Analysts see gold on the upswing after holding support at $1,850

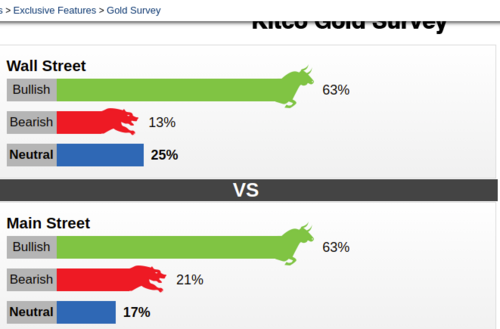

The gold market could have turned a corner and is now heading higher as prices look to end the week above $1,900 an ounce and sentiment among retail investors and market analysts is looking bullish, according to the latest results of the Kitco News Weekly Gold Survey.

Although both Main Street investors and Wall Street analysts expect to see gold prices push higher next week, there is still some caution in the marketplace after the worst monthly performance in nearly four years.

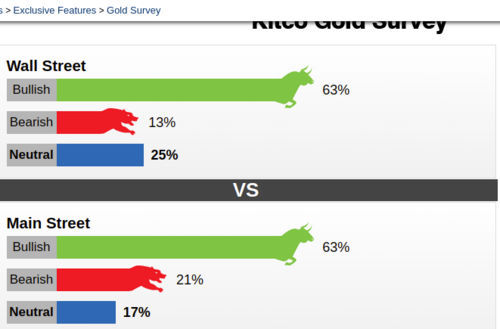

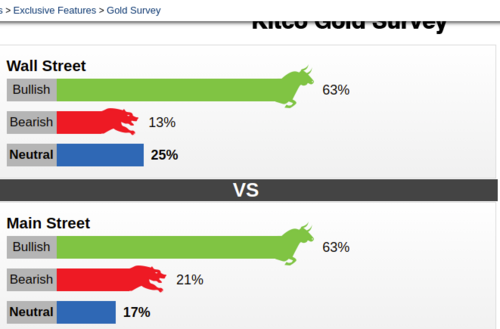

Compared to last week, after what was nearly a three-way tie among Wall Street professionals, sentiment has turned bullish. This week 16 analysts participated in the survey. Ten voters, or 63%, called for gold prices to rise; two analysts, or 13%, called for lower prices next week and four analysts, or 25%, said they see prices moving sideways.

After dropping to the 10-month low, sentiment among retail investors has jumped significantly higher. A total of 1,194 votes were cast in online Main Street polls. Among those, 749 voters, or 63%, said they were bullish on gold next week. Another 245, or 21%, said they were bearish, while 198 voters, or 17%, were neutral.

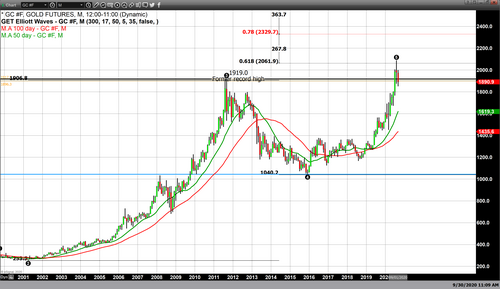

Most analysts see gold prices pushing higher as it appears that the market has carved out a technical bottom, with support at $1,850 holding at the start of the week. Gold prices are looking to the week with a 2% gain. December gold futures last traded at $1,906.50 an ounce. The rally comes after the previous week's rout, which saw the yellow metal drop nearly 5%.

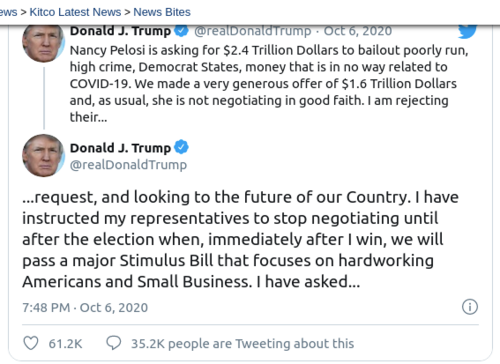

Many analysts also said that the ongoing turmoil ahead of the Nov. 3 U.S. elections would continue to support prices in the near-term. Election volatility reached a new level Friday after President Donald Trump, running for reelection, said that he posted positive for COVID-19.

