Will King Dollar Be Overthrown?

David

Wordepress blog powered by MarketHive

David

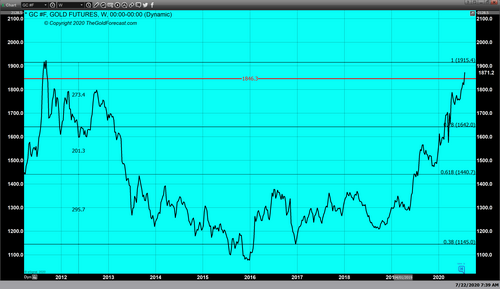

History was made today when gold pricing closed near the highest daily level since August 22, 2011. In fact, as of 5:50 PM EDT gold futures basis the most active August contract is currently settling at approximately $1900.30. On a weekly chart gold closed at a new record price for the highest weekly close.

Considering that this massive rally began in the middle of March in response to a epidemic becoming a global pandemic with gold trading at approximately $1450 per ounce. In this short time span of four months traders have witnessed gold prices rise dramatically from the mid-March lows to close today within pennies of $1900.

The global pandemic has touched every country in the world. According to John Hopkins University the total number of reported cases worldwide is now at 15,628,936, resulting in the loss of 636,262 lives.

According to the CDC, in the U.S. alone 72,219 new cases of the Covid-19 virus were reported from the previous day, taking the total number of infected individuals in the United States beyond 4 million (4,024,492) individuals. Bring the total lives lost in the United States to 143,868 with 1,113 new deaths being reported today.

Our issues with China did not start with the Covid-19 virus which is believed to have begun in a Wuhan province. Prior to the pandemic our two superpowers were fully immersed in a trade war. The rally which began in March of this year came after the trade tensions between the United States and China had already run up the price of gold.

At the end of 2019 gold was trading somewhere around $1300 an ounce after climbing from about $1040 when the multiyear correction concluded at the end of 2015. Roughly 2 years later America and China would begin trade negotiations which resulted in a trade war.

cording to Reuters, it was September 24, 2018 when the 10% tariffs on the $200 billion worth of Chinese imports was actualized and enforced, and on the very first day of 2019 China responded by taxing $60 billion of U.S. goods. Unknowingly this issue would be put on the back burners as the world’s greatest superpowers were unable to move past a phase-1 agreement, which at this point is still unresolved.

The current focus in the United States and globally is on mitigating the damage caused by the coronavirus. This has been a huge component creating bullish market sentiment for gold. The recent tensions between our two superpowers have escalated the conflict and was the final push needed to take gold to $1900.

Whenever this pandemic begins to subside countries globally will have to deal with the economic fallout that most certainly will follow. If the economic fallout is combined with heightened tensions between the United States and China collectively these fundamental issues could take gold to $2000 or higher.

Wishing you as always good trading and good health,

By Gary Wagner

Contributing to kitco.com

David

After US ordered China to close its its Houston consulate this week, Beijing said the move had "severely harmed" relations and warned it "must" retaliate.

Also, the number of Americans filing for unemployment benefits unexpectedly rose last week for the first time in nearly four months, data showed on Thursday.

Gold is viewed as a safe-haven during times of political and financial uncertainty. The precious metal has also been supported by a weak dollar.

"Gold and silver may witness choppy trade as market players assess virus risks and geopolitical tensions against expectations of additional stimulus measures however the general bias may be on the upside due to weaker US dollar," Kotak Securities said in a note.

In the US, Senate Republicans are set to unveil their proposal for a fresh round of coronavirus stimulus next week, including more direct payments to Americans. Earlier this week, Europe approved a massive stimulus of over $850 billion.

Coronavirus cases continue to rise, with more than 1.54 crore people across the world have been reported to be infected by the virus while 6.3 lakh people have lost their lives. (With Agency Inputs)

David

It was another day in which the precious metals ran strongly to higher pricing. Initially both gold and silver spiked strongly in mid-March when the coronavirus epidemic grew into a global pandemic. Gold gained almost $300 as it traded from $1450 to $1788.

