Bitcoin (BTC) – Are Bears Back in the Game?

Bitcoin Price Key Highlights

-

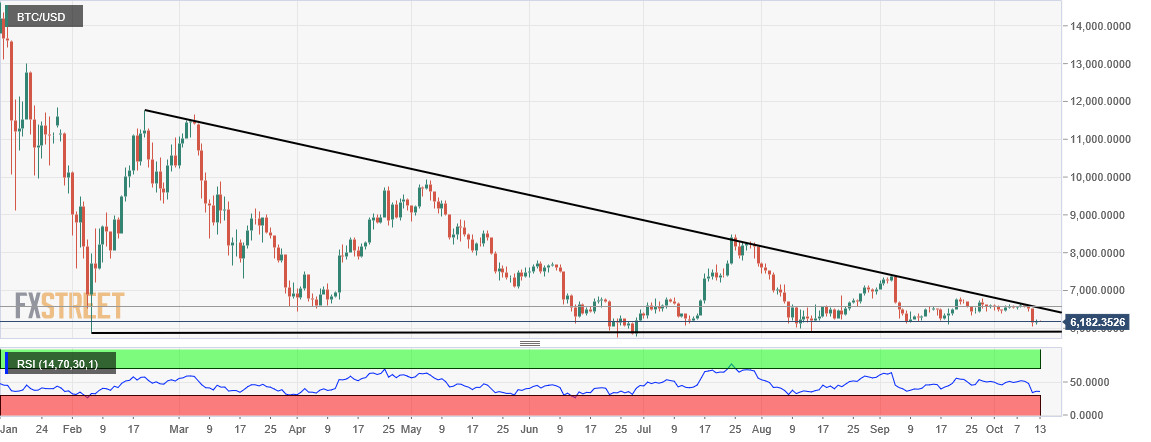

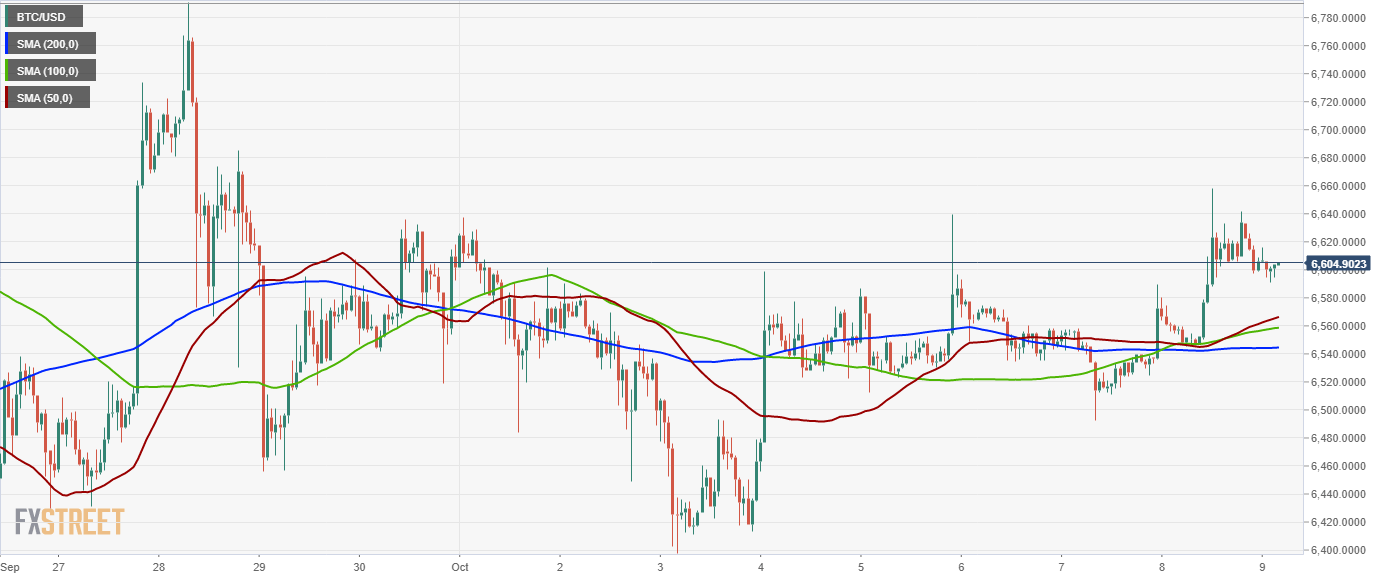

Bitcoin price appears to be turning from the resistance at the top of its descending triangle on the 4-hour chart.

-

Price could be making its way back to the bottom of the triangle again from here.

-

Technical indicators are also reflecting the presence of selling pressure that could keep gains in check.

Bitcoin price seems to be having trouble sustaining its earlier climb as the top of the descending triangle is holding as resistance.

Technical Indicators Signals

The 100 SMA is below the longer-term 200 SMA on this time frame, confirming that the path of least resistance is to the downside. In other words, resistance is more likely to hold than to break. These moving averages also coincide with the triangle top to add to its strength as a ceiling.

Stochastic is on the move down so bitcoin price could follow suit while selling pressure is present. This oscillator has some room to go before reaching oversold levels, which means that sellers could stay in control for a bit longer. RSI is also heading south and has plenty of room to cover before reaching oversold territory as well.

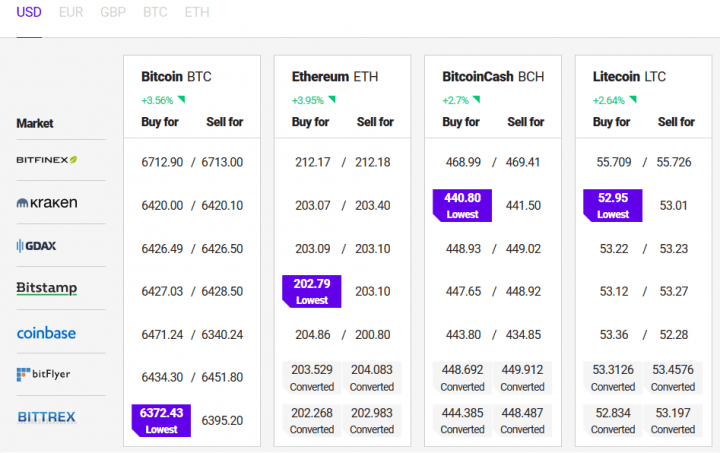

The spike higher in bitcoin is seen to be a result of the selloff in Tether as doubts are emerging on its stability and the financial health of Bitfinex. However, traders quickly booked profits as most of the move was also spurred by FOMO or fear of missing out.

Still, there’s enough reason to expect a longer-term rally to materialize as institutional funds could flow in by early next year. Fidelity Investments has unveiled its institutional platform for bitcoin and ethereum, making it available to more hedge funds and financial institutions. Goldman Sachs has also reportedly invested in BitGo in order to make cryptocurrencies more accessible to its clients.

SARAH JENN | OCTOBER 19, 2018 | 4:35 AM

David