As Bitcoin Moves Towards $6,000, The Case for an Imminent Bull Market Grows Stronger

The crypto markets have been incurring significant upwards momentum over the past month which was extended yesterday when Bitcoin (BTC) rapidly surged to highs of nearly $6,000 before it settled slightly lower.

This rapid upwards surge has further strengthened the case for an imminent bull run, as many technical indicators are now flashing bullish signals that have historically preceded long multi-year upwards trends that have previously laid the groundwork for BTC to surge parabolically.

Bitcoin (BTC) Drops to $5,900 After Failing to Break Above $6,000

At the time of writing, Bitcoin is trading up 3% at its current price of just below $5,900. Over a 24-hour period, BTC is up from lows in the $5,700 region, but is down slightly from highs that were set just below $6,000.

It does appear that $6,000 is in fact a level of resistance for the cryptocurrency, as Bitcoin has not yet been able to advance past this price level.

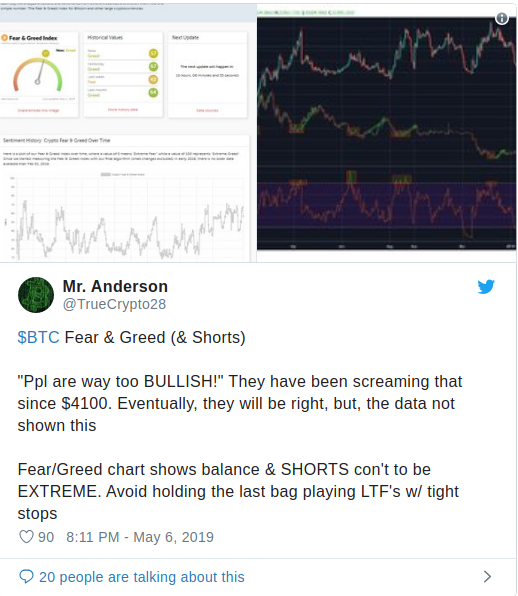

The recent upwards momentum has led to a massive shift in market sentiment that has led many traders to flip bullish, which has historically been a warning sign that a drop is imminent. Despite this, Mr. Anderson, a popular crypto trader on Twitter, recently spoke about this, noting that the market sentiment actually remains quite balanced at the moment.

“$BTC Fear & Greed (& Shorts). “Ppl are way too BULLISH!” They have been screaming that since $4100. Eventually, they will be right, but the data not shown this. Fear/Greed chart shows balance & SHORTS [continue] to be EXTREME. Avoid holding the last bag playing LTF’s w/ tight stops,” he explained.

Could the Next BTC Bull Market Already Be in its Early Phase?

The recent series of price surges in the crypto markets have put a significant amount of distance between most cryptocurrencies 2018 lows and their current prices.

Now, many technical indicators are signaling that Bitcoin could currently be in the early stages of the next bull market.

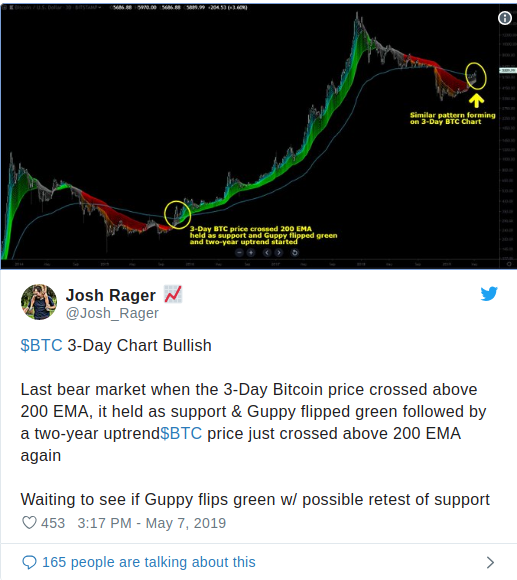

Josh Rager, a popular cryptocurrency trader on Twitter, spoke about one technical indicator that is currently flashing a bullish signal, noting that Bitcoin’s 3-day price just flipped over its 200-day EMA, which has historically been a bullish sign followed by multi-year uptrends.

“$BTC 3-Day Chart Bullish. Last bear market when the 3-Day Bitcoin price crossed above 200 EMA, it held as support & Guppy flipped green followed by a two-year uptrend. $BTC price just crossed above 200 EMA again. Waiting to see if Guppy flips green w/ possible retest of support,” Rager explained.

COLE PETERSEN | MAY 7, 2019 | 10:00 PM

David