Higher gold prices will continue as long as Covid-19 does

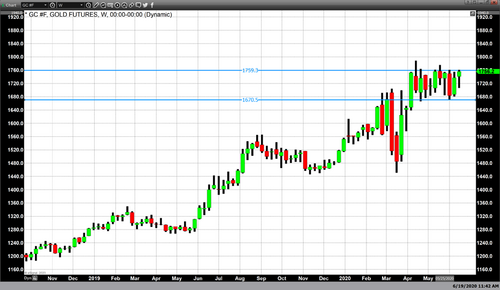

The fundamental factors which have taken gold pricing from $1460 in March, to within four dollars of $1800 per ounce this week are still present, and they continue to be highly supportive of gold prices. First and foremost, and at the root of other fundamental issues is the global Covid – 19 pandemic which is now in its fourth month. In that short period of time the total number of reported cases globally has swelled to 9,649,299, resulting in the loss of 487,800 souls.

The pandemic resulted in businesses globally shutting down as countries went into a lockdown mode to slow the spread of the virus. This lockdown led to a massive global unemployment rate. In the United States as of June 22nd 33 states still have double digit unemployment rates. Even with a fractional improvement from the April unemployment rate of 14.7%, the unemployment numbers for May were a staggering 13.3%. The number of individuals unemployed in the United States is approximately 30 million, leaving one out of ten Americans jobless.

The U.S. Treasury Department has allocated roughly $3 trillion in aid through the “CARES Act”. The Federal Reserve took interest rates to near zero and simultaneously infused liquidity into the economy through a monetary policy of quantitative easing and added $3 trillion to their balance sheets as they purchased mortgage-backed securities, U.S. treasuries and now corporate bonds. These actions are not isolated as many other central banks including the European Central Bank have implemented extremely accommodative monetary policies.

Also, highly supportive of gold pricing are rising tensions between the United States and China in regards to the trade war. In a letter to lawmakers on June 24, the Pentagon provided a list of 20 “Communist Chinese military companies” operating in the United States.

According to Time magazine Pentagon spokesman Jonathan Hoffman said “As the People’s Republic of China attempts to blur the lines between civil and military sectors, ‘knowing your supplier’ is critical. We envision this list will be a useful tool for the U.S. government, companies, investors, academic institutions, and like-minded partners to conduct due diligence with regard to partnerships with these entities, particularly as the list grows.”

Not since the financial crisis of 2008 have, we witnessed the kind of economic upheaval that is currently plaguing countries worldwide. Not since the financial crisis of 2008 have, we seen gold pricing gain value at such a rapid pace. It seems highly likely that until the pandemic has run its course and the global economy returns to pre-pandemic numbers, that we will continue to see gold prices at this level or higher.

By Gary Wagner

David