How to interpret today’s jobs report, and what does it mean fo price of gold ?

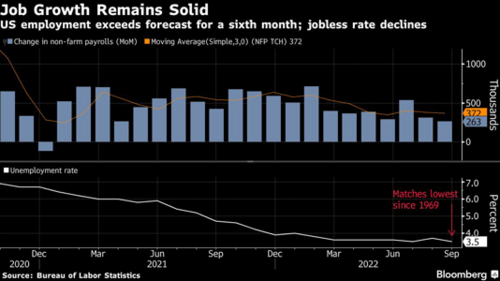

Today’s jobs report for September showed a decrease in monthly gains, with 263,000 new jobs added last month, a decline from the prior month in which 315,000 new jobs were added.

The deep impact it had on almost every asset class in the financial markets was not because of the tepid numbers but rather hopes by the Federal Reserve that these numbers would be even lower. The Federal Reserve had hoped that today’s report would reveal even slower growth because that would indicate progress by the Federal Reserve in reducing inflation.

Inflation is still greatly elevated at a 40-year high even after the Federal Reserve has raised interest rates at every FOMC meeting since March. The Fed raised rates by 25 basis points in March, 50 basis points in May, and 75 basis points in June, July, and September. The Fed took their benchmark Fed funds rate from between 0 and 25 basis points in February to between 300 and 325 basis points in September.

Although today’s report indicated slowing job growth it is believed that this contraction is not enough for Federal Reserve to slow down its current pace of interest-rate hikes.

According to CME’s FedWatch tool, last week there was a 56.5%% probability, yesterday there was a 75.2% probability which today swelled to an 82.3% probability that the Federal Reserve will raise rates by 75 basis points for the fourth consecutive time at the November FOMC meeting. This probability indicator forecast the probability of FOMC rate moves by using the 30-day Fed Funds futures pricing data.

Today’s report had a profound effect on U.S. equities. As of 2:35 PM EDT, the Dow is currently trading off by 661 points a decline of 2.22%. The NASDAQ is currently down 3.75% a decline of approximately 415 points, and the S&P is down 106.16 points or 2.90%.

Today’s report also had a deep impact on gold pricing which opened at $1721 and then traded to a high of $1722.80 before the release of the report which took gold futures basis the most active December contract to today’s low of $1698.40. Gold futures did recover trading to approximately $1714 a few hours after the release of the report. However, as of this writing at 3:20 PM, EDT over the last hour gold has been trading between $1702 and $1706.

So, what does this mean for the future of gold pricing? I believe that although this report is extremely important in an exceedingly important data set that the Federal Reserve will use at their November 2 FOMC meeting, it will be next week’s CPI inflation report for September that will be much more significant. But in terms of the long-term effect of the Federal Reserve on gold pricing, it is highly likely that if the Fed continues to raise rates and inflation remains persistent at some point market participants will have to focus on the high level of inflation rather than being laser-focused on rising rates. If that assumption is correct, it could take gold dramatically higher. But it is also likely that there will be more pain ahead.

Our technical studies indicate that the first level of resistance occurs at $1710 the 23.6% Fibonacci retracement which is based on a very short-term Fibonacci retracement data set from September 28 to October 7. Major resistance occurs at $1738 the recent high of the rally which began after gold hit its lowest value in years at $1621. The first level of support occurs at $1693.80 the 38.2% Fibonacci retracement and then at $1689.40 a 42% retracement.

By Gary Wagner

Contributing to kitco.com

Time to buy Gold and Silver on the dips

David