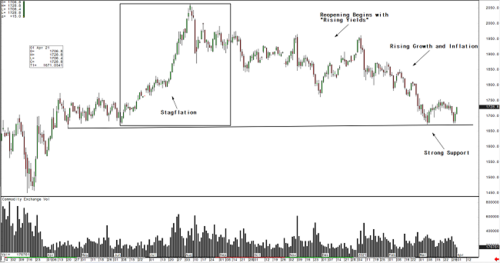

Gold futures surged higher on dollar weakness and inflation concerns

Gold futures basis the most active June 2021 Comex contract is currently fixed at $1756.50 after factoring in today’s strong gains of $14.90 (+0.86%). Dollar weakness was partially responsible for today’s gains, but the majority of gains were due to market participants bidding the precious yellow metal higher as active buyers. Silver basis the most active May 2021 Comex contract gained $0.28, and is currently fixed at $25.525.

.png)

In both gold futures and spot pricing it was dollar weakness that partially supported higher gold and silver pricing. The dollar index lost 40 points, or -0.40% and is currently fixed at 92.10. According to the KGX (Kitco Gold Index) spot gold is currently fixed at $1755.80 which is a net gain of $18.20 on the day. On closer inspection market participants bid the precious metal higher by $11.10. Concurrently dollar weakness contributed an additional $7.10 of value to a troy ounce of gold.

Bitcoin futures which trade on the Chicago Mercantile gained $1735 today, remaining extremely strong with a single coin valued at $58,045.

Much of today’s gains in the precious metals and U.S. equities is directly tied to minutes of last month’s FOMC meeting, which were released yesterday. In addition, the Federal Reserve is not standing alone in their mandate to continue to provide extremely accommodative rates vis-à-vis their Fed’s funds rate which is currently set between 0 and ¼%. Additionally, they continue to add an additional $120 billion per month to their asset balance sheets through purchasing United States bonds and mortgage-backed securities.

The Federal Reserve is not alone in its monetary policy mandate. On Tuesday the IMF backed the Fed’s decision to be patient and not rock the boat by moving interest rates up higher too quickly. The International Monetary Fund made it crystal clear that they intend also to maintain an extremely accommodative monetary policy. In their latest global financial stability report they sent a strong message that there continues to be a need for the current dovish demeanor of central banks worldwide. Both entities are acutely aware that we live in a global economic world in which positive movement in any major country has a spillover effect to other countries, and that raising rates too quickly could easily stifle the economic rebound witnessed in the United States and to a lesser extent in Europe.

Today Chairman Jerome Powell attended a virtual spring meeting sponsored by the International Monetary Fund and the World Bank. He acknowledged that there are a number of factors coming together to support a brighter Outlook for the economy in the United States. Stating that those factors have been instrumental in putting the nation “on track to allow a full reopening of the economy fairly soon.” However, he also spoke about the caveat saying that many Americans who were out of work will struggle to find new jobs because some industries will likely be smaller than they were before the pandemic, as well as a statement saying that “It’s important to remember we’re not going back to the same economy. This will be a different economy.”

While the IMF and the Federal Reserve both continue to maintain their extremely accommodative policies as such, they could have a profound and negative impact on both the euro and United States dollar. This most likely will result in both of those currencies losing value over time and that in turn has created new concerns about rising inflation rates.

By Gary Wagner

Contributing to kitco.com

Time to Use the Kinesis Money System

David

.png)