.png)

Gold futures basis the most active August contract closed up $23.70 (+1.28%) and is currently fixed at $1867.50. Silver gained 7.92%, which is a gain of a $1.70. Currently September silver futures are fixed at $23.265.

The accelerated moves to higher pricing are based upon new fundamental events unfolding during the pandemic causing market participants to not only react to central banks flooding liquidity to reignite their contracting economies. The monetary policy of quantitative easing always results in a devaluation of the currency specific to that central-bank.

The recent acceleration of higher gold and silver prices are tied to heightened tensions which have escalated to a new level between the United States and China. China reported today that the U.S. had ordered it to close its Houston consulate, magnifying the existing tension between our two superpowers. China labeled the action by the United States as an “unprecedented escalation by the U.S.” this led China to threaten and retaliate if the decision isn’t reversed.

The recent breakdown and stalemate between China in the United States adds fuel to the fire created from the massive U.S. fiscal stimulus, as well the Federal Reserve maintaining a monetary policy that is very accommodative. The actions by the Federal Reserve have the potential to devalue the U.S. dollar, which is exactly what we have seen.

The totality of geopolitical and economic expenditures creates a perfect storm scenario in which we could see gold challenge and trade to a new all-time record high. Currently, gold is at a new all-time record high when paired against the Euro dollar, the Indian Rupee, the Canadian Dollar and many others.

According to MarketWatch, Boris Schlossberg, managing director of FX Strategy for BK Asset Management said, “Gold attracts flows when real interest rates compress and when political tensions rise, so the current market regime is a perfect recipe for a move higher over the intermediate term horizon.”

It is clear to many analysts including myself that gold and silver have rallied based on two primary reasons; U.S. dollar weakness and extremely bullish sentiment by traders and market participants.

Jeroen Blokland, senior portfolio manager at Robeco Asset Management believes that, “It seems the precious metal has been caught up in the perfect storm. Much of what’s driving silver also is driving gold — aggressive monetary policy financing of fiscal spending, which limits the ability of bond yields to rise. That is sending inflation-adjusted, or real, yields lower, which tends to boost precious metals.”

Unquestionably as long as central banks continue along the path of extremely accommodative monetary policies, they will devalue the currency of their country. However not since the end of World War II have so many central banks devalued their currencies through a process of quantitative easing. These actions can only have one outcome in regards to gold and silver pricing, and that is that they will continue to gain value, and traders will continue to fuel the demand for the safe haven asset grow substantially.

Wishing you as always good trading and good health,

By Gary Wagner

Contributing to kitco.com

David

Bullish sentiment in the precious metals space will take gold prices to their all-time highs, according to Citigroup Inc., which views the upward move up as “only a matter of time.”

“Nominal gold prices have already posted fresh records in every other G-10 and major emerging market currency this year,” Citigroup analysts said in a report. “It is only a matter of time for fresh [highs in USD-terms].”

The record-high price to beat is around $1,920, which was reached back in 2011. At the time of writing, August gold futures were trading near nine-year highs of $1,840.80, up 1.29% on the day.

Citi projects gold to reach its all-time highs in the next six-to-nine months, the report stated. On top of that, analysts see a 30% chance that the yellow metal tops $2,000 an ounce in the next three-to-five months.

The drivers pushing gold higher are loose monetary policies, low real yields, and increased allocation to gold.

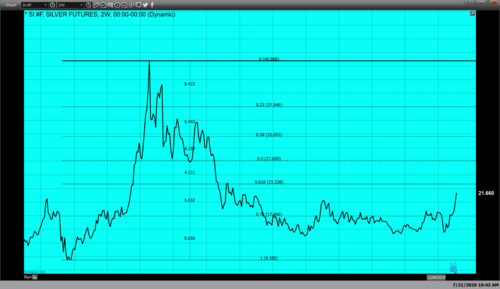

Rising safe-haven demand will also continue to lift silver prices, analysts added, projecting for the precious metal to rise to $25 within the next six-to-twelve months and even possibly reaching $30 in a bullish scenario.

