Francesco Pesole. "In FX, USD may stay pressured as investors keep betting on a rest of the world rally in the post-Trump era."

In the week ahead, the focus will remain on the U.S. election and Biden's chances of receiving a convincing enough victory. After that, however, the attention will shift to the coronavirus numbers in the U.S., which are seeing a record of more than 100,000 new cases per day, Pesole added.

"Price action over the last week … suggests investors are positioning for a post-Trump era, which, with a Fed keeping rates near zero, is seen as a dollar negative," the strategist added. "The biggest threat … comes through COVID-19. New daily COVID cases in the U.S. are running above 100k per day, which could prompt state governors to close bars and restaurants again – a move that could hit very bullish current sentiment."

Rising coronavirus cases across the world pose "the greatest economic challenge," said CIBC Capital Markets chief economist Avery Shenfeld.

"We've been watching the numbers obsessively. No, not those numbers, as we don't really need to hear from every county clerk in the U.S. When the dust settles on the election, the market will turn its attention again to the coronavirus," he said on Friday.

So far, the macro data out of North America does not show a big impact from the second coronavirus wave. However, Europe might be flashing warning signs, said Shenfeld.

"We can look across the pond to Europe, where even higher caseloads seem very likely to squeeze Q4 GDP, for what could be in store here if we can't contain infection rates," he said. "In projecting economic data during the pandemic, it's important to watch the coronavirus numbers, rather than just the public health edicts. And, unfortunately, in Europe, the U.S. and most of Canada, the case counts have yet to signal an end to the second wave. So while North America's economy looks to have still advanced in October, we're not out of the woods yet."

The looming winter and the surge in coronavirus cases bring up the next point — the need for fiscal stimulus.

Fed Chair Jerome Powell stressed that need on Thursday during a press conference, which followed the monetary policy meeting that kept interest rates unchanged.

Powell reminded that the current economic downturn is the most severe one, and it will take a while to get back to the levels of economic activity seen at the beginning of the year.

"It will require both monetary and fiscal policy to achieve that," he said. "Further support is likely to be needed from fiscal and monetary policies."

Powell also addressed the rising COVID-19 cases, saying that the U.S. is seeing "a widespread spike in cases," noting that "it does seem likely that people who have begun to engage in activities may pull back."

Data to watch

Next week will be a fairly light data week with the critical releases being U.S. inflation data out on Thursday and PPI numbers out on Friday.

Also, markets will continue to watch the U.S. jobless claims, scheduled for release on Thursday.

By Anna Golubova

For Kitco News

Kinesis Money

David