Bitcoin Teeters on $10K, But Can It Fend Off Another Bear?

Bitcoin’s recent market movements have thrown into contention consensus about its short-term price direction, with traders asking openly if demand is strong enough to fend off another bear market.

Such a question has emerged in the wake of the world’s largest cryptocurrency’s inability to set new highs above those seen in June and July, when optimism about a Facebook cryptocurrency launch pushed the price of bitcoin to $13,880 and $13,200 on June 26 and July 10, respectively.

Since then, bitcoin has largely failed to test these highs again, prompting speculation traders may be willing to push the market into a lower range, one that could be deepened by available futures options.

However, investors and analysts remain bullish based on the assumption that demand will continue its current course, helping to sustain prices around $10,000 until next year’s May halving takes effect. Then, investors will see the amount of new bitcoin introduced to the market daily cut in half, with each new block in the blockchain producing 6.25 BTC, down from 12.5 BTC.

As can be seen by the recent litecoin halving, events that increase the perceived scarcity of cryptocurrencies have proven to catalyze buying interest.

Further, Jeff Dorman, chief investment officer at Arca, an investment management firm focused on the asset class, argues that with the likes of Bakkt and Fidelity opening their doors to new money amid current global economic tensions, bitcoin looks attractive to large hedge fund managers seeking to offset risk in traditional markets.

Dorman told CoinDesk:

“Most macro hedge funds are contemplating using BTC as a better way to offset the systemic risks that are building globally. There seems to be too much interest and too much money on the sidelines for the market to really go lower in any meaningful way.”

Factoring Miner Demand

Analyzing the cryptocurrency markets remains an evolving science, but new metrics suggest that bitcoin may currently be priced favorably ahead of the halving event.

The Diffiulty Ribbon, created by influential market analyst Willy Woo, for example, was recently released. It helps illustrate how leading analysts believe miner selling pressure affects the price of bitcoin.

(As miners are believed to sell the BTC they receive from winning block rewards – to pay employees, electrical bills and other real-world costs – they are believed to influence market direction.)

The above chart shows bitcoin’s “network difficulty,” a function of how hard the software makes it to discover a new block and thus claim the new cryptocurrency it releases to the market.

When the rate of network difficulty increases slows, analysts believe this is a sign miners are shutting off their hardware (leaving only the strong miners who proportionally need to sell fewer coins to remain operational). It’s believed this leads to reduced sell pressure and more room for price increases.

The ribbon consists of simple moving averages of BTC network difficulty so the rate of change of difficulty can be easily seen. According to Woo, the best times to buy BTC are zones where the ribbon compresses.

He said:

“The timing of the last difficulty ribbon compression is very bullish, especially given we expect another compression at the halving, I don’t think we have time to come into a bear season before then.”

Holding $10K

That said, less sophisticated investors may be using simple price charts to gauge entries.

The last two months have produced a series of lower highs putting a clamp to further growth. This can be observed in the amount of sell pressure bitcoin has seen when approaching upper resistances $10,800-$13,200.

Still, prices have held above $10,000 by the end of each daily closing period for nearly 30 days, suggesting that demand for bitcoin below that mark remains strong. As a result, some analysts believe BTC’s outlook would only change bias from bullish-to-bearish long-term should a firm close below $7,333 (200-day moving average) occur.

Still, the pressure is now mounting on the bulls to produce something significant in the short-term or else risk exposing lower supports at $9,600.

Whether or not short-term price action remains bearish, analysts agree that BTC is still bullishly bid based on its position above the aforementioned 200-daily moving average and current mining activity.

However, Dorman argues simple psychology may be the overriding factor so long as $10,000 remains a strong support and belief in the halving as a price catalyst remains strong.

He concluded:

“In general, across any asset class, when consensus is to buy lower… you rarely get that chance.”

Sebastian Sinclair

Aug 28, 2019 at 04:00 UTC

David

.png)

.png)

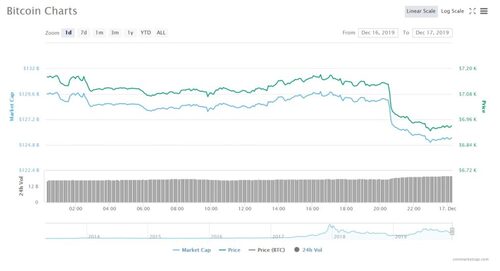

The crypto is facing resistance at the $3,700 and $3,800 price levels. Currently, the BTC price is retracing from the recent high and has fallen to the support of the EMAs. If the price is sustained above the EMAs, the crypto is likely to resume its bullish trend. Meanwhile, the MACD line and the signal line are below the zero line which indicates a sell signal. The crypto’s price is above the 12-day EMA and the 26-day EMA which indicates that price is likely to rise.

The crypto is facing resistance at the $3,700 and $3,800 price levels. Currently, the BTC price is retracing from the recent high and has fallen to the support of the EMAs. If the price is sustained above the EMAs, the crypto is likely to resume its bullish trend. Meanwhile, the MACD line and the signal line are below the zero line which indicates a sell signal. The crypto’s price is above the 12-day EMA and the 26-day EMA which indicates that price is likely to rise.