At the time of writing, September silver was up nearly 7% on the day and trading at $21.540 an ounce.

Tuesday, the market is focused on a potential agreement between the European Union leaders for a massive stimulus package that deals with the coronavirus-related economic fallout. Markets are optimistic that the 750 billion euro ($857.33 billion) recovery fund and its related 1.1 trillion euro 2021-2027 budget will help the EU economy recover after the COVID-19 pandemic.

In the U.S., investors are carefully watching their own stimulus talks. Senate Majority Leader Mitch McConnell, Treasury Secretary Steven Mnuchin and other key players, are scheduled to meet in the White House on Tuesday. Republicans are expected to propose a $1 trillion rescue package, which is much less than the Democrat’s proposal of $3.5 trillion.

By Anna Golubova

For Kitco News

David

QUESTION: Mr. Armstrong; I listened to one of your recent interviews and you said that silver may be better than gold going forward and that a gold standard was pointless because you cannot fix the price of gold while everything else floats. That was the best explanation I have ever heard. So my question is are you referring to common silver coins dated before 1965?

ANSWER: The silver to gold ratio peaked and has begun to turn. The problem with gold is that it rallied rather than making a strategic low, which would have set it up for a major slingshot. This failure to create the slingshot low will temper its advance which is what we are beginning to see now with the change in trend with respect to the ratio. Governments are hunting gold and imposing all sorts of restrictions. From a true barter perspective, silver coins will be easier to use if they end up canceling the paper currency. This is highly likely in Europe first, and then it will migrate to the USA.

by Martin Armstrong

Categories: Gold, Silver

David

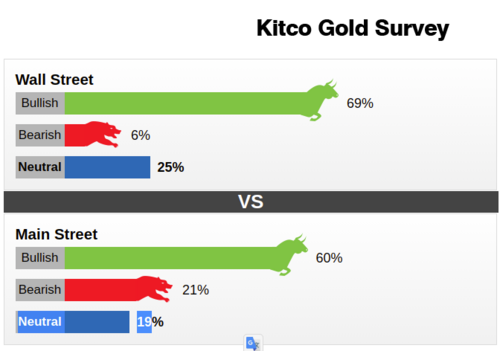

The gold market is consolidating above $1,800 an ounce and although bullish sentiment has fallen from record levels, market analyst and retail investors remain bullish on prices next week, according to the latest Kitco News weekly gold survey.

Although gold has struggled to push off support around $1,800 an ounce, analysts have said that the market still has a lot of technical momentum and strong fundamental support.

“Dips continue to be bought and that shows there is underlying strength in the marketplace,” said Bob Haberkorn, senior commodities broker with RJO Futures. “Right now gold is consolidating but we can see higher prices next week.”

This week, 16 Wall Street professionals who took part in this week’s poll, 11, or 69%, called for gold prices to rise. One analysts, or 6%, predicted lower prices. Meanwhile four votes or 25% expected prices to trade sideways.

A total of 1,642 votes were cast in an online Main Street poll. Of these, 977 respondents, or 60%, looked for gold to rise in the next week. Another 348, or 21%, said lower, while 317 voters, or 19%, were neutral.

Although the majority of Wall Street analysts are bullish on gold next week, sentiment has dropped from last week’s record high of 88%. Both Wall Street and Main Street were expecting to see gold push higher for a sixth consecutive week. As of 1 p.m. EDT on Friday, Comex August gold futures last traded at $1,810 an ounce, up 0.4% compared to the previous week.

Adrian Day, chairman and CEO Adrian Day Asset Management said he expects momentum to continue to push gold prices higher.

“Since people are buying gold as an insurance or hedge, the price become less important, so gold can move significantly higher,” he said.

According to many analysts, the one factor that will continue to drive gold prices higher in the near term is further weakness in the U.S. dollar as the current embarks on a new downtrend.

Charlie Nedoss, senior market strategist with LaSalle Futures Group, said that growing expectations that the U.S. government will announce new stimulus measures to support the faltering economy, as the COVID-19 pandemic continues to run rampant through the country, will weigh on the U.S. dollar and support gold prices.

