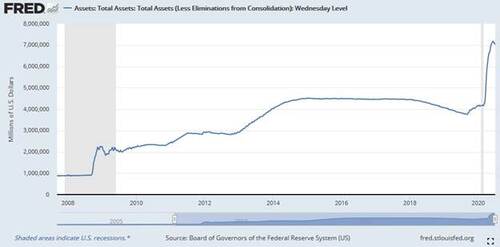

Gold’s recent rise occurred as a series of stair steps

Just over one week ago, on Tuesday, July 7th, gold prices broke and closed above $1800 per ounce for the first time since November 19, 2011. Over this last week there have been two occasions when gold pricing on an intraday basis dipped below $1800. However, in both instances’ gold closed above that key psychological and technical price point.

In fact, gold has remained above $1800 on a closing basis for the last seven consecutive trading days. While this is not enough time to say with certainty that the former level of resistance has now become the new level of support, at least for now it

seems that that assumption has a high probability of becoming correct.

.png)

There have been mixed interpretations of whether or not recent price action can be construed as bullish or bearish. The majority of analysts including myself have viewed this recent price move is extremely bullish. However, one gold analyst interpreted the recent price action with gold around the $1800 level as possibly “looking a little tired”.

Our technical studies indicate that nothing could be further from the truth. Gold has staged a dynamic rally which began at $1450 during the middle of March in response to the global pandemic which was just beginning. From mid-March to the first week of April gold gained over $300 per ounce, taking pricing to $1788, its highest value of the year.

Following that rally there was no real strong correction, as gold became range bound trading between $1680 and $1760 through April, May and the first week of June. The only possible way of Interpreting this sideways trading range is to acknowledge that gold prices were consolidating from the recent run-up.

On June 3rd, gold traded to $1675 the low of its range, and on June 23nd, broke above the highs of the trading range ($1766) and closed at $1781. Once again gold prices traded in a narrow and defined range, however on this occurrence the range was above the prior bounds. In other words, gold has been gaining value in a slow and methodical stairstep manner.

In other words, recent gains in gold pricing have occurred in a stairstep manner. Moving higher, followed by a period of consolidation and sideways trading action before returning to rally mode and higher pricing. The fact that recent gains were not accomplished through a parabolic rise indicates price stability.

Wishing you as always, good trading,

By Gary Wagner

David

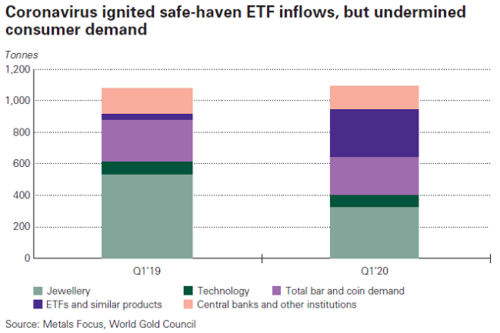

ETF gold buying in just the first half of 2020, 655.6 tons worth an impressive $39.5 billion, has already surpassed the previous record full-year increase in 2009.

ETF gold buying in just the first half of 2020, 655.6 tons worth an impressive $39.5 billion, has already surpassed the previous record full-year increase in 2009.

.jpg)

.jpg)

.jpg)

.jpg)

.png)

.png)