Trump has said that he will be quarantined for the next 14 days.

"With all this uncertainty and now it looks like we have found a bottom in gold, at least for now," said Afshin Nabavi, head of trading with MKS (Switzerland). He added that he sees prices trading in a range between $1,920 and $1,875 an ounce.

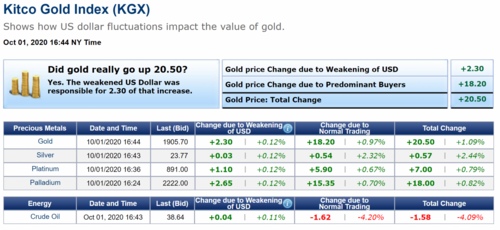

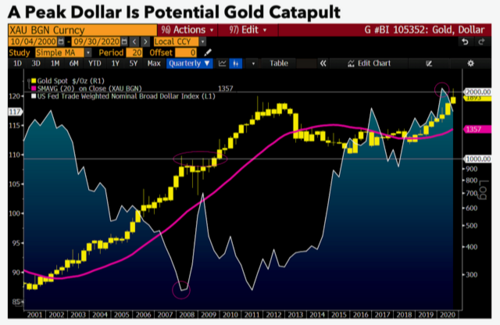

Colin Cieszynski, chief market strategist at SIA Wealth Management, said that while gold prices have room to move higher, he is watching the U.S. dollar.

"It's possible that a USD safe-haven rally could hold gold back, but if that happens, gold could still climb relative to other currencies," he said.

Carsten Fritsch, commodity analysts at Commerzbank, said that the U.S. dollar index had shown some resilient strength this past week as it continues to trade above 93 points, which has capped gold's performance. However, he added that it could be only a matter of time before the U.S. dollar breaks lower and propels gold prices higher. He noted that a lot of the uncertainty is coming out of the U.S.

"At some point, the U.S. dollar will have to move lower. An end to U.S. dollar strength would be helpful for gold," he said.

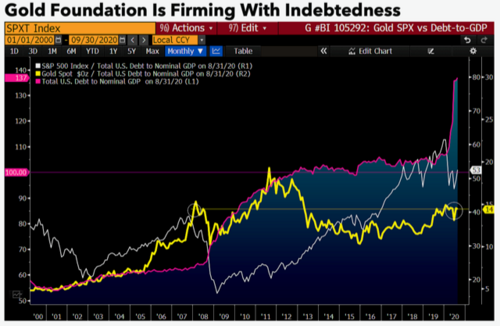

Although the gold prices will remain an essential factor to determine gold's price action, Richard Baker, editor of the Eureka Miner's Report, said that he is bullish on gold because of important market ratios.

"Even in the Friday chaos, gold has advanced solidly in comparative value to copper and the oil," he said. "The lustrous metal is also gaining on the S&P 500. Even though its dollar price is presently down, the value comparisons are very encouraging, especially in a sustained environment of negative benchmark real rates."

Although there is strong short-term bullish sentiment in the marketplace, it is challenging to ignore a robust neutral bias.

Ole Hansen, head of commodity strategy at Saxo Bank, said that he is neutral on gold as the market hasn't been able to push higher given all that has happened in the last few days.

"If gold can't rally when there is news that the U.S. president has COVID-19, then the market is just not ready to move up," he said. "I would like to be bullish on gold, but I don't like the price action right now. I don't think you should short the market, but I also don't see many reasons to buy at these levels.

Hansen added that for gold to move higher, it needs a new driver like new stimulus measures from the U.S. government.

By Neils Christensen

For Kitco News

David

.gif)