“I think you need to be bullish on gold as the market rallies off the cheap money being released in to the economy,” he said.

Darin Newsom, president of Darin Newsom Analysis, said that not only is a weaker U.S. dollar supporting gold prices but so is the record rally in equity markets.

“Right now there is no reason to buy the dollar,” he said. “So money continues to flow into gold as a safe play to protect against the push higher in equities. Right now you can’t find the trend, so I see gold prices moving higher.”

Chris Vecchio, senior currency strategist at IG Group, said that not only does gold have a strong technical outlook but it is benefiting from a strong fundamental backdrop.

Although there is strong sentiment in the marketplace, some analyst have noted that a correction would be healthy following break above long-term support.

“I see gold range bound, but increasingly in need of a correction to attract fresh interest. On that basis while I remain bullish I see it lower next week,” said Ole Hansen, head of commodity strategy at Saxo Bank.

Colin Cieszynski, chief market strategist at SIA Wealth Management, said that he is neutral on gold as the market waits for a new catalyst.

“After three central banks (BOJ, ECB, BOC) maintained monetary policy at their latest meetings, there was no new stimulus to propel gold higher in the short term. At the same time, the underlying tailwind for gold from monetary stimulus remains intact,” he said.

By Neils Christensen

For Kitco News

David

MeasuresGold seems poised for a return of volatility, but we’re not likely to see it unless there is more stimulus or COVID-19 is brought under control.

After experiencing some early session weakness and putting its weekly winning streak in jeopardy, gold futures are trading higher at the mid-session on Friday. This puts it in a position to post its sixth consecutive weekly gain.

The catalysts providing support are flat demand for higher risk assets, lower Treasury yields and a weaker U.S. Dollar. The hope of more global fiscal and monetary stimulus is helping to generate the most buying interest in my opinion.

At 17:18 GMT, August Comex gold is trading $1809.90, up $9.60 or +0.53%.

Since hitting a new contract high on July 8, gold has been struggling to maintain its upside momentum. The support is there with longer-term investors buying every significant dip since April, but the short-term trade has been mostly sideways as traders grapple with strong demand for higher-risk assets and the occasional rally in the U.S. Dollar due to renewed safe-haven demand.

Ultimately, it’s the direction of Treasury yields that determines the direction of gold prices because they are competing assets. Usually, government debt is the more attractive safe-haven investment. Not only is it guaranteed, but it also pays interest. However, the closer yields move to zero percent, the stronger the demand for gold, which pays nothing to hold it.

Saying that the surge in coronavirus cases is driving gold demand is not necessarily a valid statement. It may be the easiest headline to write, howeve

The way I see it, a jump in coronavirus cases leads to speculation that some U.S. states and foreign countries will partially shut down again, raising fears the economy and labor market will continue to struggle.

A setback in the economy and labor markets will increase calls for more fiscal assistance from governments and more monetary assistance from central banks. That’s what bullish gold traders are betting on.

The long-term bullish factors driving gold prices remains intact with real interest rates low. The short-term factors are enough to support gold and prevent a price collapse, but it’s going to take the announcement of new stimulus measures to send prices higher.

One such event is the European Union’s proposed stimulus package designed to kick-start the Euro Zone’s COVID-hit economies. Another is an additional stimulus package from the United States.

Short-Term Outlook

Over the short-run gold investors need to see some fresh stimulus to drive prices higher. Otherwise, prices could become rangebound, but not necessarily bearish as traders wait out the development of a vaccine to fight coronavirus.

The market seems to be poised for a return of volatility, but we’re not likely to see it unless there is more stimulus or COVID-19 is brought under control.

David

Even with the intermittent drawdowns that both gold and silver pricing have experienced over the last few months, overall gains in both metals have been impressive and significant. Obviously higher pricing in both precious metals is the direct result of global central banks accommodative monetary policy, and in the United States the massive buildup of their internal balance sheet to implement quantitative easing. It is also obvious that these actions are the direct result of the pandemic which has dramatically affected economies worldwide.

