Gold prices to average above $2,000, Silver to average above $30 through 2024

Gold and Siver’s imp[resive rally this summer is just the start of the precious metal bull market, according to one Canadian Bank.

In areport published Tuesday, commodity analysts at CIBC upgraded their gold and silver forecasts for the rest of the year into 2021. The analysts said that they see gold prices averaging the third quarter around $1,925 an ounce. The average goes up to $2,000 for the fourth quarter, the analysts said.

Looking ahead, CIBC sees gold prices averaging $2,300 an ounce in 2021, $2,200 an ounce in 2022, $2,100 in 2023 and $2,000 an ounce in 2024.

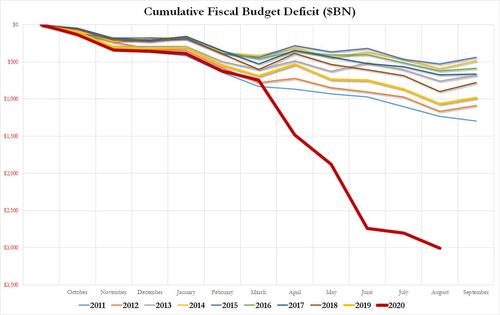

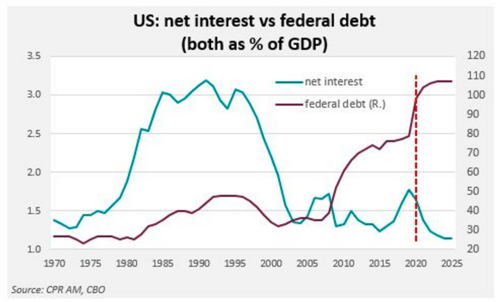

“The outlook for continued low real interest rates, increasing government debt burdens coupled with geopolitical uncertainty arising from the upcoming U.S. election are all supportive of further significant price appreciation,” the analysts said.

Looking at silver, the Canadian bank sees the precious metal averaging $25 in the third quarter; in the fourth quarter the average price is expected to rise to $28 an ounce.

Looking ahead, CIBC sees silver prices averaging $32 an ounce in 2021, $31 an ounce in 2022, $30 in 2023 and $28 in 2024.

“Even though the commodity has already performed well year-to-date, this metal has potential to provide investors with even more torque given the relatively smaller market for silver vs. gold,” the analysts said.

The analysts said that gold investor should continue to watch real interest rates as a critical factor to drive prices in the long-term. They added that they also expect to see central banks inject more liquidity to support financial markets.

“While we appear to be in the midst of another round of QE with significant uncertainty surrounding the magnitude and length of a global recession, real rates below 2% are here to stay in the near term,” the analysts said. “The gold and silver price has already reacted favorably to fundamentals, but could still have room to move higher if history repeats itself.”

The bank also sees further weakness in the U.S. dollar as another important factor to support gold and silver prices.

“The USD remains under pressure with COVID-19 far from being under control and some pandemic stimulus measures set to roll off over the coming months. The USD’s period of dominance is likely over for some time as the country struggles under a heavy debt load, high unemployment, and continuing trade war uncertainty,” the analysts said.

By Neils Christensen

For Kitco News

David

.gif)

.gif)