Bloodbath = golden opportunity

I have a simple but critical point to make today. The best time to buy gold stocks in my entire career so far was after the crash of 2008.

This historic opportunity is repeating itself.

Consider today’s mid-day decline in gold prices.

We've seen this before…

Gold gapped down on October 13, 2008, from $900.50 to $831.50.

In that case, this happened just a few weeks before the bottom. For reasons I’ve written about before, I failed to invest at that time and missed out on some life-changing opportunities. I'm not going to miss that chance this time.

When will that be?

I won’t pretend to know how closely history will repeat itself, but I’m skeptical that monetary and fiscal policy can prevent a global economic recession that could take markets much lower.

Why?

Because—whether it should or it shouldn’t—the proximal cause it still getting worse.

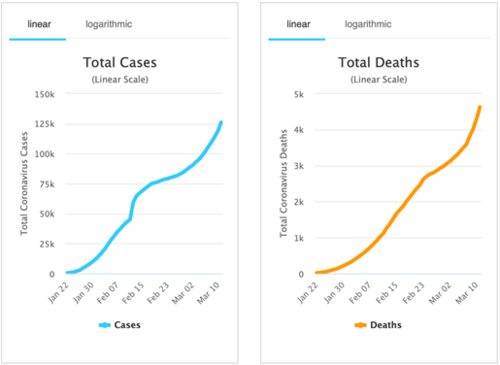

The COVID-19 outbreak is changing consumer behavior. It’s causing businesses to slam the brakes. It’s prompting governments to take extreme actions. And both the number of cases and the fatalities are going vertical.

Now, I’m not a doctor, and I’m not looking to make an argument about the medical realities of the situation.

In terms of public perception, it may matter more that beloved actor Tom Hanks has COVID-19 than that almost 5,000 people have died from it. The NBA cancelling its entire season, Trump banning travel from Europe for 30 days, universities sending students home… the pile-on here just keeps growing.

As a speculator, I see these trends accelerating, and I can’t ignore them. I can only conclude that the consequences will get worse until the lines above have peaked and the public believes things are improving.

So how will we know when the bottom is in?

We won’t for certain, except in hindsight. But as I’ve already written this week, we don’t need to be able to buy at the exact bottom in order to be able to make a lot of money. Near is good enough.

What a different a bit of experience makes…

I remember how I felt in 2008. It was like an elevator car dropping out of under me—repeatedly. This time, I saw it coming, took some profits, and prepared myself mentally to hunker down and get ready to buy when I’m sure the bottom is in. I don’t feel bad or disoriented at all. I feel eager.

I'm so looking forward to bottom-fishing that my greatest struggle now is to hold myself back when I see already great bargains. I know exactly what I want to buy.

This is why I like to say that times like this are like having a stock-market time machine. We can’t travel to the past, but we can buy at prices we missed in the past, before the future revealed which stocks would be winners.

I’m excited.

I’m as happy to have a chance to buy these stocks on the cheap as I would be to be able to buy a brand-new Ferrari for the price of a used Yugo.

I hope you are as well.

And I’d love to help you make the most of the opportunities before us as well.

If you’d like to know where I’m planning to deploy my own hard-earned cash, please check out my flagship newsletter, The Independent Speculator. You can try it for a month at relatively little expense and cancel if you decide it’s not for you.

If you already know what you want to buy and have questions about what to hold or sell, please try out my Consumer Reports-style newsletter, My Take. Again, you can try it for a month at relatively little expense and cancel if you decide it’s not for you. Note: due to heavy demand, we are doubling the price of My Take on April 5, 2020. Existing subscribers will be grandfathered.

And if you’d rather do all this on your own but just want my analysis of general market trends like the above, please make sure you’re signed up for our free weekly email, the Speculator’s Digest. I promise we won’t spam you with daily sales pitches. I will, however, do my best to deliver valuable, original analysis not published anywhere else, every week.

Whatever happens next, it will be chaotic—which means it will be full of opportunity.

Caveat emptor,

By Lobo Tiggre

David