Although we first learned about this new virus after a cluster of severe pneumonia cases were reported on New Year’s Eve 2019 in the city of Wuhan China, it was not until February 2020 that the first case of Covid 19 was detected in the United States. According to the CDC by mid-March, “all 50 states, the District of Columbia, New York City, and for territories at reported cases of Covid 19.” This novel coronavirus is a variation of an existing virus, however this variation had never been seen in humans.

Although this contagion was identified in the beginning of 2020 it was not until March 11 that the World Health Organization declared the outbreak a pandemic. By March 23 New York City had confirmed a total of 21,000 cases. Making the largest most densely populated city in the U.S. the epicenter of the outbreak in the United States. By the first week of April global infections had reached over 1 million individuals.

.png)

According to John Hopkins as of July 17, 2020, the total number of confirmed cases is almost 14 million with 13,926,747 cases reported. Among these infected individuals almost 600,000(593,209) people lost their lives. This pandemic has now plagued countries worldwide since the first part of this year, still new cases continue to emerge in various hotspots in the United States such as Texas, Arizona and Florida. Worldwide hotspots can be found mainly in the following countries; Brazil, Mexico, India, Columbia, Iran, Peru, Russia, South Africa and Iraq. As of July 17, the two largest hotspots were in the United States and Brazil. Concurrently many countries worldwide are working to “flatten the curve” reducing the number of new cases from one day to the next.

More importantly even when the pandemic has run its course and subsides, global economies will have to begin to figure out how to effectively deal with the enormous expenditures that were necessary to restart their economies, as well as the massive amount of capital expended through central banks and their highly accommodative monetary policies

It is for that reason that we have seen such dramatic gains in both gold and silver. Since the first week of June when gold traded to a low of $1671 to current pricing of $1812.10 today, an ounce of gold has risen roughly $125, which is a net gain of 6.9% in approximately 1 ½ months. Silver also gained dramatic ground as it traded from the approximate lows of $17.55 during the first week of June, and is currently fixed at $19.745 as of today’s close. Silver his gained $2.20 in the last seven weeks and gained 11.1% in value over this extremely short period of time, half that of golds rise.. The underlying fundamentals which have moved both gold and silver dramatically higher, have already created the necessary environment for both precious metals to continue to move higher and possibly trade above the record high of gold at $1920, and silver at the dollars per ounce.

pic.jpg)

What is certain is that the global pandemic will most likely take a longer time to run its course unless a vaccine is created. It is also certain that once the pandemic has subsided the economic fallout which is a direct result of the massive expenditures by countries worldwide used to provide aid for its citizens, and economic stimulus to reignite their contracting economies will have percussions and ripple effects for years to come.

While we all wish for the best, we must prepare for the worst. It is for that reason that market participants and investors have turned to the safe haven assets of gold and silver as a viable means to address the economic fallout which is inevitable.

Wishing you as always, good trading,

By Gary Wagner

Contributing to kitco.com

David

Yamana Gold (TSX:YRI) announced today gold production of 164,141 ounces and silver production of 2.01 million ounces.

The gold miner released preliminary production results.

Production was down compared to the previous quarter when gold production came in at 192,238 ounces and silver production was 2.73 million ounces.

The company said that overall production in Q2 from most mines exceeded plan and the production in the company’s annual guidance.

Costs were up in the quarter. All-in sustaining costs for the quarter were $1,125 per GEO sold due to higher production costs, such as the demobilization and ramp-ups of Cerro Moro and Canadian Malartic along with the implementation of precautionary safety measures related to COVID-19 across all operations.

Yamana expects to scale up production as the year progresses.

"Furthermore, in line with prior guidance, the Company expects to generate increasing production, improving costs and significant cash flows in the second half of the year, sequentially increasing over the third and fourth quarters. As previously guided, production is expected to weight into the second half of the year, with 54% of production expected in the second half compared to 46% in the first half," said the company in a statement.

By Kitco News

David